Pandemic presents new option for home buyers as market “kept foot firmly on the accelerator”

Home buyers who have been precluded from entering Puget Sound’s competitive market may want to consider condominiums as an option, according to industry experts who commented on the latest housing statistics from Northwest Multiple Listing Service.

“With the trend toward telecommuting and moving to outlying suburban areas, the Seattle/King County condominium market presents a new option,” suggested Gary O’Leyar, owner and designated broker at Berkshire Hathaway Home Services Signature Properties. Noting the county’s bigger supply of condos – 1.67 months of inventory versus 0.69 months for single family homes – and a slight break from double-digit appreciation, O’Leyar said buyers may want to take a closer look at this “window of opportunity.”

In King County, NWMLS data show prices range from $149,000 to $14,895,000, with a median asking price of $525,495. The median price for condos that sold in King County last month was $399,975; system-wide the median sales price was $359,950.

Single family homes (excluding condos) had an area-wide median sales price of $509,950. That is $150,000 more than condos (nearly 42% higher).

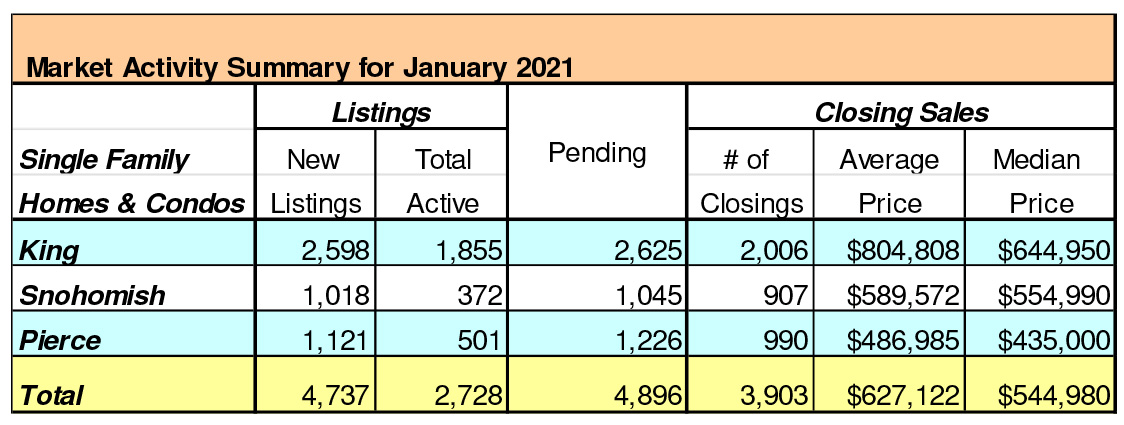

The NWMLS report covering 26 counties, shows a YOY increase in new listings of single family homes and condos (up about 5.5%) and a jump of more than 16% in closed sales, rising from 5,074 transactions to 5,896. The median price for last month’s sales ($483,250) surged 14.3% from the yearago figure of $422,750. Pending sales grew slightly from last year (less than 1%) but were up 7.4% from December.

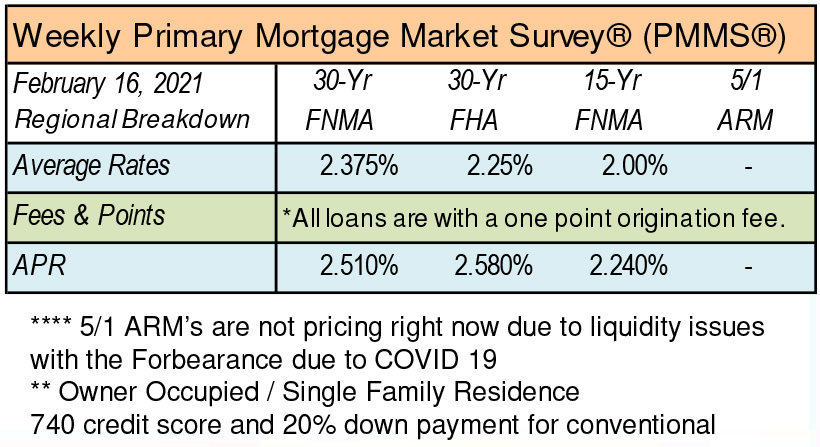

J. Lennox Scott, chairman and CEO of John L. Scott Real Estate, expects more listings “after Super Bowl Sunday, which serves as the kickoff to the early spring housing market.” He described the current market as “incredibly hot, even all the way up to some luxury price ranges.” Historically low interest rates remain a strong motivator for buyers, Scott stated. “It still feels like multiple-offer everything this winter.”

Some brokers are reporting up to 40 private showings for a single listing, according to Scott. “To compete in today’s ultra-competitive market, we’re seeing some buyers front-loading their offer above the list price,” he reported, explaining, “This is done in an attempt to ‘stop the action’ and push the sellers to accept their offer before the set review date.”

“We believe we may be heading into the typical busy spring real estate market any day now,” Mike Grady, CEO and president of Coldwell Banker Bain, remarked. Northwest MLS director John Deely echoed that optimism.

“With the major counties moving into Phase 2, resulting in open houses resuming with up to 10 visitors socially-distanced (including the broker), a new administration, and COVID-19 vaccinations underway, we’re hearing much optimism from our brokers.”

Long home ownership tenure

One in four homeowners have lived in their home for more than 20 years – the highest level that owners with that tenure has ever reached, a new Redfin study shows. That’s due in large part to the aging in place trend, which is accelerating during the COVID-19 pandemic. As Americans stay in their homes longer, housing shortages are growing. The typical homeowner in 2020 had lived in their home for 13 years, a big jump from 8.7 years a decade earlier, according to the Redfin study. Longer homeownership tenure has contributed to a logjam in housing inventory, which dropped 23% year over year in December to an alltime low, according to the National Association of REALTORS®.

Tight inventory is pressing on home prices.

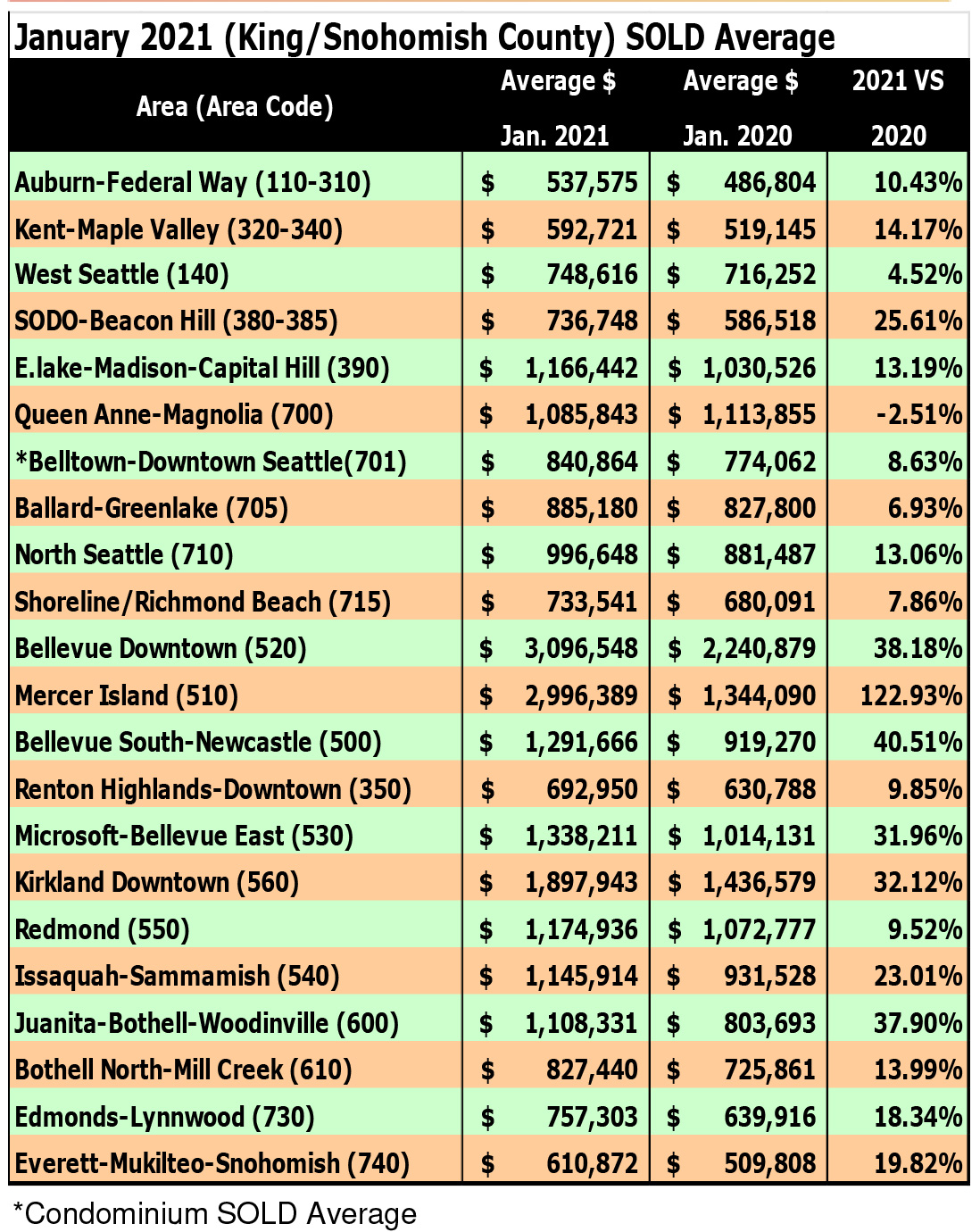

Breakouts! – Residential SOLD Average

Low Rates, COVID are Motivating Prospective Home Buyers

A high percentage of those who told the National Association of Home Builders (NAHB) late last year that they were thinking of buying a home have now turned thought into action. Rose Quint writes in the NAHB Eye on Housing blog that 15 percent of those queried in its 4th Quarter 2020 Housing Trends survey said they were considering a purchase and now 56 percent of them are actively looking. A year ago, only 43 percent of those considering buying had shifted into gear.

Gina Brown (NMLS#115337)

Senior Loan Officer

425-766-5408

gina@gmgloan.com

www.loansbygina.com