Brokers say all parties in housing transactions need to recalibrate during shifting market

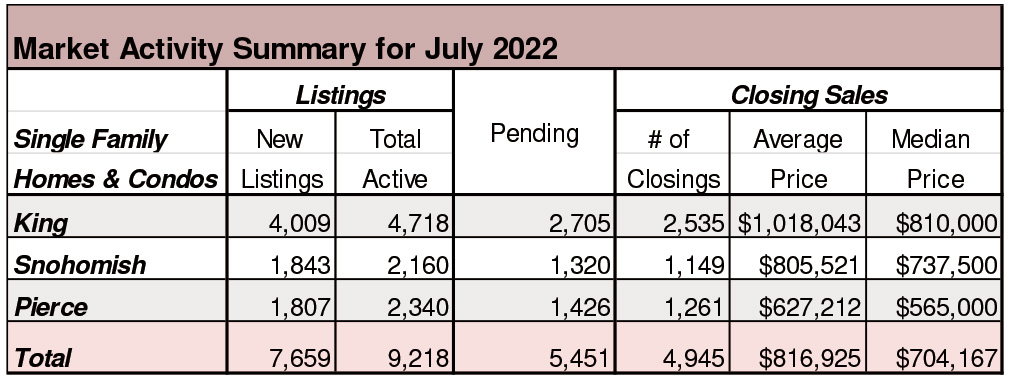

“Today’s buyers have their cups finally overflowing with options as residential inventory grows to about two months of supply,” said Dick Beeson, managing broker at RE/MAX Northwest Realtors in Gig Harbor. The MLS report summarizing July statistics show 2.01 months of inventory system wide.

Inventory of single family homes and condominiums across the 26 counties served by Northwest MLS has not exceeded two months since January 2019 when there was 2.3 months of supply.

Commenting on the “many moving parts” of the market and the need to recalibrate, Beeson said sellers “are starting to see that overpricing just ain’t in the cards right now.” He also noted buyers still have to compete with other would-be homeowners, and depending on the property, some sellers are receiving offers over their asking price. “Buyer and seller expectations have changed. It feels like things are starting to normalize a little,” Beeson remarked.

Active listings have nearly doubled from a year ago, jumping from 7,948 offerings of single family homes and condos to 15,381 (up 93.5%). The addition of 11,805 new listings during the month contributed to the boost. Compared to June, the selection expanded by 1,976 listings (up 14.7%).

Evidence of slower activity appears in the sales figures. Pending sales retreated about 24% from a year ago, dropping from 11,567 to 8,775 mutually accepted offers. The NWMLS report shows a nearly 30% year-over-year decrease in closed sales (declining from 10,919 closings to 7,645).

Despite fewer sales, prices still rose, but at a slower rate. The median price on last month’s closed sales of single family homes and condos increased 6.1% from a year ago, rising from $589,000 to $625,000. For single family homes only (excluding condos), prices jumped about 6.6% and condo prices gained more than 8.6%.

“Buyer opportunities have returned to the Puget Sound market, including increased availability and selection of properties, as well as fewer multiple offer/premium pricing situations,” said J. Lennox Scott, chairman and CEO of John L. Scott Real Estate.

John Deely, executive vice president of Coldwell Bank Bain, said, “We are coming off the fevered pitch of a market that had tremendous velocity over the last few years. With listings starting to build again we are seeing a bit of a natural slowdown, yet still very much a sellers’ market.”

The good news, according to Deely, is “not only is there more inventory for buyers to view, but sellers who were on the fence about placing their home on the market, mainly because they had nowhere to go, are now seeing potential.”

One of the most educated cities in America

The Seattle/Bellevue/Tacoma area is one of the most educated in the country, according to a new report from WalletHub. The personal-finance website ranked the most educated cities in America using 11 key metrics, including share of adults 25 and older with a bachelor’s degree or higher, quality of the public-school system and gender education gap. WalletHub ranked Seattle/Bellevue/Tacoma ninth in the nation. The Puget Sound region ranked eighth in percentage of associate’s degree holders or college-experienced adults. Ann Arbor, Mich., San Jose, the District of Columbia, Madison, Wis., San Francisco/Oakland, Boston and Durham/Chapel Hill, NC, ranked Nos. 1-8, respectively. Visalia, Calif., ranked last at No. 150.

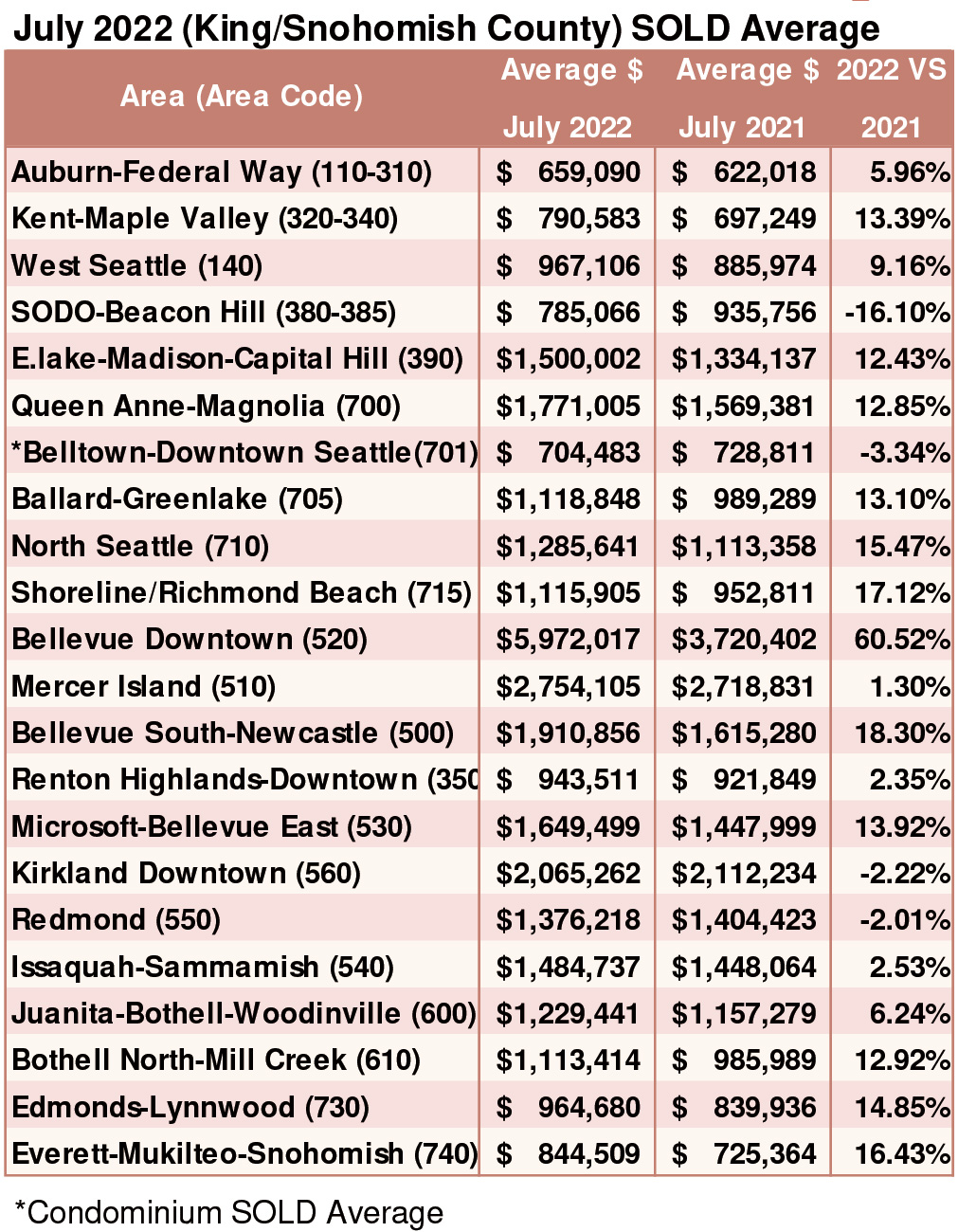

Breakouts! – Residential SOLD Average

Most valuable segment of real estate asset

Residential real estate is the most valuable and accessible segment of real estate asset class.

Real estate investment giants continue to buy up homes. In fact, Blackstone is close to finalizing what could be the biggest traditional private-equity real estate investment fund in history, according to the Wall Street Journal.

In a regulatory filing last month, Blackstone said that it has secured $24.1 billion of commitments for its latest real estate fund called Blackstone Real Estate Partners X. Combined with Blackstone’s real estate funds in Asia and Europe, the company will have over $50 billion available for opportunistic investments.

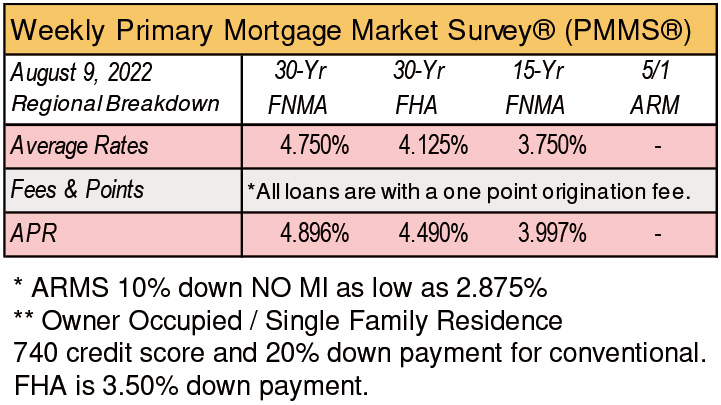

Gina Brown (NMLS#115337)

Senior Loan Officer

425-766-5408

gina@gmgloan.com

www.loansbygina.com