Northwest MLS brokers end 2021 with depleted inventory, rising prices, weather disruptions

Severe shortages of inventory, record-low temperatures and snow restrained December housing activity around Washington state beyond expected seasonal slowdowns, according to a new report from Northwest Multiple Listing Service.

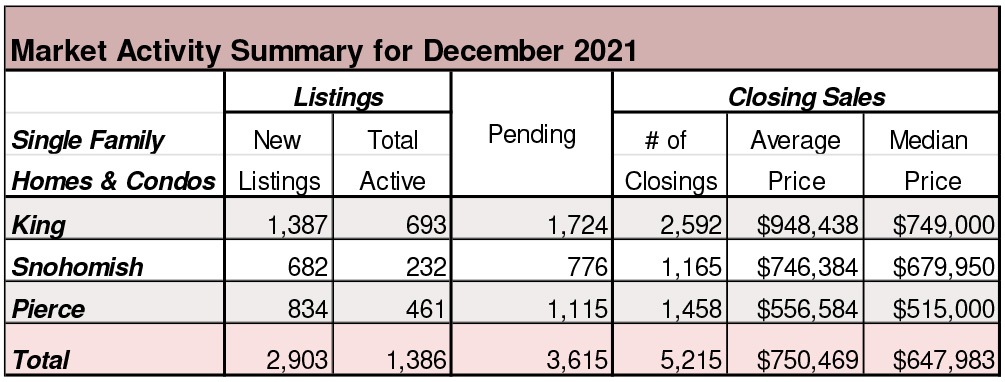

Summary statistics from the MLS show the volume of new listings added area-wide dropped 12.3% during December compared with the same month a year earlier. Year-over-year inventory, pending sales, and closed sales all fell by double digits. Only prices rose – up 17.4% overall for homes and condominiums that sold across the 26 counties in the report.

The median price for last month’s closed sales was $572,900, up from twelve months ago when it was $488,000. Prices for single family homes (excluding condos) surged nearly 17.5%, from $502,247 to $590,000. King County was one of only three counties where the single family price change was under 10%; prices there rose from $740,000 to $810,000. A dozen counties had price jumps of 20% or more. Condo prices jumped 17.6%, from $370,000 to $435,000.

Northwest MLS brokers reported 8,017 closed sales last month, a drop of nearly 1,000 transactions from the year-ago total of 9,008. Eleven counties had double-digit declines, including King (down 16.3%) and Snohomish (down 17.6%).

Despite hurdles (including pandemic-related), Northwest MLS brokers tallied 107,354 closed sales during 2021, an increase 12.1% from the previous year when they notched 95,760 closings.

Even though the number of pending sales, at 5,850 overall, declined more than 15% from a year ago, they far outstripped the number of new listings (4,617), contributing to the meager month end inventory. In fact, a search of NWMLS records going back a decade indicates the 3,240 active listings of homes and condos area-wide is the first time the selection has dipped below 4,000 listings. A year ago, buyers could choose from 4,739 active listings while in November there were 4,621 properties in the MLS database.

Stated another way, there was less than two weeks of supply (0.40) at month end. Inventory was even more sparse in seven counties, with Snohomish having the most acute shortage at 0.20 months.

J. Lennox Scott, chairman and CEO of John L. Scott, described the current market as “truly historical,” noting 2021 was one of the best years on record for pending sales in the Puget Sound region. “The week of snow and ice that hit Puget Sound in late December delayed the big kickoff to the 2022 housing market by about a week. This held back buyers who have been waiting patiently for each new listing to hit the market.

The year-end storms did not dampen Scott’s optimism for 2022. “Fresh on the heels of the holiday season and snowy weather, the local market will see continued strong buyer demand, multiple offers, and premium pricing. This year is poised to be another great year in residential real estate,” he exclaimed.

Rebates for electric vehicles in Washington

Washington Gov. Jay Inslee is proposing a plan to offer rebates for new and used electric vehicles, on top of the sales tax exemption that currently exists for such vehicles in the state. Under the proposal, rebates of up to $7,500 would be available for new electric sedans under $55,000 and under $80,000 for new vans, sport utility vehicles and pickup trucks. The rebate drops to $5,000 for used vehicles and a $1,000 rebate would be offered for zero-emission motorcycles and e-bikes. People would be eligible for rebates if they make under $250,000 a year, or under $500,000 a year for joint tax filer households. Low-income drivers, individuals with an income of below $61,000, would be eligible for an additional $5,000 rebate toward the purchase of a new or used electric vehicle.

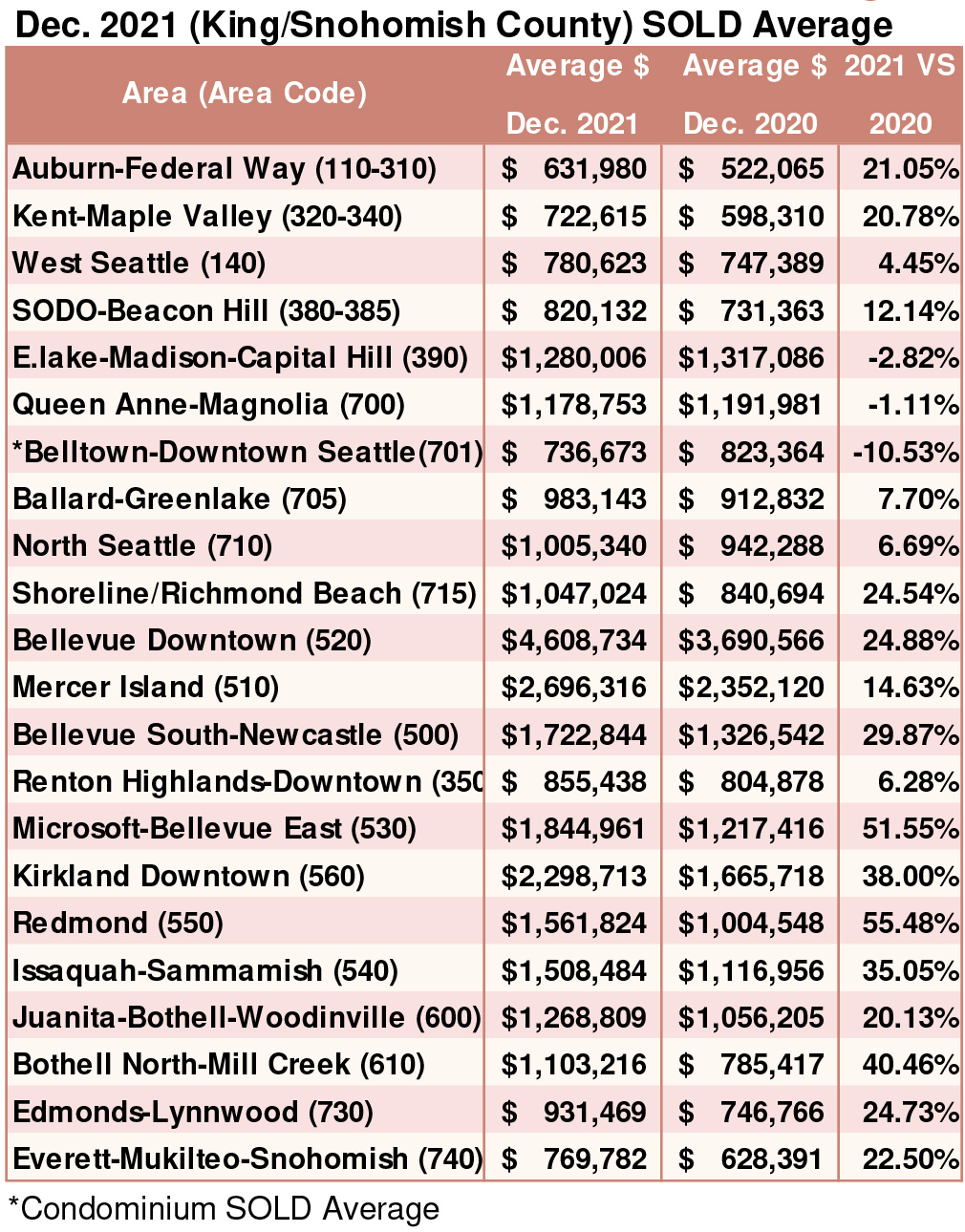

Breakouts! – Residential SOLD Average

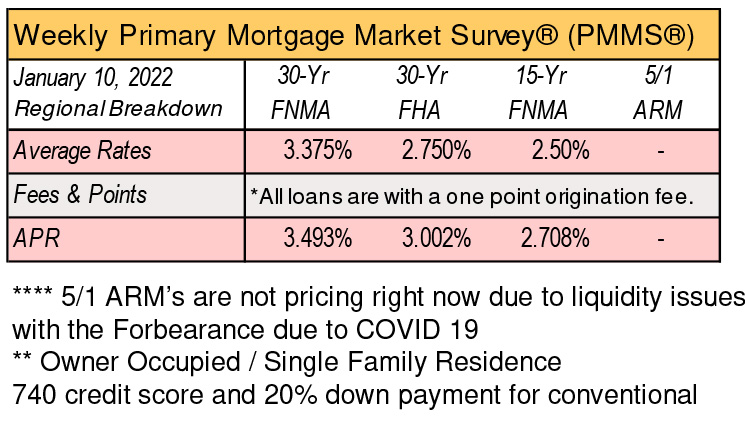

Time to buy before the rates continue to surge

The average 30-year fixed rate mortgage increased to 3.22% during the week ending Jan. 6, up from 3.11% the week prior, according to the latest Freddie Mac PMMS Mortgage Survey. A year ago, the 30-year fixed rate mortgage averaged 2.65%.

The 15-year fixed rate mortgage averaged 2.43% last week, up from 2.33% the week prior. A year ago at this time, it averaged 2.16%.

Mortgage rates tend to move in concert with the 10-year Treasury yield, which reached 1.75% on Wednesday, up from 1.51% a week before.

Gina Brown (NMLS#115337)

Senior Loan Officer

425-766-5408

gina@gmgloan.com

www.loansbygina.com