Despite seasonal slowdown, Northwest MLS brokers report pent-up demand for housing

November statistics from Northwest Multiple Listing Service surprised few brokers. They point to holidays, inclement weather, and various economic factors for prompting pauses in listing and sales activity. Nonetheless, several industry leaders commented on positive signs, fueled in part by pent-up demand and evidence of easing inflation pressures.

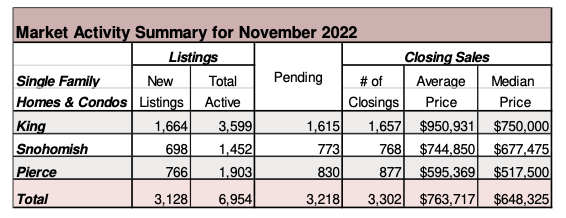

Northwest MLS figures show both pending and closed sales fell sharply from a year ago, but median prices system-wide edged up slightly (0.88%), from $570,000 to $575,000. Pending sales (mutually accepted offers) across the 26 counties in the report were down 40% (dropping from 8,571 a year ago to 5,106) while closed sales fell 42% (declining from 8,976 to 5,194). NWMLS figures show brokers closed an average of 173 sales per day across all counties.

“Our traditional seasonal slowdown around the holidays is happening earlier this year, with the alignment of climbing interest rates, economic news, local weather, and a volatile stock market,” stated John Deely, executive vice president of operations at Coldwell Banker Bain. “These conditions make it easier for consumers to place large purchases on hold, though we saw several notable sales in the luxury market over the last month, as real estate is still one of the best investments one can make,” he remarked.

Data from the multiple listing service shows 15.84% of November’s sales topped $1 million, while a year ago 13.96% of sales were at that level.

Inventory statistics were mixed. Brokers added 4,890 new listings during November, a decline of 24.2% compared to the same month a year ago when they added 6,455 new listings.

At month end, there were 12,245 total active listings, a whopping increase (about 165%) from the selection of a year ago when there were only 4,621 active listings.

Fifteen of the 26 counties reported price increases from a year ago, with 11 counties having declines. All four counties in the Puget Sound region experienced modest price gains, ranging from about 1.1% in Kitsap County to 2.9% in Snohomish County.

J. Lennox Scott, chairman and CEO of John L. Scott Real Estate, noted both the number of home buyers and the number of new listings are running below pre-pandemic seasonal levels. “There is a shortage of unsold inventory, especially in the more affordable and mid-price ranges where approximately 80% of transactions take place within each market.” He reported a strong level of activity intensity for new listings going under contract within the first 30 days.

Deely believes the 2023 market “is shaping up to be quite competitive with building inventory and pent-up buyer demand.”

Most Expensive U.S. Zip Codes

The sixth-most expensive zip code in the United States, based on median home sales prices, belongs to King County. According to PropertyShark’s list of the top 100 most expensive U.S. zip codes, Medina (98039) ranked No. 6 with a record-high median sales price of $4,750,000. A record 14 zip codes throughout the country surpassed the $4 million median mark, led by Silicon Valley’s Atherton ($7,900,000), Sagaponack, Suffolk County, NY ($5,750,000), Ross, Marin County, Calif. ($5,500,000), Miami Beach, Miami-Dade County, Fla. ($5,200,000) and Beverly Hills, Los Angeles County, Calif. ($5,122,000). PropertyShark said it ranked the zip codes based on closed-sales data.

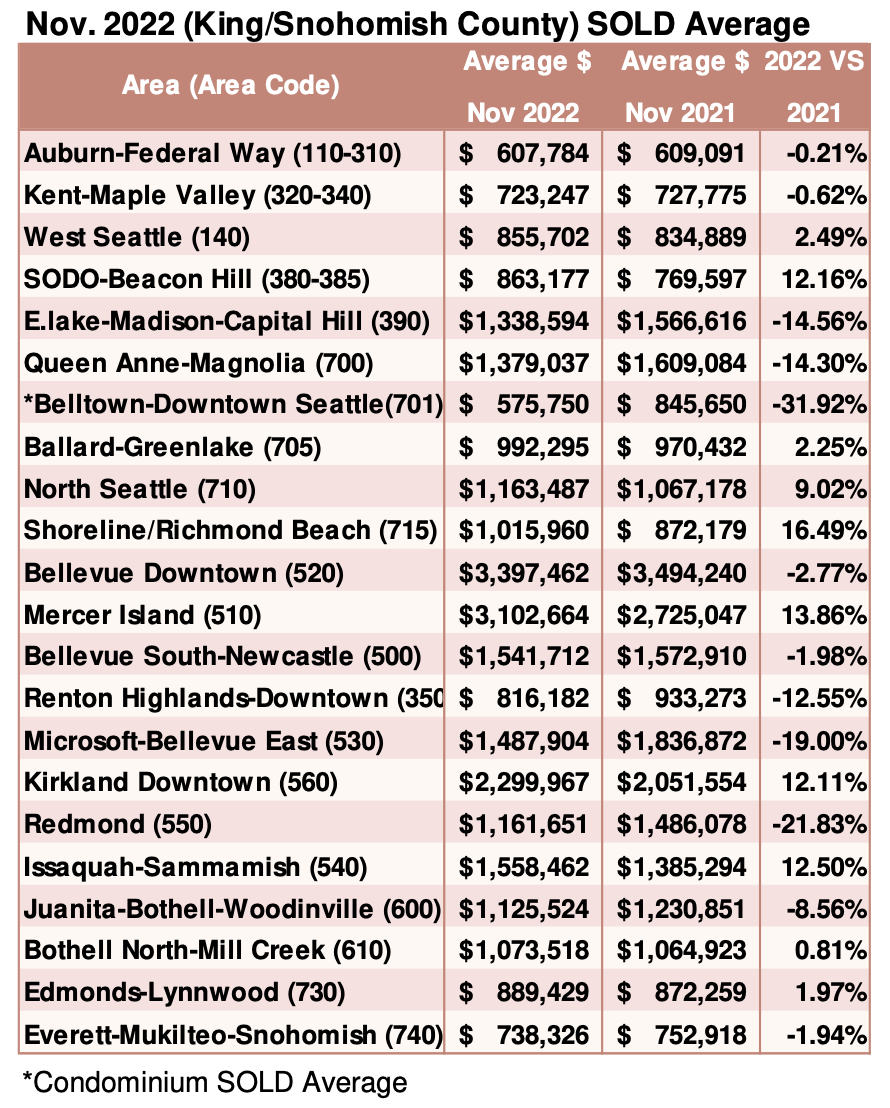

Breakouts! – Residential SOLD Average

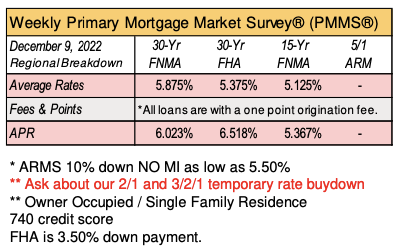

New loan limits for 2023

The Federal Housing Finance Agency (FHFA) announced the maximum conforming loan limits (CLL) for mortgages to be acquired by Fannie Mae and Freddie Mac will increase in 2023. Loans above this amount are known as jumbo loans.

In most of the U.S., the maximum CLL for single-family and one-unit properties will be $726,200, an increase of $79,000 from $647,200 in 2022.

High Balance in King/Snohomish/Pierce is $977,500.00 before becoming a jumbo loan.

Gina Brown (NMLS#115337)

Senior Loan Officer

Home Trust Financial NMLS1761573

425-766-5408

gina@gmgloan.com

www.loansbygina.com

![]()