Brokers detect good news for home buyers, citing gains in listings and moderating prices

Finally, some good news for home buyers! Sizeable increases in new listings compared to a year ago and reports of moderating prices “might meanwe are seeing some relief for buyers,” suggested John Deely, a board member at Northwest Multiple Listing Service.

At month end, April’s active listings stood at 5,616, yet during the month, member-brokers added 12,043 new listings of homes and condos. There was a jump of more than 57% from the same month a year ago when the pandemic shutdown began. Compared to March, the volume of new listings rose 14%, and even compared to two years ago (April 2019), new listings were up about 3%.

April’s month-end inventory of 5,616 listings was a year-over-year (YOY) drop of 45%; a year ago, there were 10,282 active listings in the MLS database.

Pending sales continue to surge, keeping inventory depleted. Brokers reported 10,583 pending sales during April, up nearly 47% from a year ago when they logged 7,207 mutually accepted offers. Last month’s pending sales dipped slightly (2.58%) from March.

“At long last, May is here. Historically, we see a nice uptick in new listings every May. This increased availability and selection will be present throughout the summer,” suggested J. Lennox Scott, the chairman and CEO of John L. Scott Real Estate. He tempered his prediction by noting there is a large backlog of prospective home buyers, a situation he says will “keep the market in a state of ‘instant response’ for each new resale listing.”

Even with some improvement in listings, the MLS report shows only nine counties have more than one month’s supply of inventory. Areawide, there is only 0.64 months of inventory, with even less supply (0.57 months) in the four-county Puget Sound region.

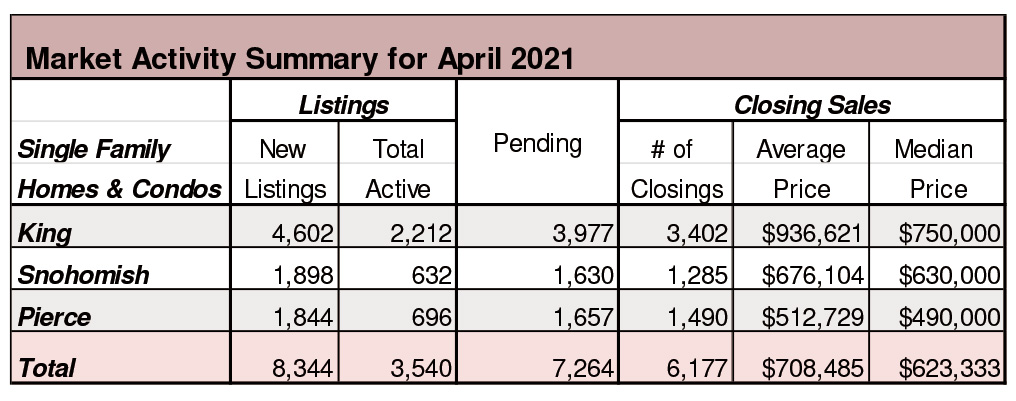

With supplies depleted, prices continue to climb. Brokers reported 8,791 closed sales of single family homes and condos during April, nearly 50% higher than the year-ago total of 5,866 completed transactions. Year-over-year prices on closed sales surged 25%, from $452,030 to $565,000. Nearly every county had double-digit gains.

Prices on single family homes rose about 26.5%, while condo prices increased by a more modest 12%. Although bidding wars are common, Deely said some brokers are reporting things may be starting to moderate related to pricing. “Brokers tell us some sellers who have been pushing the envelope on their home price are now experiencing longer list times and, in some cases, have had to drop their prices.” He emphasized sellers need to price appropriately. “With things starting to return to normal, the off-the-chart activity placing sellers in the driver’s seat may be moderating,” he remarked.

Washington’s economy the least impacted

Washington state’s economy has weathered the coronavirus pandemic

better than any other state in the nation, a newly released study has found. The report, by personal finance website WalletHub, compared the 50 states and the District of Columbia across 13 key metrics, including the share of employment from small businesses to the share of workers with access to paid sick leave and the increase in unemployment insurance claims. A score was then assigned to each state based on those metrics, and Washington state’s economy ranked as the least impacted so far by the pandemic. Specifically, the study found that the Evergreen state has: One of the highest shares of workers who are able to work from home; A higher than average number of employees returning to work after being unemployed; A higher than average share of workers with access to paid sick leave.

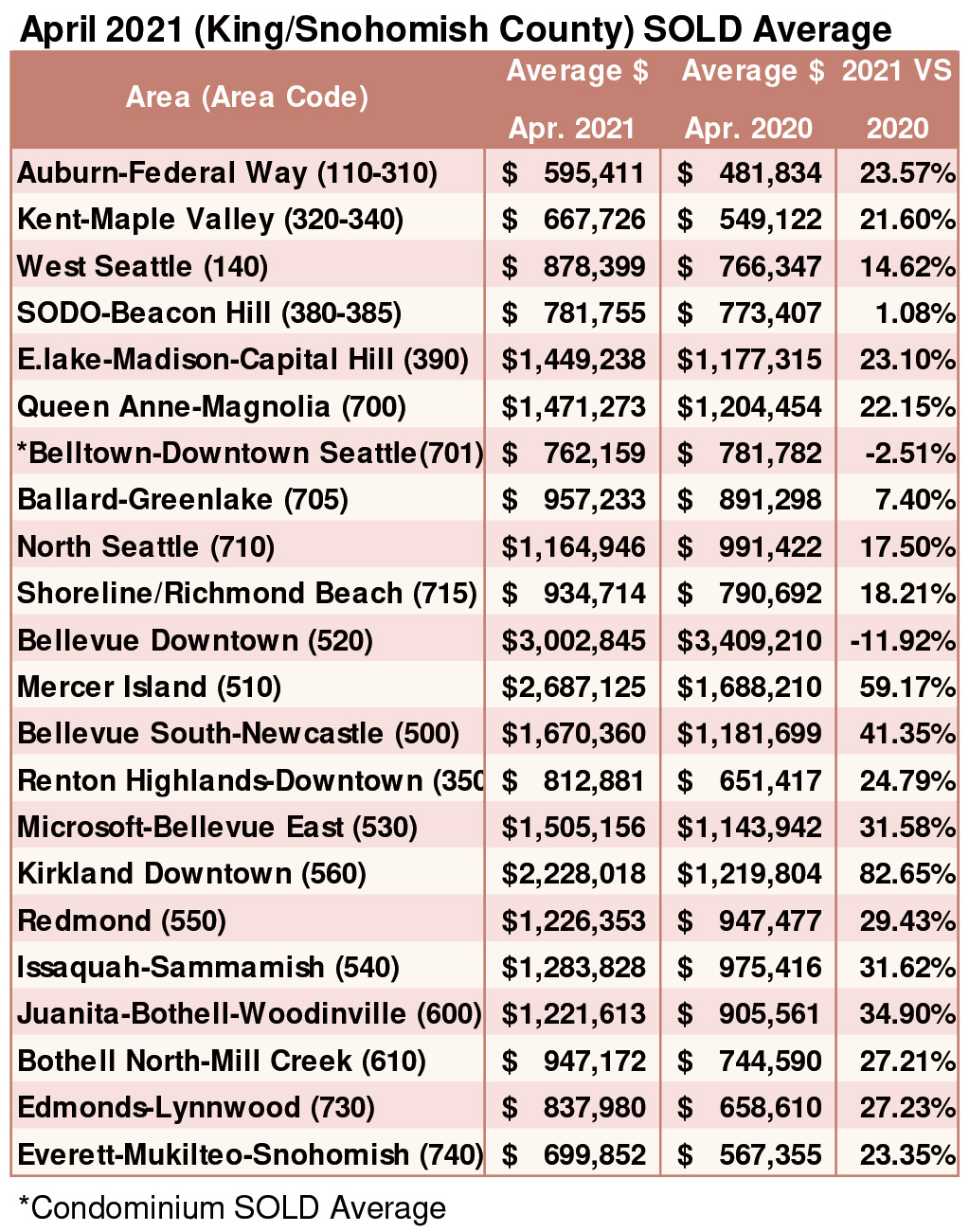

Breakouts! – Residential SOLD Average

Millennials driving home prices; Entry level homes see greatest gains

Another home price index shows double digit annual price increases, this time for March, and the CoreLogic HPI also has the highest month-over-month gain we have seen in the present environment. The company says there was an 11.3 percent national rate of appreciation during the month while prices were up 2.0 percent from February.

The company says the 2021 spring homebuying season is on track to outpace trends seen in 2019 and 2018. Millennials are driving the demand, accounting for 54 percent of home purchase applications over the last year.

Gina Brown (NMLS#115337)

Senior Loan Officer

425-766-5408

gina@gmgloan.com

www.loansbygina.com