May marked a month of new records for some Northwest MLS market indicators

May was a month of record-setting highs and lows for some key housing market indicators tracked by Northwest Multiple Listing Service.

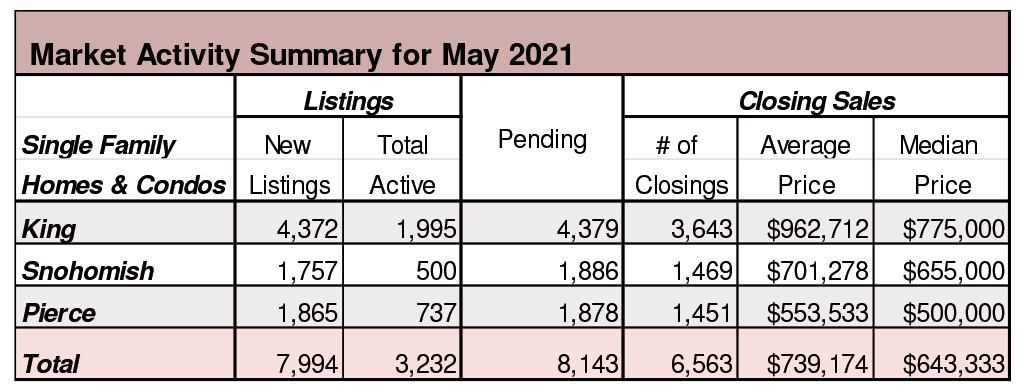

Northwest MLS director Robb Wasser, branch manager at Windermere Real Estate/East in Bellevue, noted the number of active listings for single family homes dropped from April to May for the first time in at least 20 years. The month-to-month decline was small (only 83 listings), but compared to 12 months ago, May’s inventory plummeted by 4,824 listings (down 46.6%).

Months of inventory of homes and condominiums fell to just over two weeks (0.59 months) system-wide, which encompasses 26 of Washington’s 39 counties. Only March 2021 and December 2020 have been lower when both months ended with only 0.53 months of supply.

Year-over-year price increases measured by percentages appeared to hit a new high with the median price on last month’s 9,374 closed sales soaring 30% from a year ago.

A check of Northwest MLS data shows prices on the 8,011 single family home sales (excluding condos) that closed last month sold for 107.3% of the asking price. In the 4-county Puget Sound region (King, Snohomish, Pierce and Kitsap), the figure was 108.6%, while in King County it was 109.5%.

“Everything is about breaking records this past year with record-breaking housing prices, record-breaking low inventory, and record-breaking consumer savings rates during the pandemic,” remarked Meredith Hansen, owner/designated broker at Keller Williams Greater Seattle. “All this equals a very strong, chaotic market that may not slow down for the next year,” added Hansen, who is also a member of the NWMLS board of directors.

Brokers added 11,922 new listings of single family homes and condos during May, slightly fewer than April’s total of 12,043. Compared to a year ago, as brokers, sellers, and buyers were adjusting to pandemic related restrictions on the real estate industry, the volume of new listings rose 20.8%.

Pending sales edged above the volume of new listings, with brokers reporting 11,969 mutually accepted offers. That number also outgained the year-ago total of 10,389 (a gain of 15.2%), and was the highest number since September when MLS members logged 12,053 pending sales.

High demand kept supply depleted. At month end, there were 5,533 active listings in the NWMLS database, nearly half the inventory of a year ago when buyers could choose from 10,357 listings.

J. Lennox Scott, chairman and CEO at John L. Scott Real Estate, is confident the robust activity will continue. “We are in a prime position to see a good number of resale listings and a proportional number of homes going under contract. Frenzy-level buyer demand has not waned. The local market is still virtually sold out in the more affordable and mid-price ranges, as well as into the luxury ranges in some areas.”

Seattle is No.1 for growth in 2020

New data from the U.S. Census Bureau shows that between July 1, 2019, and July 1, 2020, Seattle had a net gain of about 16,400 residents, hitting a total population of 769,700. That pencils out to a growth rate of 2.2% last year. And that means that among the 50 biggest U.S. cities, Seattle is – No. 1 for growth in 2020.What about all those Sunbelt cities that everyone has been flocking to during the pandemic? Sure, they’re growing fast, but they were behind Seattle. Fort Worth, Texas, ranks No. 2, followed by Mesa, Arizona; Austin; and Tampa. Seattle’s 2020 growth was actually pretty much in line with the numbers we saw back in the 2010s – and Seattle was also the fastest-growing city of the past decade.

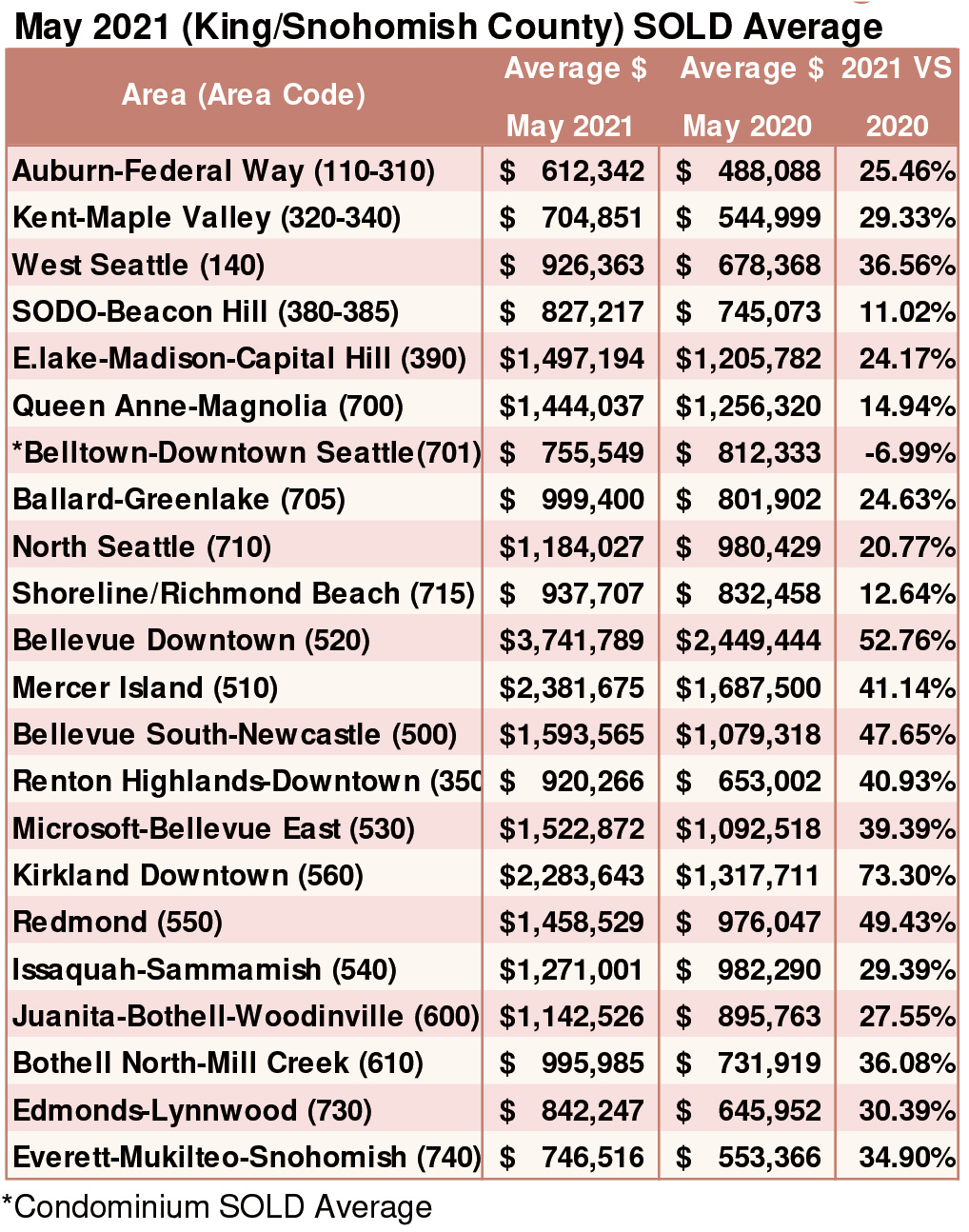

Breakouts! – Residential SOLD Average

New home sales challenges

Record-high building material prices and a continued lack of labor brought down new home sales in April to a seasonally adjusted annual rate of 863,000 ― roughly 5.9% lower than the revised March rate, according to a joint analysis from the U.S. Census Bureau and the Department of HUD.

April’s new home sales are nearly double that of April 2020’s estimate of 582,000.

“New home sales volume remains well above pre-pandemic levels, but it’s become very clear that the high and volatile price of lumber and other key building materials is introducing challenges to the new home building and sale process,” said Matthew Speakman, economist at Zillow.

Gina Brown (NMLS#115337)

Senior Loan Officer

425-766-5408

gina@gmgloan.com

www.loansbygina.com