STRATEGIES FOR TODAY'S HOUSING MARKET

At Rella & Associates we keep up to date on the ever-changing market conditions daily, listen to your wants and needs, and educate you so that you can get your dream home!

Buying Process

STEP 1

FINANCIAL PLANNING

1. Simulation of payment amount

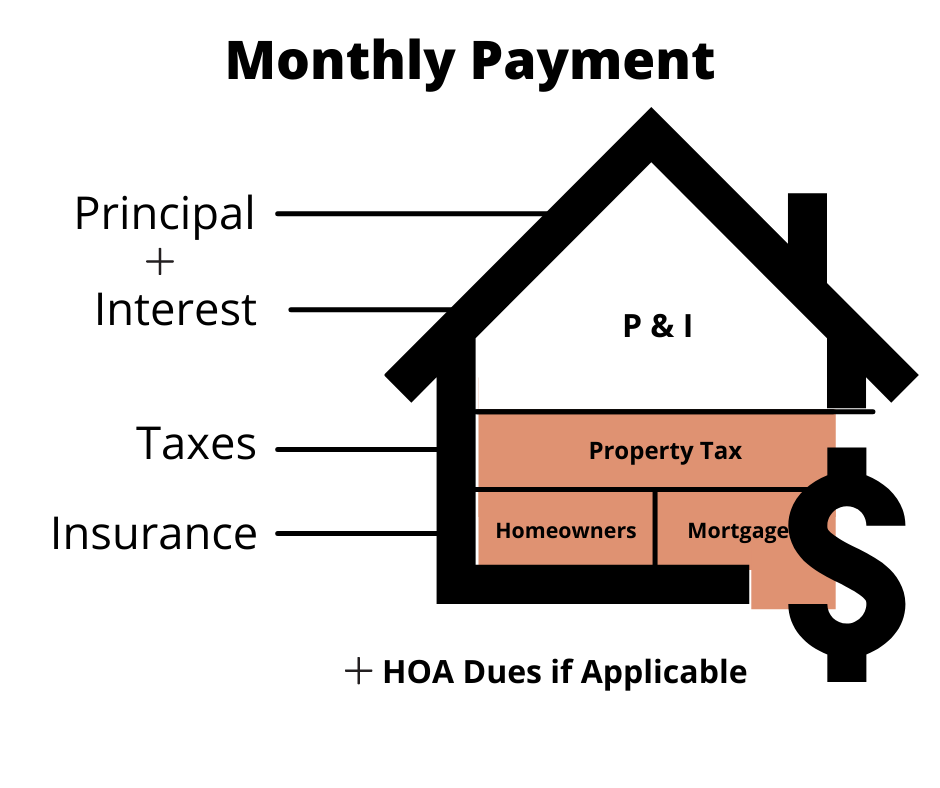

Your monthly payment will include:

Your loan amount will vary depending on your down payment ratio and borrowing conditions. Note that your maximum borrowing amount is decided by your income. For example, if you have a monthly income of $ 10,000, the maximum amount you can borrow is up to $ 4,000 (around 40%).

2. How to raise your down payment

Once you have an estimated down payment amount, the next step is to search for a procurement method. Your down payment is not limited to your funds in your bank account, as you can use proceeds from a home sale, future earnings and stock, 401k/retirement funds as well as pensions, overseas funds, and gifts from family members (including domestic and overseas). Please consult with your loan officer for more information.

3. Application for provisional approval of loan

When all of the conditions above have been met, you will receive a loan pre-approval letter from the loan company you decide to work with. This pre-approval letter is your minimum first requirement before finding a property and will provide any seller with a higher sense of certainty when reviewing your offer.

What Fully-Underwritten?

Pre-Qualification: An estimate of what you can borrow

Pre-Approval: When ALL information such as Income, Credit, & Assets have been verified

Fully-Underwritten Pre-Approval: When your pre-approval is verified by the underwriter who is in charge of looking at your information submitted and giving the final YES! Sellers really like FULLY UNDERWRITTEN PRE-APPROVALS as this is an additional guarantee for them to ensure a smooth closing and can lead to a faster close with fewer surprises down the road.

STEP 2

FIND A HOUSE

1. WANTS vs. MUST-HAVES

However, it’s important not to narrow your criteria too much. If the home checks 80% of your boxes, it’s advisable to move forward.

2. Condition

3. The Secret To Winning Multiple Offer Situations

Key Points:

• Please contact us to go see the property the DAY it comes on the market

• Offer Review Dates are typically the following Monday-Wednesday after the weekend

• When deciding on an offer price avoid commonly used numbers

• If there is a possibility of reviewing before an Offer Review Date, submit early to impress the sellers

• The highest purchase price does not always win. Make sure your terms & contingencies are just as excellent

• Have a Fully-Underwritten Pre-Approval & Have your lender call the listing agent to talk about your qualifications

• Write a personal letter to the sellers

Contingencies

A contingency allows you to get out of a contract and obtain a refund of your earnest money deposit under certain conditions.

If You Waive Your Contingency:

- You can still terminate the contract prior to closing, but you may forfeit your earnest money or the seller may have other remedies against you.

- You may proceed with purchasing the property, but without first potentially discovering material defects before closing.

Financing Contingency

A Financing Contingency conditions the sale on the buyer obtaining a loan under certain timelines.

Without this contingency, if the buyer cannot close because a loan is not approved, the buyer forfeits the earnest money.

Appraisal Contingency

An Appraisal Contingency allows a buyer to terminate the contract if the lender’s appraisal is less than the purchase price & the seller does not either reduce the purchase price or provide an appraisal at a purchase price that the lender accepts.

Without this contingency, if the Buyer’s lender’s appraised value of the property should be less than the Purchase Price, the Buyer shall pay additional funds towards Buyer’s Down Payment as necessary to resolve the low appraisal issue.

Title Contingency

A Title Contingency allows a buyer to review the title for easements, covenants, or restrictions that affect the buyer’s intended use of the property. If the seller does not cure the buyer’s disapproved title issues, then the buyer can terminate the contract with earnest money returned to the buyer.

Without this contingency, a buyer may fail to identify title restrictions that prevent a buyer from using the property as the buyer had intended.

Inspection Contingency

An Inspection Contingency allows a buyer to have the property inspected & to terminate the contract or ask for repairs or credits if dissatisfied with the condition of the property based on the inspection.

Without this contingency, a buyer may fail to identify material defects in the home before closing and a Pre-Inspection is recommended prior to writing an offer.

Pre-Inspection

(In a buyer’s market, the home inspection happens after their offer has been accepted by the sellers…)

However, in this current market Pre-Inspections are most common, as sellers will most likely not accept an offer with an inspection contingency)

A Pre-Inspection gives buyers the ability to discover any major issues the home may have before making an offer so you don’t have to buy the home blindly.

After you go through the pre-inspection report and decide that you want to go through and submit an offer, it is then recommended to WAIVE the actual inspection contingency.