Brokers, homebuyers welcome growing inventory and market returning to “some sense of normalcy”

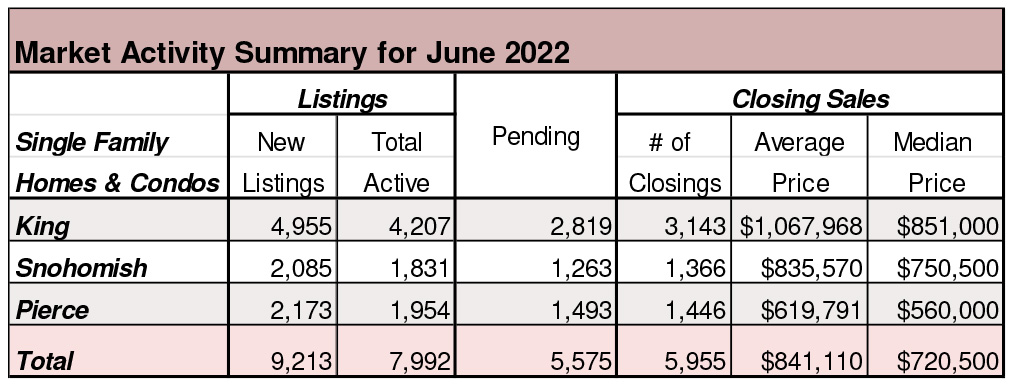

Housing statistics from Northwest Multiple Listing Service for June show signs of a shifting market, creating opportunities for some buyers. Compared to a year ago, Northwest MLS (NWMLS) brokers reported a healthy jump in inventory, double-digit drops in both pending and closed sales, and the smallest year-over-year (YOY) increase in prices since June 2020.

“What the changes mean in general terms, are more houses on the market, longer market times, stabilizing home prices, fewer showings and open house visitors, fewer offers at one time, and more price adjustments,” said Frank Wilson, Kitsap regional manager at John L. Scott Real Estate.

Northwest MLS brokers added 14,223 new listings of single family homes and condos to inventory during June, up from both May, when they added 13,075 homes system-wide, and a year ago, when they added 13,111 properties to the database. Last month’s total was the highest volume of new listings since May 2019 when brokers tallied 14,689 new listings.

At the end of June there were 13,405 active listings of single family homes and condominiums in the Northwest MLS database, which includes 26 of the state’s 39 counties. That’s more than double the inventory of a year ago (6,358 listings), and the best selection since October 2019 when buyers could choose from 14,379 listings.

Both pending sales (mutually accepted offers) and closed sales declined from a year ago. MLS members reported 8,937 pending sales during June, down 27.5% from the year-ago total of 12,328, and down 3.8% from May.

Closed sales also fell from a year earlier (down about 17.2%), but last month’s total of 9,047 completed transactions nearly matched May’s volume of 9,096.

The latest MLS report shows area-wide prices rose about 10.4%, from a median price of $589,000 to $650,000. On a percentage basis, that is the smallest year-over-year (YOY) gain since June 2020 when prices rose around 5.7%.

King County had the second highest sales price last month, coming in at $851,000. That represents a 9.1% increase from a year ago, but a slight decline (3.4%) from May’s figure of $880,000. Median prices topped $1 million for both Vashon and the Eastside map areas, as well as for areas encompassing North Seattle and Lake Forest Park.

Prices of single family homes (excluding condos) system-wide rose about 10.5% from a year ago. Condo prices increased by a similar amount (10.2%).

Lennox Scott, chairman and CEO of John L. Scott Real Estate, also commented on the “intensity adjustment” in the Puget Sound market, while noting sales activity remains strong. “Everything is coming together for buyers in the market, with increased selection of available listings and fewer multiple-offer situations to navigate. A strong contingent of buyers is taking note of new listings and poised to put an offer on the right home, in the right condition, at the right price.”

Where rent is rising fastest

The Emerald City boasts the third-fastest-rising rent year over year in the country, according to a new report from Redfin. The Seattle-based real estate company found the median monthly asking rent in the United States in May surpassed $2,000 a month for the first time, up 15.2 percent year over year and 2 percent month over month. Seattle, Austin, Nashville and Cincinnati all saw increases of more than 30 percent since last year. The median asking rent in Seattle is $3,097 per month, according to Redfin. Austin leads the country with a 48-percent surge in median asking rent year over year, followed by Nashville (32), Seattle (32) and Cincinnati (32), Miami (29), Fort Lauderdale (29), West Palm Beach, Fla. (29) and New York (24).

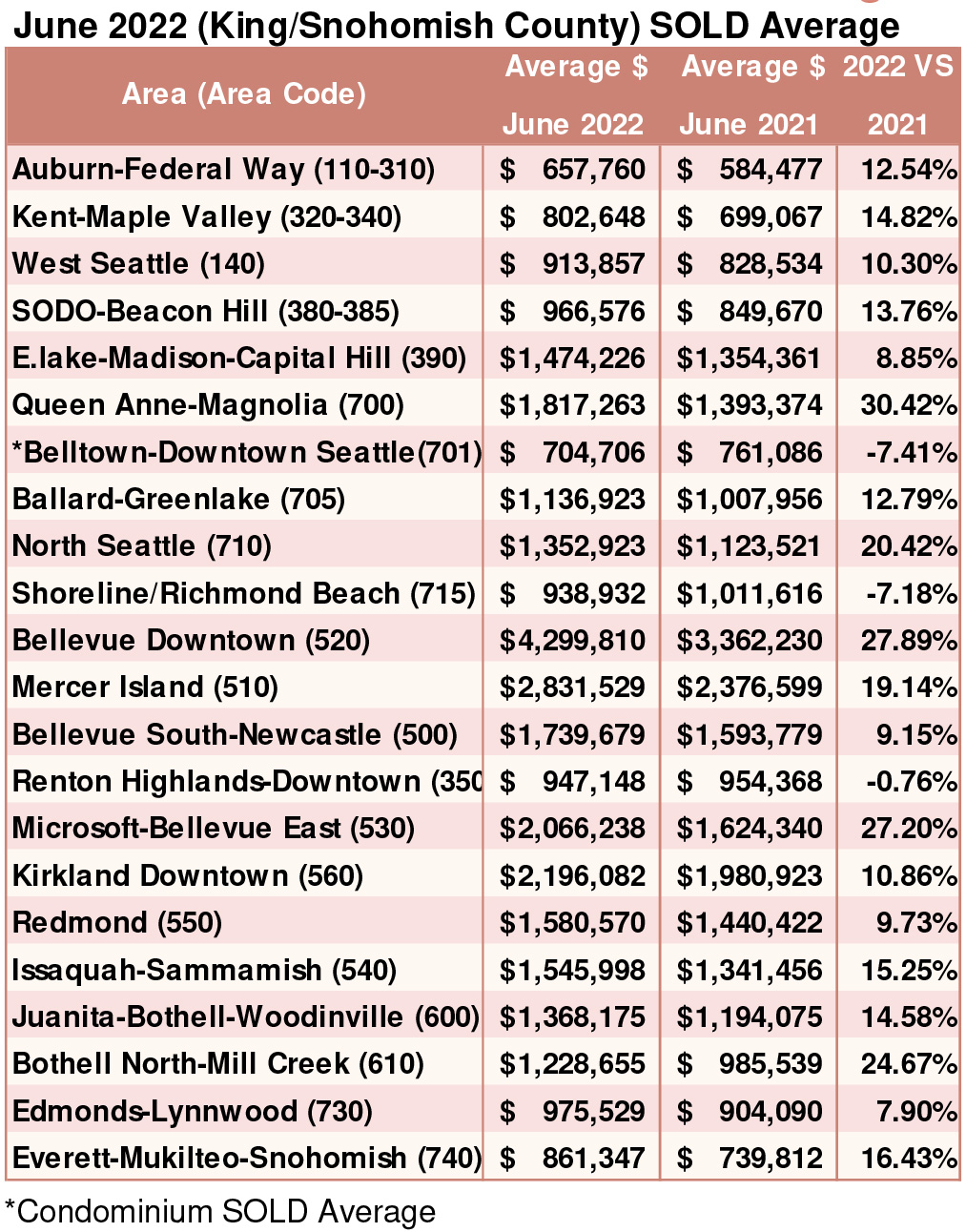

Breakouts! – Residential SOLD Average

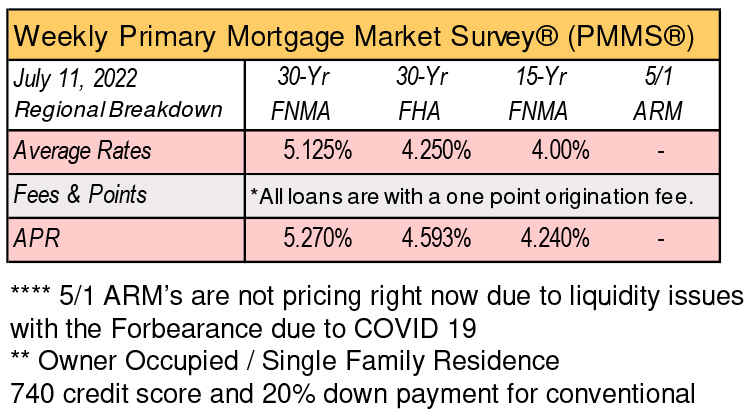

2-1 Buydown explained

A 2-1 buydown is a mortgage agreement that provides for a low interest rate for the first year of the loan, a somewhat higher rate for the second year, and then the full rate for the third and later years.

A 2-1 buydown is a type of financing that lowers the interest rate on a mortgage for the first two years before it rises to the regular, permanent rate.

The rate is two percentage points lower during the first year and one percentage point lower in the second year.

Sellers may offer a 2-1 buydown to make a property more attractive to buyers.

Gina Brown (NMLS#115337)

Senior Loan Officer

425-766-5408

gina@gmgloan.com

www.loansbygina.com