Inventory Climbs Across Most Washington Counties as Sales and Prices Moderate

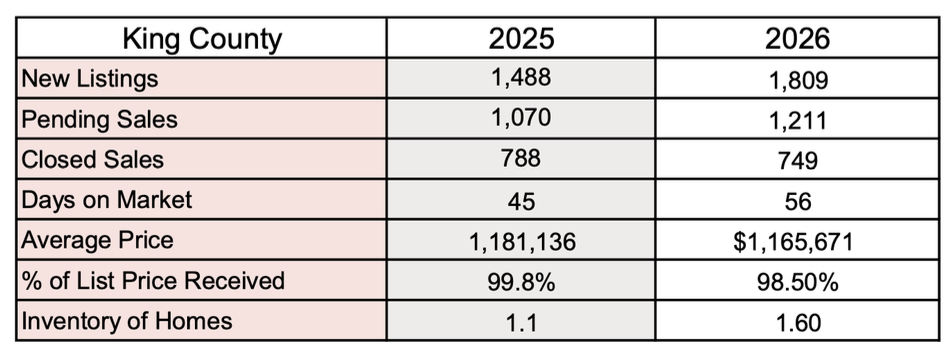

January housing market data shows a continuation of recent trends, with growing inventory outpacing buyer demand across much of Washington state. Active listings increased nearly 21% year over year, while closed sales declined 7% and median prices fell 3%.

“Substantial year-over-year growth in active listings continues to be accompanied by much slower, even negative growth in sales and median prices,” said Steven Bourassa, director of the Washington Center for Real Estate Research at the University of Washington.

Compared to December, inventory rose nearly 6% in January, while closed sales dropped 31% and median prices declined about 3%. The data suggests more homeowners are willing to sell, while affordability constraints continue to limit buyer participation.

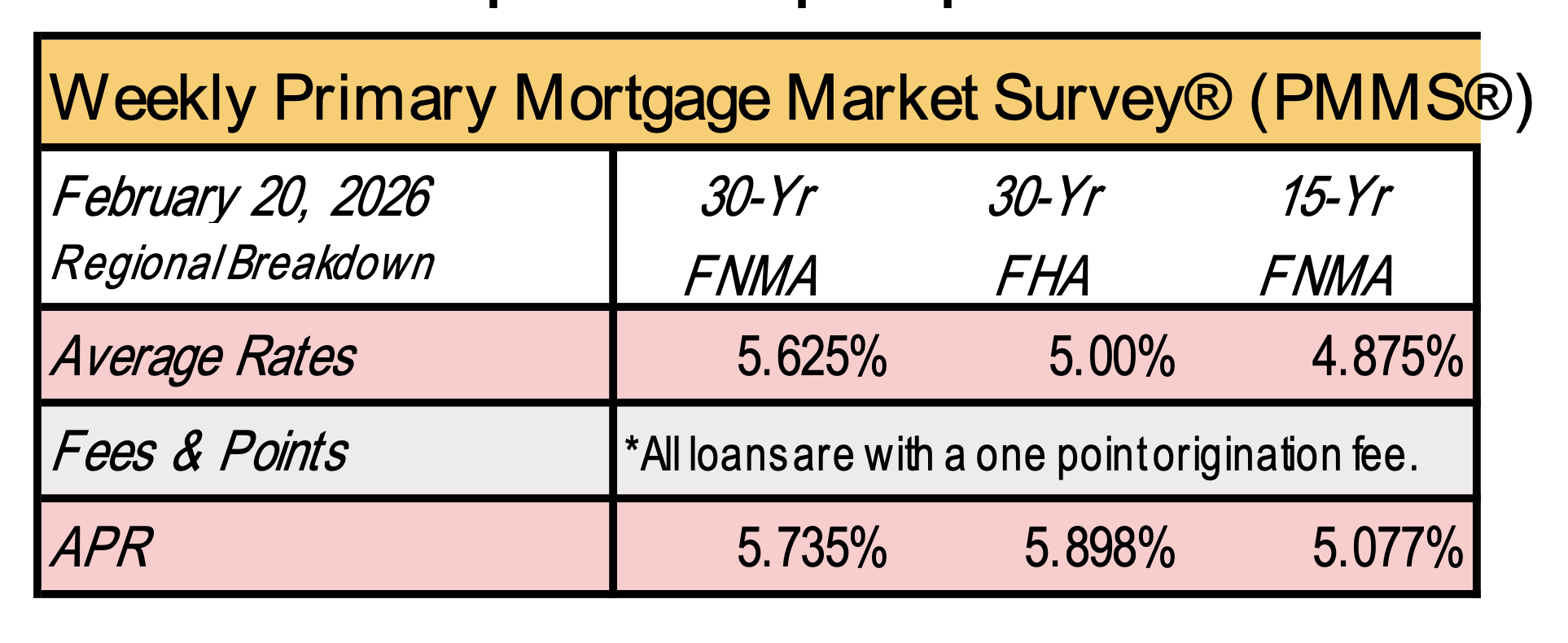

Consumer and broker activity rebounded strongly from December, signaling early momentum as the market begins to transition toward the spring selling season. Mortgage interest rates also continued a gradual downward trend, ending January at 6.10%, compared to 6.15% at the end of December.

Rates have reached similarly low levels only twice since the run-up in 2022 — briefly in February 2023 and again in September 2024 — when rates dipped temporarily before rising again. This time could be different, as the rate decline has continued over a longer period, suggesting it may be more sustainable.

The median sales price for residential homes and condominiums sold in January 2026 was $595,000, down 3.25% from January 2025 ($615,000). Month over month, the median price declined 2.8% from $612,250 in December 2025.

Source: NWMLS

The Housing Markets Seeing the Sharpest Home Price Declines

The South and the West are experiencing the sharpest impacts, where price declines have become the norm.

Florida, Texas, Colorado, Washington, DC, Hawaii, Arizona, Utah, Oregon, and California have recorded the steepest declines in Cotality’s Home Price Index (HPI). The index evaluates the risk of metro areas entering a downturn by analyzing multiple market segments and drawing on 45 years of home price trends through proprietary statistical models.

The markets showing the sharpest HPI declines include Kahului-Wailuku, HI; Victoria, TX; Wichita Falls, TX; Napa, CA; Naples, FL; Punta Gorda, FL; Cape Coral, FL; North Port, FL; Rome, GA; and Sebastian, FL.

Punta Gorda has experienced the largest equity percentage drop at -7.97%, representing a median value decrease of $26,624. -Continue reading at Realtor.com

Delinquent consumer loans have steadily increased as pandemic distortions fade, returning broadly to pre-pandemic levels. According to the latest Quarterly Report on Household Debt and Credit from the Federal Reserve Bank of New York, 4.8% of outstanding household debt was delinquent at the end of 2025, 0.3 percentage points higher than the third quarter of 2025 and 1.2% higher from year-end 2024.

This increase reflects a normalization period coming out of the pandemic, when delinquency rates were suppressed by payment forbearance and fiscal support. As these government assistance programs ended and credit reporting normalized, delinquency rates rose steadily and are now on par with pre-pandemic levels.

-Mortgage News Daily

Gina Brown (NMLS# 115337)

Senior Loan Officer

🏢 C2 Financial (NMLS# 135622)

425-766-5408

ginabrown@C2financial.com

www.loansbygina.com