Western WA housing market “more balanced, and not so crazy – and that’s a good thing”

“Home sellers really need to re-think their expectations,” suggested Mike Larson, a member of the board of directors at Northwest Multiple Listing Service (NWMLS) when commenting on statistics summarizing May activity. The new report showed a significant increase in active listings compared to a year ago, a slowdown in sales, and prices still rising.

Larson, the managing broker at Compass in Tacoma, said the days of “multiple offers and waived inspections, at least in Pierce County, are behind us.” He described the market as “more balanced and not so crazy, and that’s a good thing. Buyers are getting a little relief – not much, but a little as we’re slowly easing back into the kind of market we had pre-COVID.”

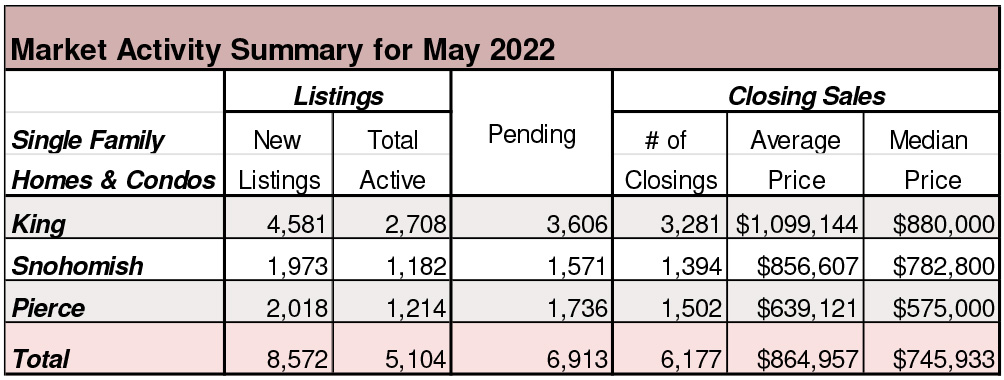

NWMLS members added 13,075 new listings to inventory during May, up 9.7% from a year earlier and the highest monthly number since June 2021.

At the end of May, buyers could choose from 8,798 active listings system-wide, up a whopping 59% from a year ago when there were only 5,533 properties in the database. That is the largest selection since September 2020 when there were 9,099 single family homes and condominiums offered for sale across the 26 counties served by Northwest MLS. The selection in Snohomish County jumped from 500 to 1,182 listings (up 136.4%).

Even with the healthy uptick in inventory, there is still less than one month of supply area-wide (0.97 months).

Pending sales declined about 11.7% from twelve months ago but increased 8.2% compared with April. Members reported 10,563 pending sales of homes and condos last month, up from April’s figure of 9,760, but down from the year-ago total of 11,969.

Closed sales dipped slightly from a year ago (down about 3%) but rose 9% from April. Members completed 9,096 sales last month, which was 278 fewer than a year ago. May’s total outgained April by 752 transactions.

Buyers can expect to pay more for homes and condos, although the increases may be moderating. Last month’s system-wide median price of $660,000 was up 12.8% from the year-ago figure of $585,000.

“In May, we saw a slowdown in the steep price increases we have witnessed so far this year,” observed John Deely, executive vice president of operations at Coldwell Banker Bain. He noted prices for single family home sales (excluding condos) in King County jumped from $775,000 in January to a whopping $995,000 in April, a change of $220,000 in only four months (a jump of 28.4%). Prices for single family homes in King County were nearly unchanged from April ($995,000) to May ($998,888).

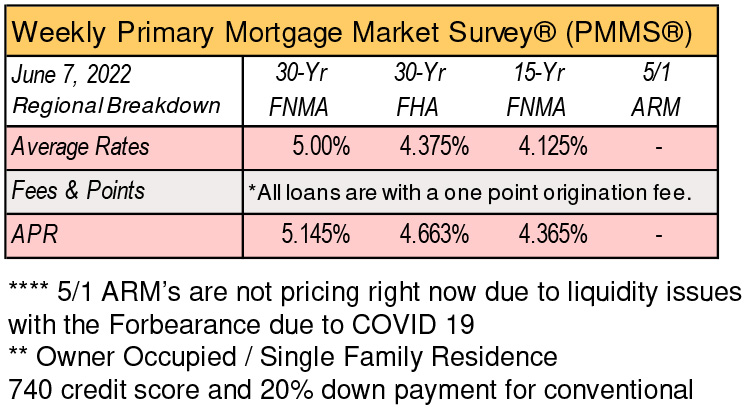

“Rising interest rates coupled with inflation are causing buyers that rely on conventional mortgages to reconsider the affordability, and possibly take a break or look in areas that are less costly,” Deely commented. “We seem to be heading from an extreme seller’s market toward a more balanced market with increasing inventory.”

Best cities to raise a family

Seattle ranked No. 7 in the country among the best cities to raise a family, according to a recent WalletHub study. Nearly 32 percent of people who moved last year said they did so to be closer to family, according to WalletHub. The personal-finance site said the average American moves 11.7 times in their lifetime. For the study, WalletHub compared more than 180 cities using 46 key metrics, including housing affordability, quality of school systems, the percentage of fully-vaccinated residents and more. Fremont, Calif., took home the No. 1 slot, followed by Overland Park, Kansas, Irvine, Calif., Plano, Texas, Columbia, Md., and San Diego.

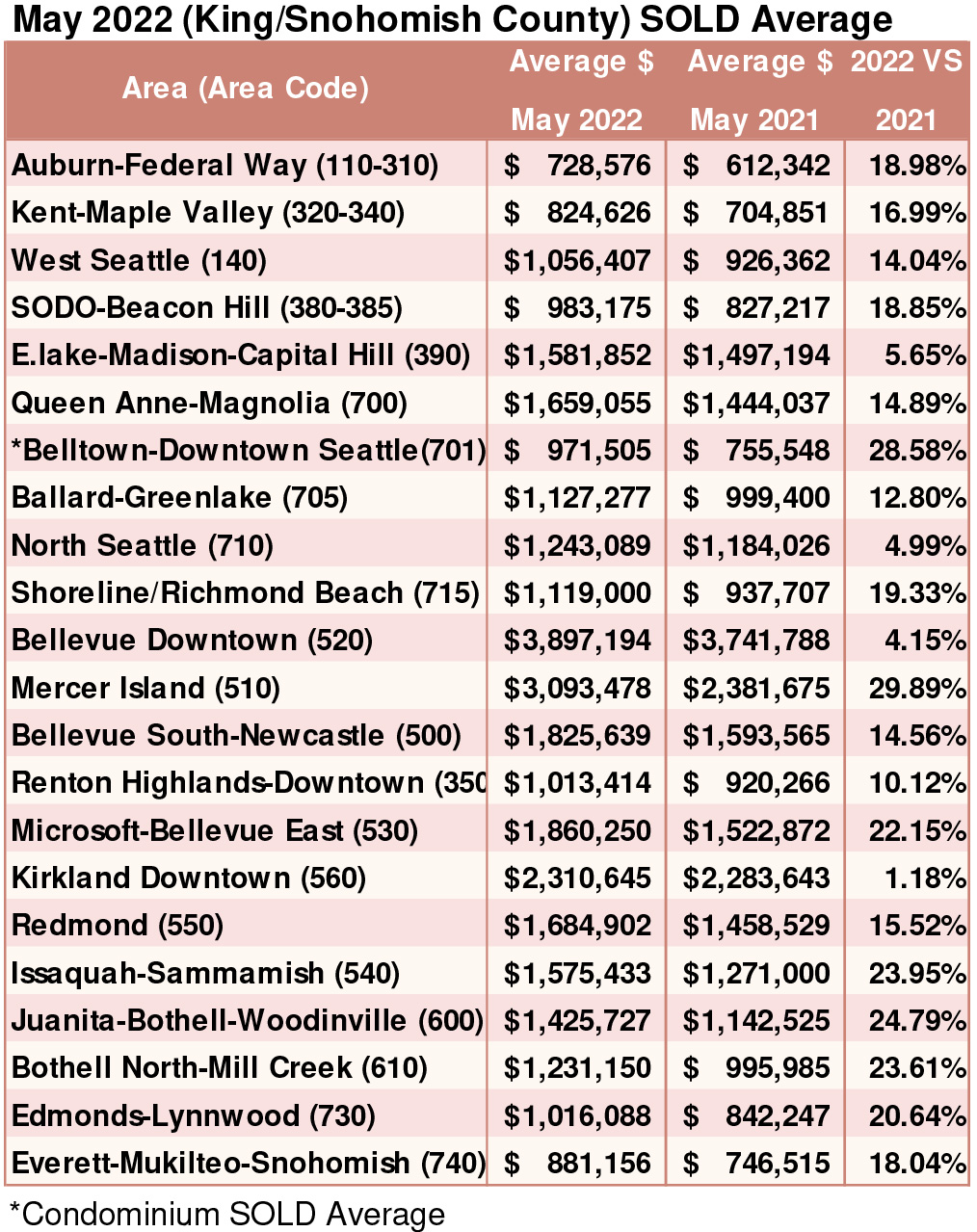

Breakouts! – Residential SOLD Average

Housing inventory: Severe shortages

In stark contrast to the recent New Home Sales data, a new white paper from Black Knight suggests that, by the time we include existing homes, there are actually “severe, accelerating, chronic shortages in every market,” and “in every price range.”

Collateral Analytics (a division of Black Knight) compiles various monthly statistics focused on price, availability, time on market, etc. to arrive at what it refers to as a “market condition rating” (MCR) for the top 100 metro areas in the U.S. The MCR ranges as follows: “hot, strong, good, normal, soft, weak, distressed” with a majority of the nation tending to fall in the middle 3 categories at any given time.

Gina Brown (NMLS#115337)

Senior Loan Officer

425-766-5408

gina@gmgloan.com

www.loansbygina.com