Northwest MLS brokers not seeing much seasonal slowdown, say buyers still need to be bold

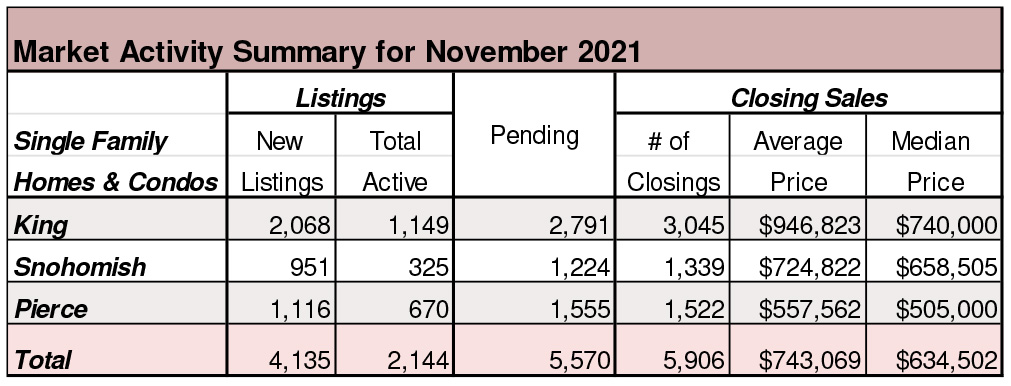

Historically soggy weather and the onset of holidays did not deter thousands of buyers and sellers during November, based on the latest report from Northwest Multiple Listing Service. Numbers for new listings, pending sales, and closed sales were comparable to year-ago totals, while prices rose a little more than 15%.

Northwest MLS figures show 8,571 pending sales across 26 counties last month, nearly matching the year-ago total of 8,584 mutually accepted offers. The 8,976 closed sales marked a slight improvement on twelve months ago when MLS members tallied 8,875 completed transactions (up 1.14%).

“Typically, we see a lull of sales activity during late fall and into early winter. While there are fewer transactions at this time of year, the intensity for each new listing going under contract is extremely high,” J. Lennox Scott, chairman and CEO of John L. Scott Real Estate remarked, noting there were substantially more homes going under contract (8,571) than there were new listings (6,455).

Area-wide, there were 4,621 active listings of single family homes and condominiums at month end, down nearly 29% from a year ago when there were 6,505 listings. The selection at month end amounted to about two weeks of supply (0.51 months). Five counties had even less supply: Snohomish (0.24 months), Thurston (0.35) King (0.38 months), Clark (0.39) and Pierce (0.44 months).

NWMLS board member John Deely, executive vice president of operations at Coldwell Banker Bain, observed King County prices, currently at $740,000, have been trending downward since July when this year’s prices peaked at $789,000. Total active listings are spiraling downward as well, with King County’s supply down 60% from a year ago, which he said “speaks to the continued inventory crunch.”

“To put this into further perspective, King County had only 1,149 active listings at the end of November – the lowest inventory I can remember – and a 90% decrease since November 2010 when there were 11,867 active listings,” Deely commented, adding, “This is hampering existing sellers from moving up. Baby boomers find themselves in large homes and not needing the space, but they are hesitant to sell without a place to go should they want to stay in the region.”

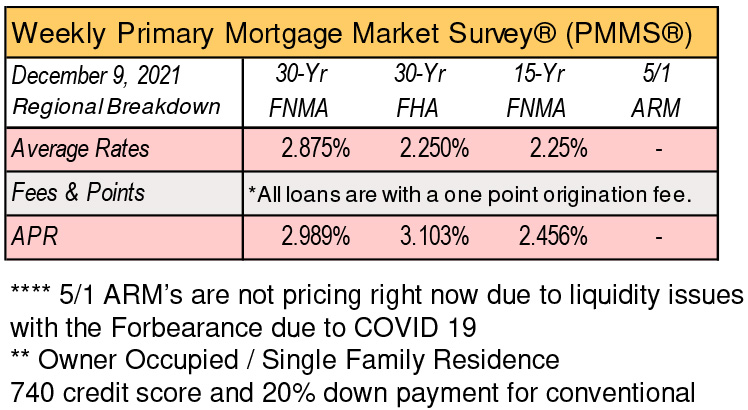

On a brighter note, Deely said new financing options are expected to develop during 2022. He mentioned the “modern bridge loan,” which would give homeowners the ability to sell their current residence after they’ve found and purchased their new home.

Looking ahead to 2022, Matthew Gardner, chief economist at Windermere Real Estate expects the pace of appreciation “to slow significantly” from levels seen this year. “In fact, I predict single family prices will increase by around 8% in King and Snohomish counties, and by almost 11% in Pierce County. Although still well above the long-term averages, affordability issues and modestly rising interest rates will take some of the steam out of the market in 2022,” he added.

West Seattle Bridge to be opened in mid-2022

Mayor Jenny Durkan said that crews working to repair the West Seattle Bridge are on track to finish the project and have the bridge back open for vehicular traffic sometime in mid-2022. The city closed the bridge in March 2020 after questions were raised about its structural integrity following the discovery of cracks in the bridge. The city had to decide if it wanted to erect a new bridge in its place or repair the existing bridge, which opened in 1984 and was projected to have a life of at least 40 years. The city opted to repair the bridge in order to open it sooner for the thousands of motorists who use it every day.

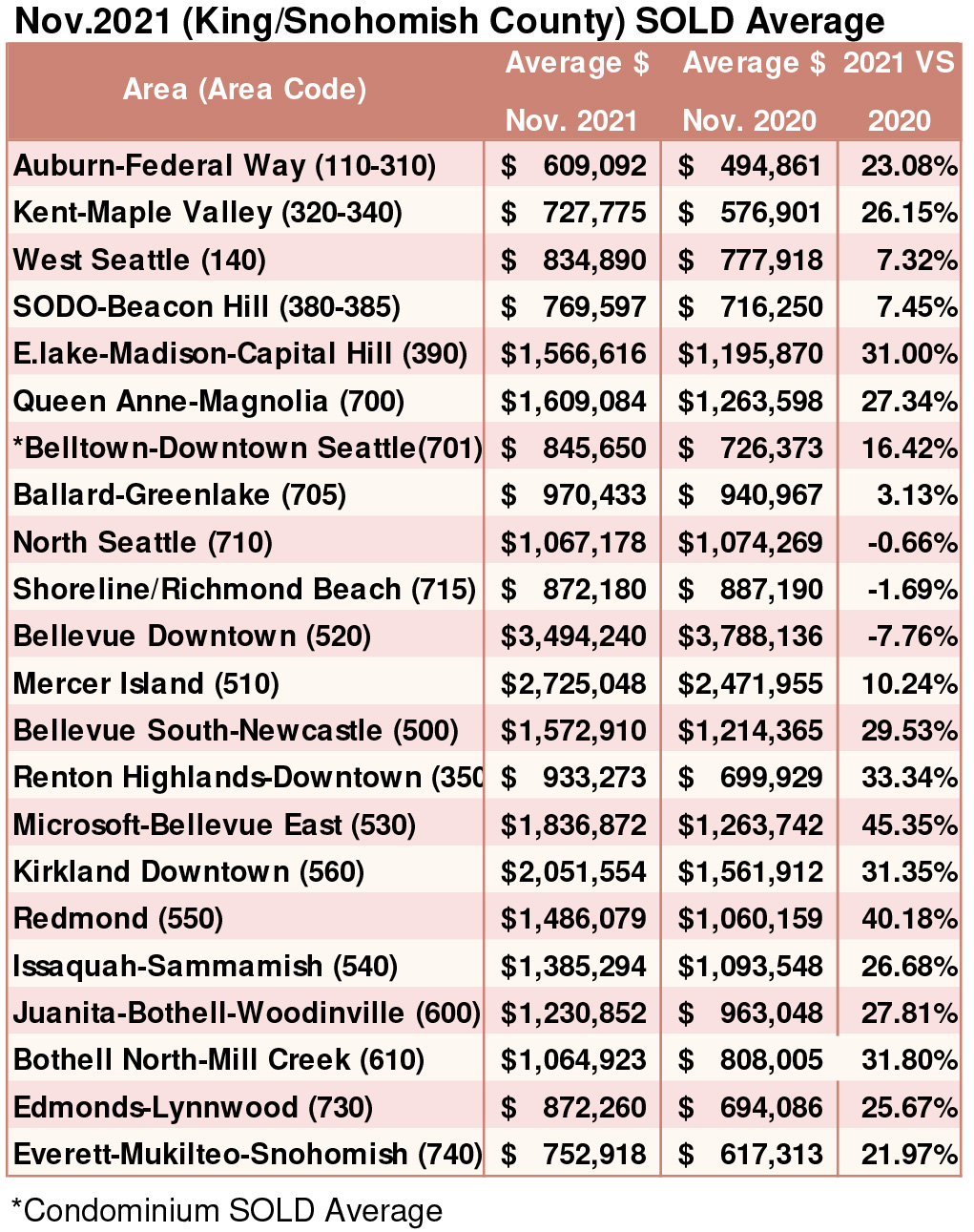

Breakouts! – Residential SOLD Average

Consumers gloomiest in a decade, but still a great time to sell

The chief finding from Fannie Mae’s November National Housing Survey (NHS) was an increase in consumer pessimism. The company says respondents to the right track/wrong track question expressed the most downbeat attitude in 10 years. Seventy percent of those expressing an opinion about the direction of the economy said it was on the wrong track, a 5 point month-over-month increase. Only 22 percent chose the opposite answer.

Consumers still overwhelmingly think it is a good time to sell, with 74 percent making that claim.

Gina Brown (NMLS#115337)

Senior Loan Officer

425-766-5408

gina@gmgloan.com

www.loansbygina.com