Rising interest rates not yet slowing home sales or “too concerning” for NWMLS officials

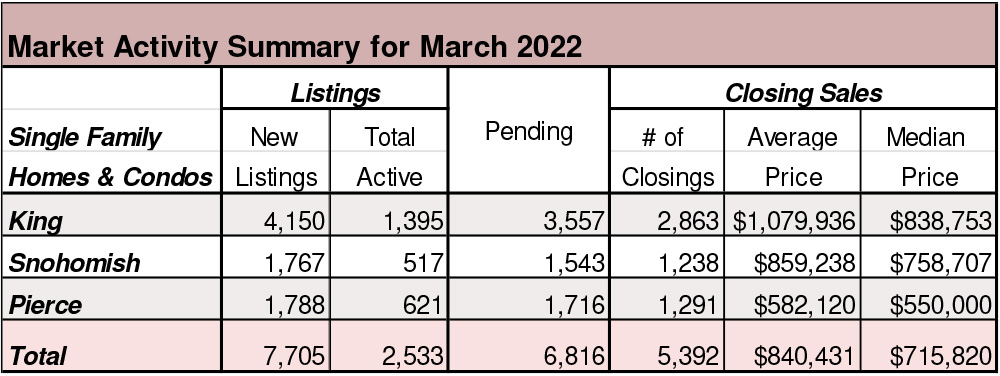

Rising mortgage rates are not yet slowing home sales in most areas across Washington state, according to several brokers who commented on the latest statistical report from Northwest Multiple Listing Service. The report showed a 7.4% year-over-year drop in pending sales, but brokers suggested the decline is likely a reflection of limited supply.

“Typically, by now, we would start to see rising mortgage rates impacting homes sales and/or prices,” observed Matthew Gardner, chief economist at Windermere Real Estate. “That has yet to happen despite rates rising significantly since the start of the year.”

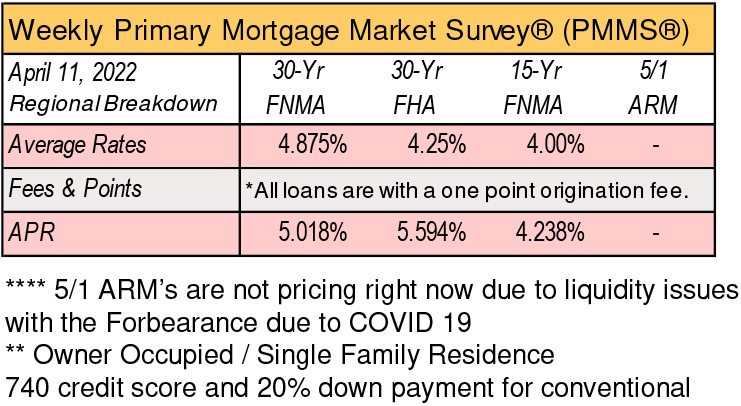

Freddie Mac reported the average rate for a 30-year loan rose to 4.56% last week, with rates climbing at the quickest pace in almost three decades.

Gardner said he expects mortgage rates to continue trending higher in the coming months, adding, “I will be watching to see if there are any negative market impacts, but as of now, I’m not too concerned.”

Northwest MLS brokers reported 10,059 pending sales (mutually accepted offers) during March across 26 counties. That’s down from the year-ago figure of 10,863, but compared to February, the volume of pending sales jumped nearly 31%.

“The market is following the normal seasonality of spring,” according to J. Lennox Scott, chairman and CEO of John L. Scott Real Estate. “This season brings more resale listings coming on the market.”

The latest MLS report shows brokers added 11,197 new listings of single family homes and condominiums to inventory during March, up from the year-ago total of 10,562. Last month’s total is up from February’s figure of 7,920 for a gain of more than 41%.

Nevertheless, with pending sales (10,059) nearly matching new listings, inventory remained limited system wide. The MLS report shows only 0.58 months of supply, with King, Pierce, Snohomish and Thurston counties all having less than two weeks of supply.

The supply squeeze is contributing to competition among hopeful homeowners and rising prices.

For last month’s 7,989 completed transactions, the area-wide median price was $638,000, up about 16.4% from a year ago and up 9% from February.

Northwest MLS figures show prices in the four-county region (King, Kitsap, Pierce and Snohomish) have surged nearly $200,000 (38.5%) since March 2020, jumping from a median price of nearly $520,000 to nearly $720,000.

Scott pointed to the overall economy “and specifically job growth in the central Puget Sound region” as factors for the future housing market. “For the local areas considered lifestyle and destination markets, we will be watching local in-migration as a key indicator of future home price appreciation.”

How happy are Seattle and WA?

Seattle is the seventh-happiest city in the nation, according to WalletHub’s 2022’s Happiest Cities in America report. The personal finance website last year found that the state of Washington was the 13th-happiest in the nation. To determine where Americans were happiest, WalletHub compared 180 cities and all 50 states across several key indicators, including unemployment rates, job opportunities, the potential for income growth, divorce rates and sleep rates. Seattle had the lowest unemployment rate, ranked second in income growth and first in the number of people who play sports. The state’s happiness ranking was also based, in part, on the number of people who spend time volunteering for causes they believe in.

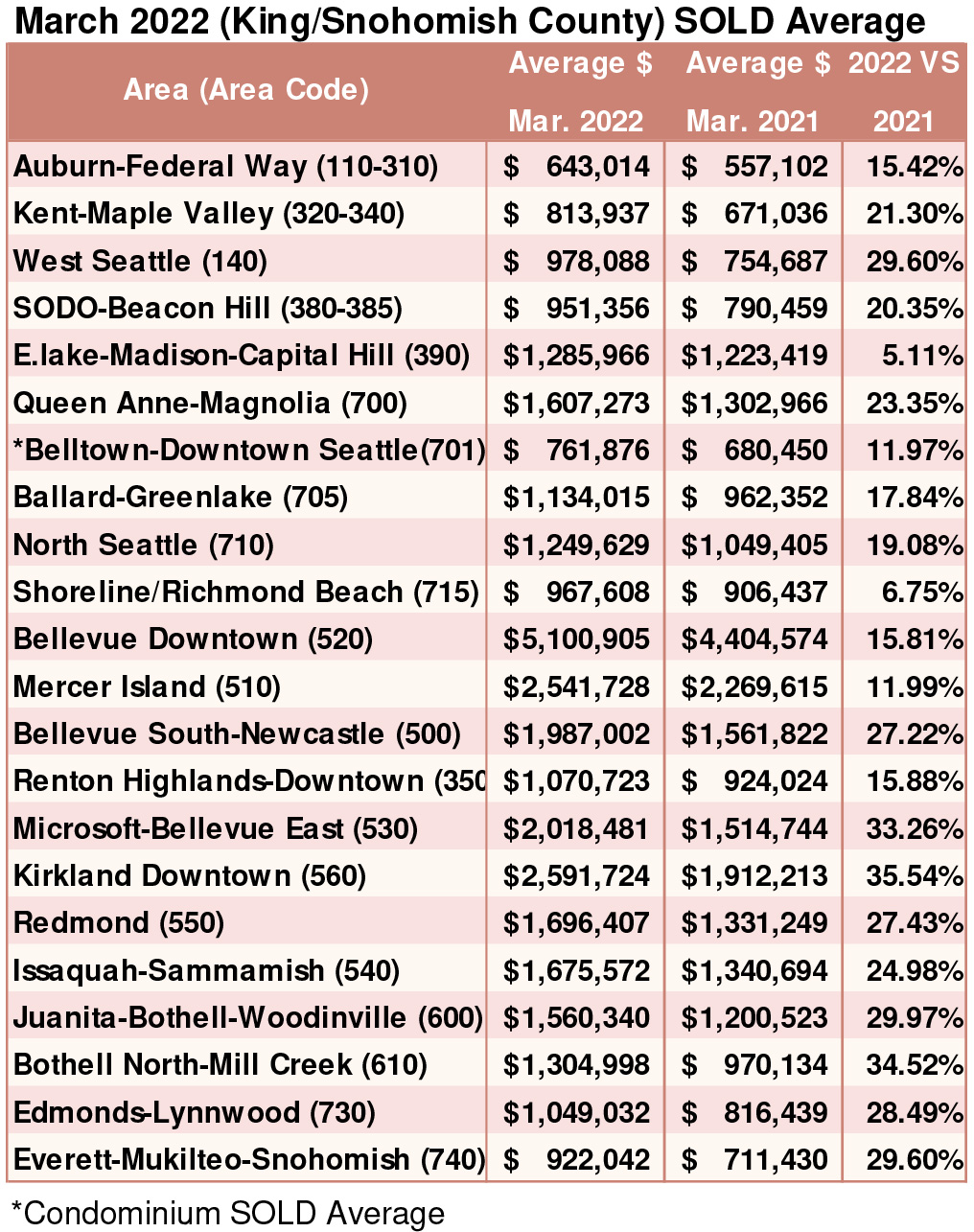

Breakouts! – Residential SOLD Average

Homeownership costs remain less pricey than renting

Despite the recently tightened affordability of homeownership, buying a home is still a better financial option than renting in more than half of U.S. markets, according to Attom Data Solutions’ 2022 Rental Affordability Report. Owning a median- priced home costs less than the average rent for a three-bedroom property in 58% of the 1,154 U.S. counties analyzed, meaning that major homeownership expenses take up a lesser portion of the average local wage than rents do.

This conclusion is somewhat surprising as home prices continue to increase across the country — and median purchase prices have actually increased more rapidly than average rents and average wages in 88% of the counties covered in the report.

Gina Brown (NMLS#115337)

Senior Loan Officer

425-766-5408

gina@gmgloan.com

www.loansbygina.com