Prices and number of sales increased despite reduced inventory

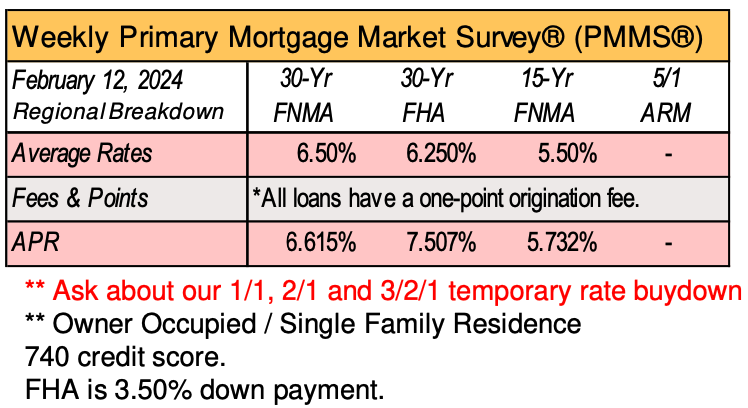

Real estate market activity has remained slow in accordance with typical seasonal patterns. Interest rates held steady through the month of January to end at 6.69%.

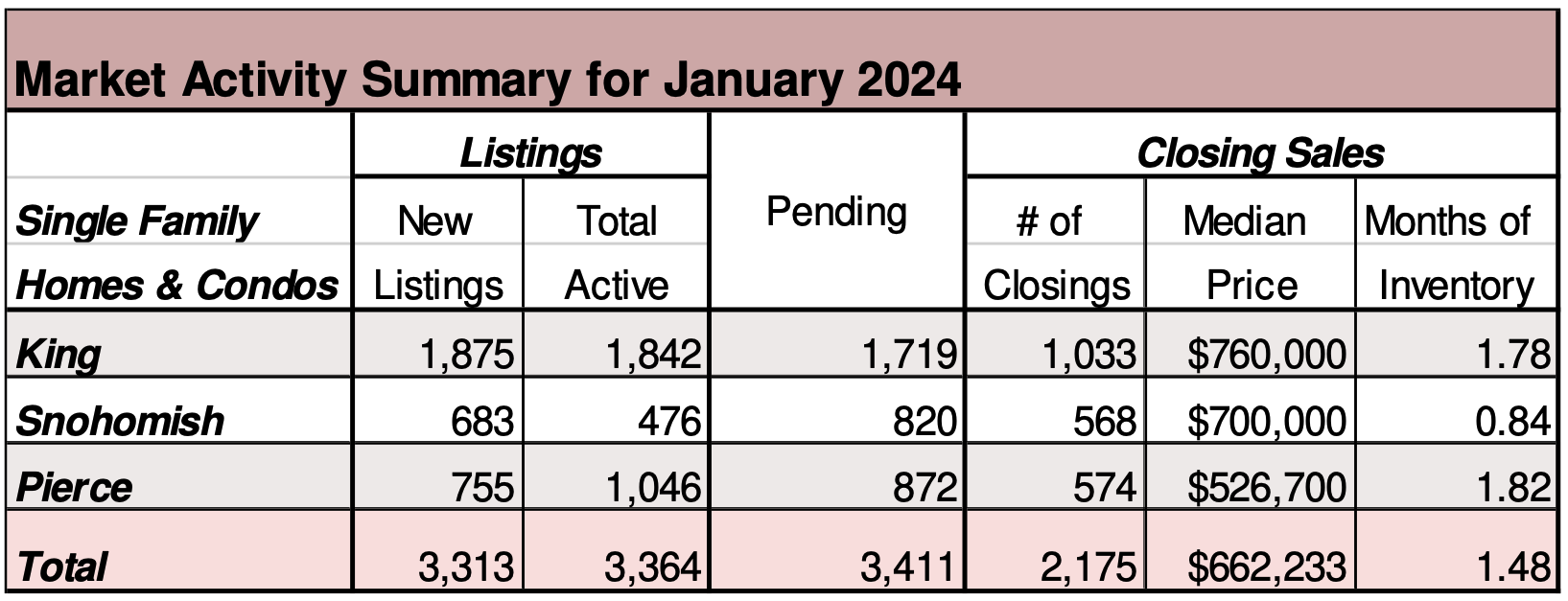

For the Washington counties covered by the NWMLS, January 2024 saw a 3% increase in closed sales transactions year-over-year, an improvement from December 2023’s year-over-year change in closed sales transactions, which was a decrease of 11%.

NWMLS brokers added 4,954 new listings to the database in January 2024, which is nearly the same (+.6%) as in January 2023, when 4,925 new listings were added.

There were 5,282 total residential units & condo units under contract in January 2024, a decrease of 8.6% when compared to January 2023 (5,776). The volume of homes on the market has continued to decline throughout

Washington with 15 out of 26 counties seeing a year-over-year

decrease. There were 7,084 active listings on the market at the end of January 2024, a decrease of nearly 14% compared to January 2023 (8,220).

A balanced market is considered to be 4 to 6 months by most industry experts. At the current rate of sales, it would take around two months to sell every home that is active in the NWMLS inventory. The four counties with the lowest months of inventory in January 2024 were Snohomish (0.84), Thurston (1.69), King (1.78), and Pierce (1.82).

Despite the decrease in available inventory, 13 of the 26 counties in the report experienced an increase in the number of homes sold year-over-year.

Condominium sales jumped nearly 21% year-over-year, with 492 units sold in January 2024. The median price of condominium sales increased 7% year- over-year from $424,000 in January 2023 to $453,750 in January 2024.

Overall, the median price for residential homes and condominiums sold in January 2024 was $593,500, up 6.5% when compared to January 2023 ($557,250). The median sales price increased year-over-year 19 out of 26 counties, with the highest median sale prices in King ($760,000), San Juan ($757,000) and Snohomish ($700,000).

“Seller reluctance has led to a continued decline in year-over-year inventory levels, an overall 14% decrease of active listings on the market,” said Mason Virant, associate director of the Washington Center for Real Estate Research at The University of Washington. “Encouragingly, year- over-year sales transactions saw a 3% improvement over January 2023. Low levels of for-sale inventory have led to increased competition amongst buyers, producing a nearly 7% year-over-year increase in median home prices across the Washington counties covered by the NWMLS.”

5 smart times to lock in a mortgage rate

If you’re not sure when it makes sense to lock in a mortgage rate, here are a few times you may want to do so.

- When you’ve found your dream home

- During a period of economic stability

- When rates are at historical lows

- Before anticipated rate increases

- Ahead of major life changes

Locking in a mortgage rate is a pivotal decision in the home buying process and timing plays a crucial role. Whether you’re capitalizing on a stable economy, taking advantage of historically low rates or anticipating future rate increases, being strategic about when to lock in your mortgage rate can lead to substantial savings over the life of your loan. In most cases, the best strategy is to stay informed, work closely with your mortgage advisor and seize the opportunities presented by the market to make the most financially sound decision for your homeownership journey. – www.cbsnews.com

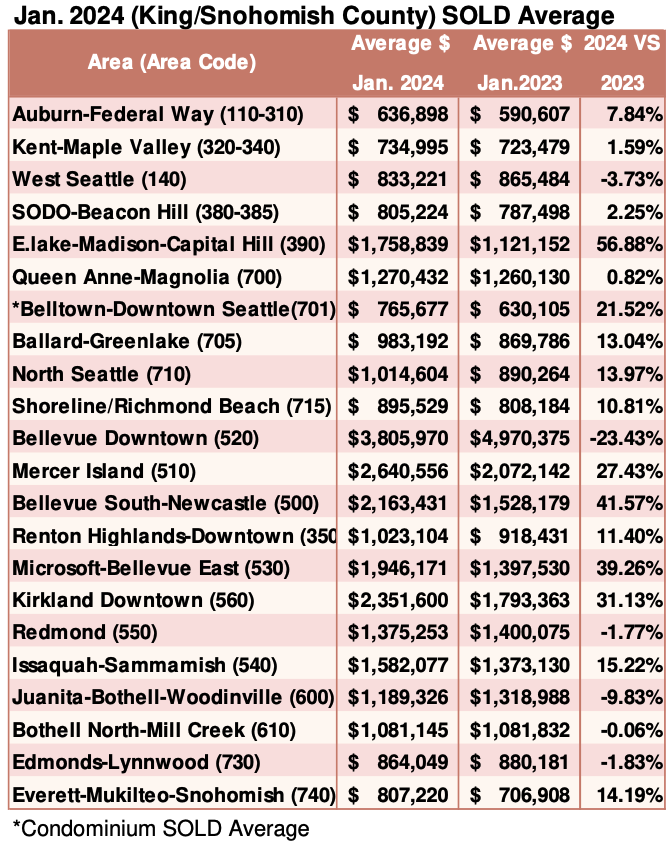

Breakouts! – Residential SOLD Average

Consumer sentiment toward Housing at

Highest level in nearly Two years

The Fannie Mae Home Purchase Sentiment Index® (HPSI) increased 3.5 points in January to 70.7, highest level since March 2022, due primarily to increased consumer confidence in job security and another significant jump in the share of consumers expecting mortgage rates to decrease. In January, 82% of consumers indicated that they are not concerned about losing their job in the next 12 months, up from 75% last month. Additionally, an all-time survey-high 36% of respondents indicated that they expect mortgage rates to go down in the next 12 months.

Gina Brown (NMLS#115337)

Senior Loan Officer

Home Trust Financial NMLS1761573

425-766-5408

gina@gmgloan.com

www.loansbygina.com

![]()