Home buyers are finding some relief, but Northwest MLS brokers say it is temporary

Competition for homes eased slightly in July across much of Washington state, but brokers from Northwest Multiple Listing Service expect the respite to be short-lived, with inventory still tight and prices still climbing.

“Although the local market is intense, buyers can find some relief because there aren’t as many offers to compete with compared to earlier this year,” observed J. Lennox Scott, chairman and CEO of John L. Scott Real Estate. He noted the number of listings brokers added last month outgained the number of homes going under contract by a small margin in most areas in the report.

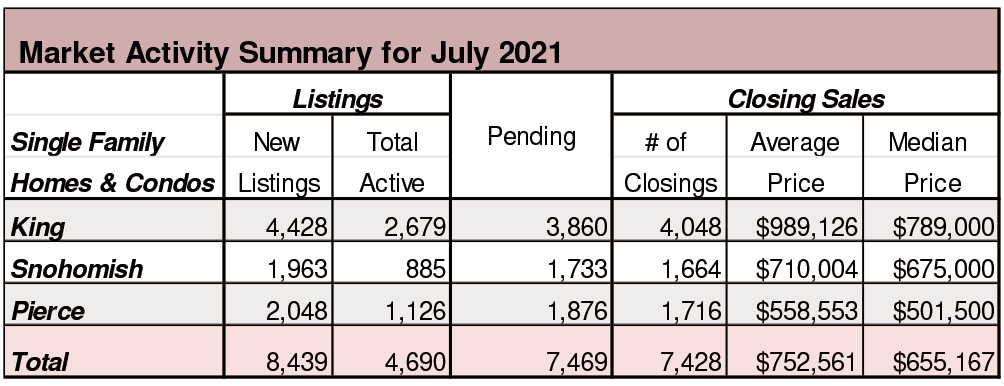

Northwest MLS brokers added 12,916 new listings to the database during July. They reported 11,567 pending sales (mutually accepted offers) areawide, which covers 26 counties. At month end, there were 7,948 total listings offered for sale, down 22.5% from the year-ago total of 10,259. That was the highest level since October when inventory totaled 8,623 properties, including single family homes and condominiums.

“While dangerous to compare 2020 lockdown figures to this year, it is interesting to see that new listings volume is starting to rise above 2019 levels,” observed James Young, director of the Washington Center for Real Estate Research at the University of Washington. In July, MLS figures show member-brokers have added 1,723 more new listings of single family homes and condos than during July 2019 (12,916 versus 11,193). Year to date, brokers have added 1,438 more new listings this year compared to 2019.

Prices continue to climb by double digits in all but a few counties. Across all areas, prices for closed sales of single family homes and condominiums (combined) jumped 21.4% during July compared to a year ago, rising from $484,995 to $589,000.

Northwest MLS figures show there is 0.73 months of inventory system-wide, with only 12 of the 26 counties in the report having more than one month of supply.

John Deely, a member of the Northwest MLS board of directors, said one plus for buyers is some of the condo numbers. The MLS figures show the volume of new listings (1,702) outgained pending sales (1,549), although total active listings remained below year-ago levels (down 35% areawide).

Condo prices rose more modestly, at 12.6%, than the rate for single family homes (22%). In King County, which accounted for nearly six of every 10 condo sales during July, the year-over-year increase was just under 7%. The median-priced condo in King County sold for $460,000, while overall the median sale price was $428,000.

Renter protections upheld by a federal judge

A federal judge has upheld renter protections passed by the Seattle City Council in 2017, finding they are a reasonable approach for reducing housing discrimination. The protections, enshrined in the Fair Chance Housing Ordinance, prohibit most landlords from inquiring about the criminal history of renters or prospective renters. The city said it was trying to reduce barriers to housing for people with criminal records and to reduce discrimination in housing, because people of color are disproportionately represented in the criminal justice system. A group of landlords sued in 2018, claiming violations of their property and free-speech rights. U.S. District Judge John C. Coughenour ruled in favor of the city on July 6.

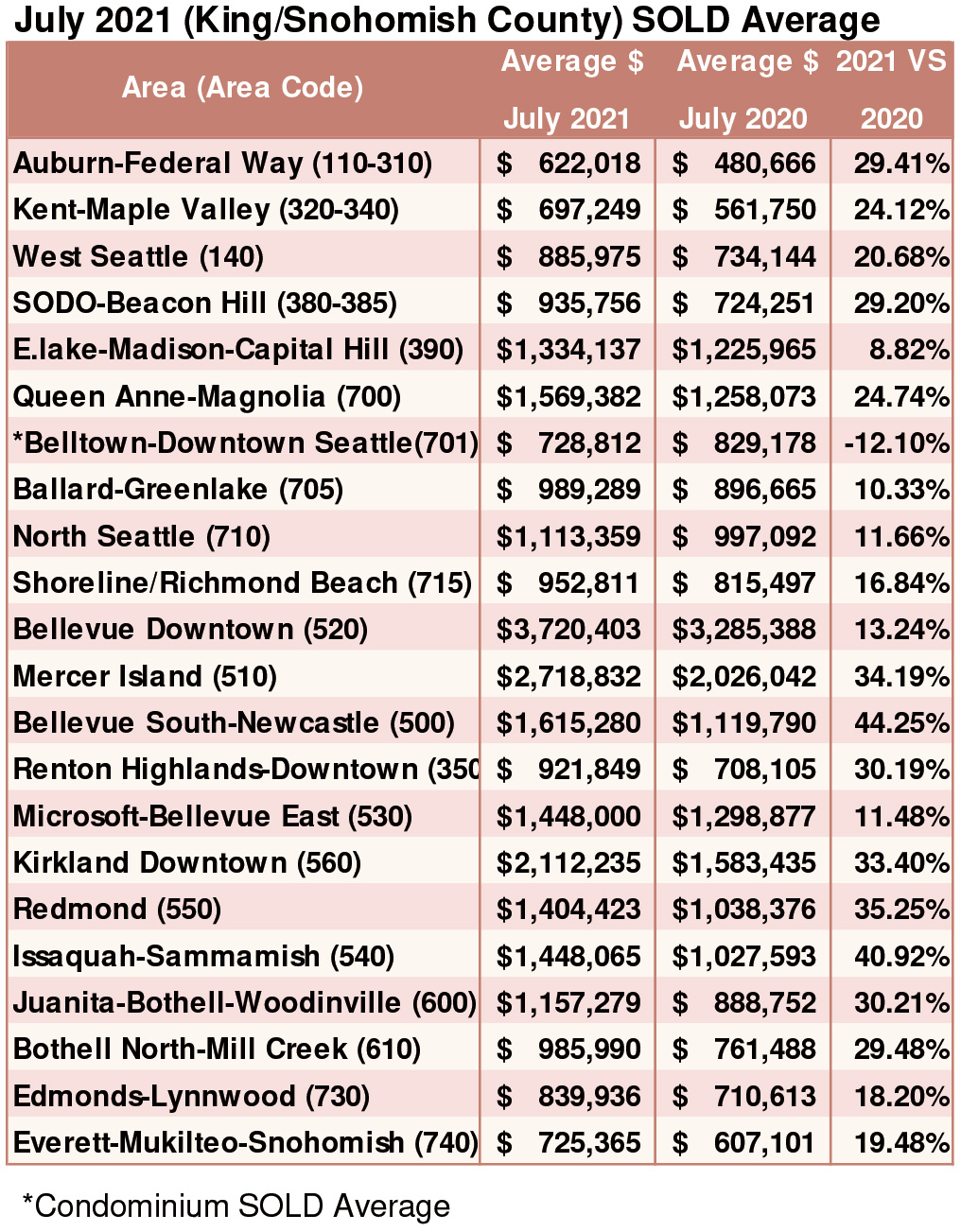

Breakouts! – Residential SOLD Average

Home price appreciation shows no sign of slowing down

CoreLogic says home prices nationwide, including distressed sales, increased in June by 17.2 percent on an annual basis. In May the annual change was 15.4 percent, the greatest increase since 2005.

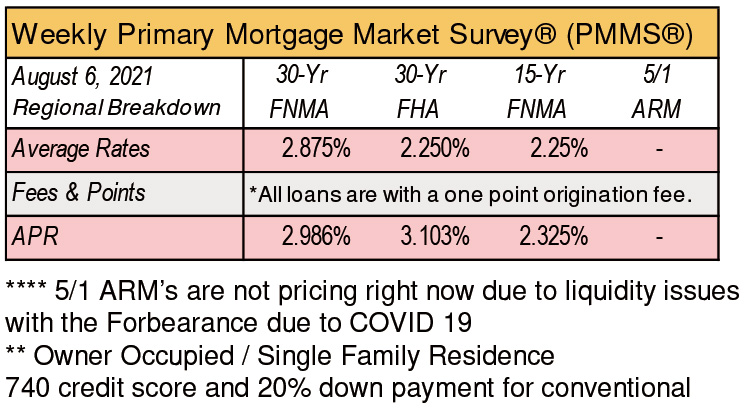

Frank Martell, CoreLogic’s president and CEO says, “Home prices have been rising in the mid-single digits for some years now. The recent surge to double-digit price jumps reflect the convergence of exceptional demand and persistent low supply. With plenty of cash on the sidelines, along with very low mortgage rates, prices are heading up and affordability will become a more acute issue for the foreseeable future.”

Gina Brown (NMLS#115337)

Senior Loan Officer

425-766-5408

gina@gmgloan.com

www.loansbygina.com