Multiple offers “the norm” for home buyers, but may ease with uptick in listings

Multiple offer situations are the norm for today’s home buyers, but some brokers with Northwest Multiple Listing Service suggest February’s improving inventory and a slowing pace of price increases may ease some of the competitive pressures.

“In February, we saw an increase in listings, which could be an indicator that more sellers are primed and ready to go. Inflation, rising interest rates, and new financing options are bringing more sellers into the market,” said John Deely, executive vice president of operations for Coldwell Banker Bain.

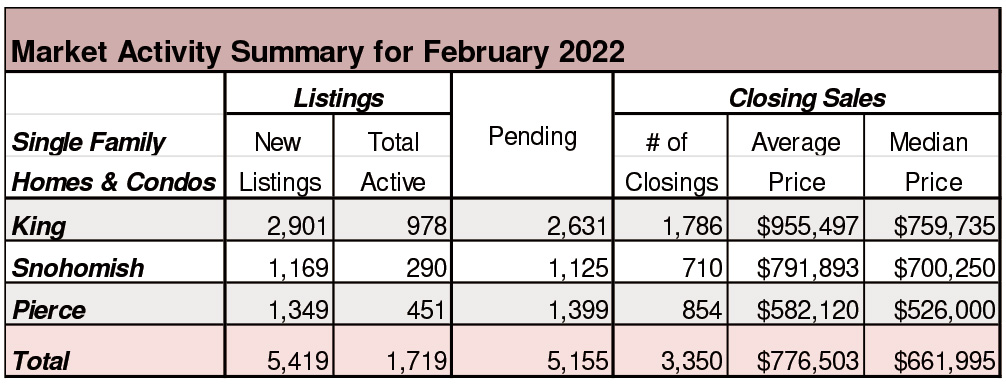

Northwest MLS brokers added 7,920 new listings to inventory during February, a 6.8% improvement from a year ago, and a gain of more than 33% from January’s total of 5,927. Pent-up demand led to big month-over-month gains in pending sales and more shrinkage in overall supply.

Sellers system-wide accepted 7,697 offers on their homes during February, about the same number (7,724) as a year ago, but a 21% jump from January’s volume of pending sales (6,350). Fourteen of the 26 counties in the MLS report had fewer pending sales than a year ago, a likely consequence of tight supply.

Prices continue to trend upward. The area-wide median price for last month’s closed sales of single family homes and condominiums was $585,000, up 14.3% from a year ago, and up 5.4% from January.

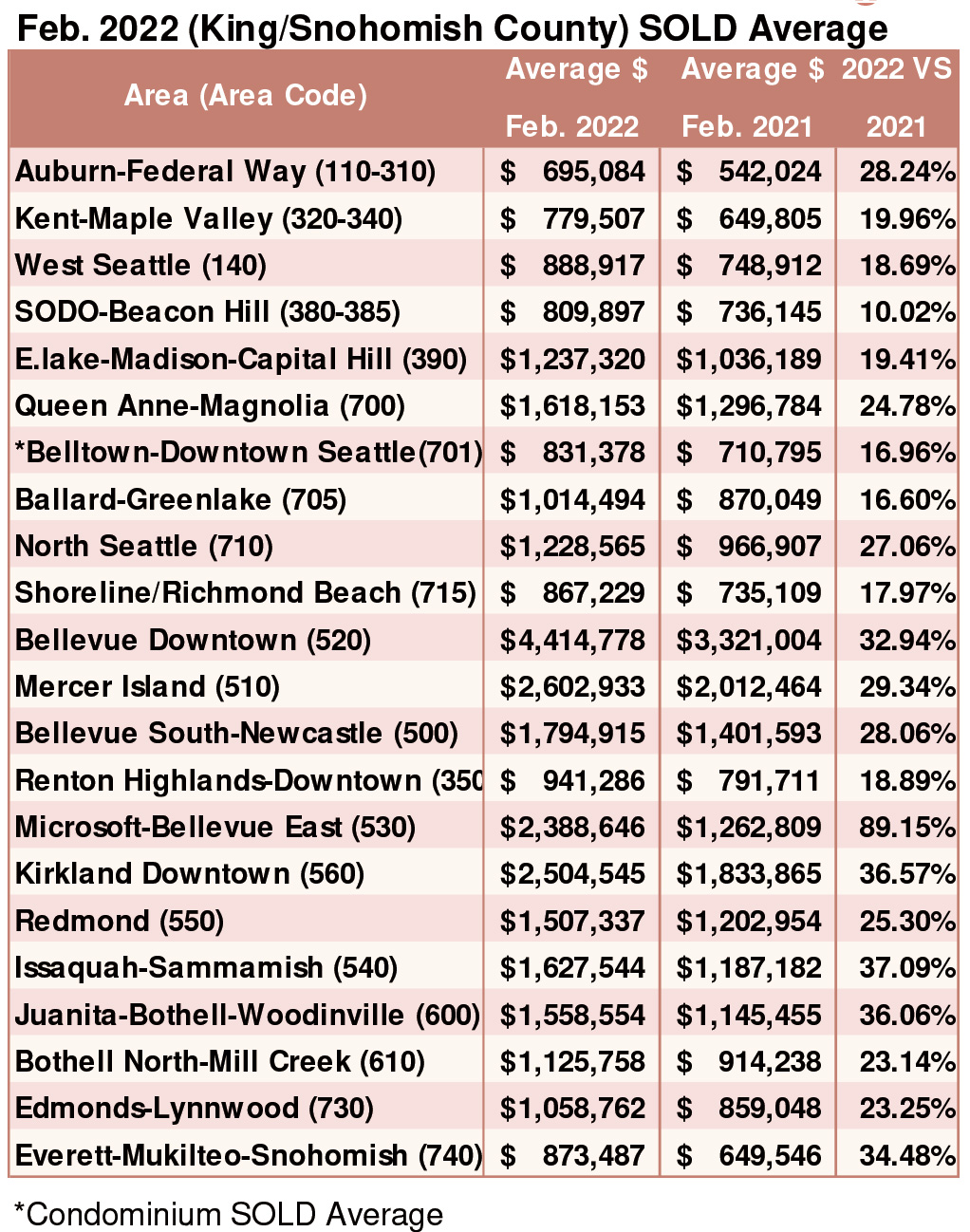

Prices for single family homes (excluding condos) rose at a smaller rate, about 12.2%, increasing from $535,000 a year ago to $600,000 last month. Commenting on the increases, Matthew Gardner, chief economist at Windermere Real Estate, noted some areas were “clearly very popular” with buyers of single family homes because they had especially strong growth. He singled out West Bellevue, West Lake Sammamish, and Redmond on the Eastside, and in Seattle named Ballard, Magnolia, and Queen Anne.

Industry analysts believe conditions will probably continue to favor sellers.

At the end of February, there were 3,461 total active listings in the MLS database, up from January’s total of 3,092 for a gain of nearly 12%, but down about 19.5% from twelve months ago when inventory included 4,298 listings of single family homes and condominiums.

Measured by months of supply, there was about 19 days (0.67 months) at the end of February. That was the highest level since September 2021 when the MLS reported 0.75 months of supply.

“As we head into spring, it’s time for buyers to reenergize and go through a renewal of spirit as they begin or continue their home search,” stated J. Lennox Scott, chairman and CEO of John L. Scott Real Estate. “Buyers will be pleased to hear that more listings are on the way! Historically, the number of new listings bumps up in March and April, and then goes up even higher in May and June.”

Higher inflation is costing you more money

The cost of living for an average U.S. family has gone up an extra $276 a month, according to The Wall Street Journal. As inflation rises, the price of groceries, gasoline and cars is making up all those costs. Overall household debt jumped by $1 trillion, the most since 2007, according to the Federal Reserve Bank of New York. Driving that debt in part are car and home loans, as car prices jumped up over 12%. Low supply and high demand are driving up car prices, but shoppers are still driving off with new cars and higher loans. The median home price is up nearly 20%. Credit card balances increased by $52 billion in the fourth quarter of 2021, the largest quarterly increase ever recorded.

Breakouts! – Residential SOLD Average

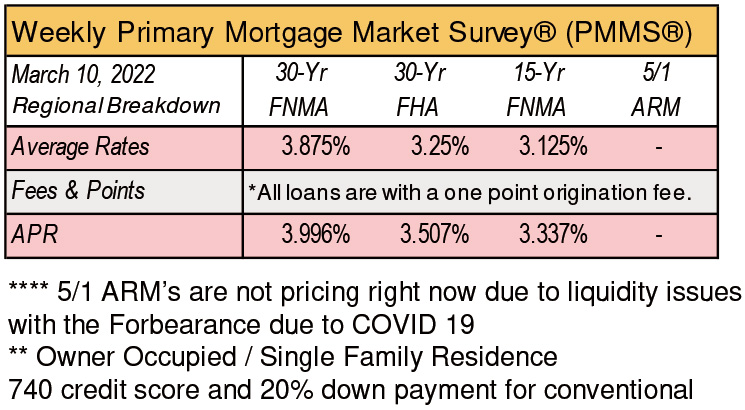

Mortgage rates aren’t still under 4 percent

Rates aren’t merely changing a lot from day to day, they’re changing multiple times per day in many recent occasions. This week was especially troublesome for the Freddie survey, Monday’s rates were, by far, the lowest. In fact, after adjusting for the upfront points and the fact that many of Freddie’s respondents probably didn’t even look past last Friday’s rate offerings before responding, the 3.85% headline isn’t too terribly far from reality.

To be clear, rates are no longer anywhere close to that low. The average lender is now definitively up and over 4.25% for the first time since early 2019. In other words, today’s rates are the highest in almost 3 years.

Gina Brown (NMLS#115337)

Senior Loan Officer

425-766-5408

gina@gmgloan.com

www.loansbygina.com