Improving housing inventory, rising costs may bring some “normalcy” to Western WA market

Rising interest rates and inflation, coupled with slight improvement in inventory, may bring some normalcy to Western Washington’s frenzied housing market suggest some brokers with Northwest Multiple Listing Service.

“The Puget Sound housing market has shifted down several levels of hotness in most areas and is more in alignment with the strong market we saw pre-pandemic,” stated J. Lennox Scott, chairman and CEO of John L. Scott Real Estate.

Commenting on a new Northwest MLS report summarizing April activity, Scott noted a “slight increase” in unsold properties, adding, “Not all homes are selling within the first week on market.” He believes the “intensity adjustment means multiple offers will not be as commonplace as they’ve been in the last two years.” He also indicated premium pricing (above asking price) is softening as well. He expects the “normal seasonality in the real estate market will be more pronounced, bringing a bit of normalcy to home buyers and sellers,” but believes there will still be an “elevated buyer focus on each new listing.”

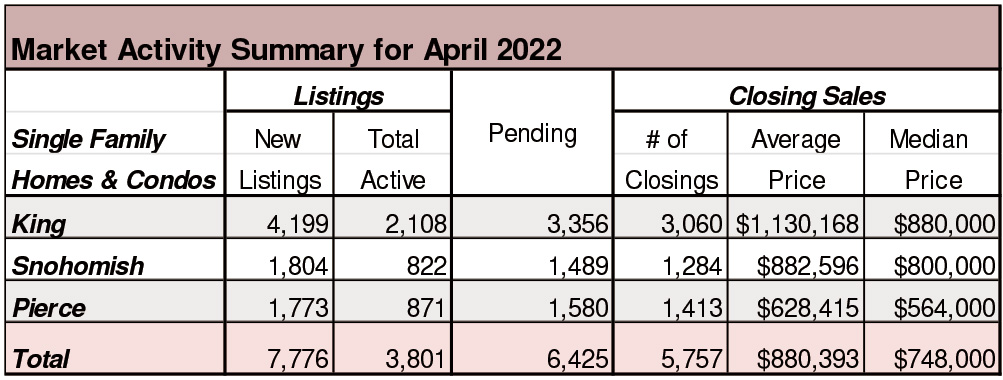

Member-brokers added 11,681 new listings of single family homes and condos during April, the highest number since last July when 12,916 listings were added.

At month end, the selection of homes and condos in the database totaled 6,514, the highest level since September 2021 when there were 7,757 total active listings.

Notably, the number of new listings (11,681) surpassed the number of pending sales (9,760), to help boost inventory. Pending sales were down about 7.8% from a year ago and down 3% from March.

Closed sales of homes and condos slid from year ago, from 8,791 to 8,344 for a drop of around 5.1%.

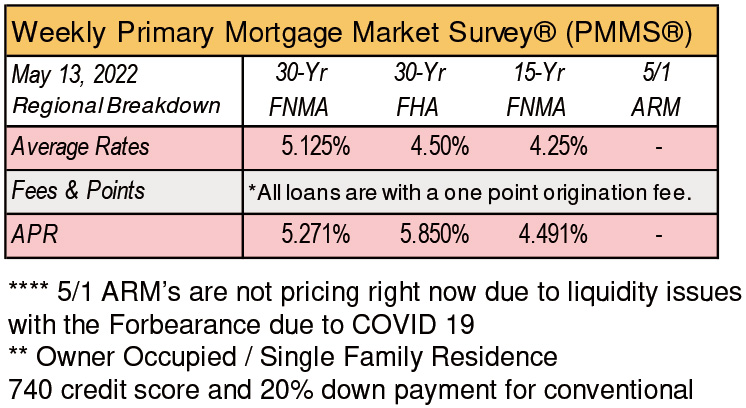

“We are starting to see signs of impact from the significant rise in mortgage rates earlier this year, such as an increase in active listings and months of inventory creeping higher, but the full impact will likely not be felt for a few months,” said Matthew Gardner, chief economist at Windermere Real Estate.

The NWMLS report shows there was about three weeks (.78 months) of inventory of single family homes and condos combined at the end of April. By this metric, that is the highest level in nearly 18 months. MLS data show there was .80 months of supply in October 2020.

“One thing that has not been impacted by rising financing costs is home price growth,” Gardner said, pointing to double-digit gains in nearly every county, “including a whopping 27% in Snohomish County, the highest by far in the four-county Puget Sound region.”

Area-wide prices for single family home sales (excluding condos) in King County also increased, climbing nearly 20% from a year ago, from $830,000 to $995,000.

Best states for working from Home

Remote workers in the Evergreen State have it better than those in most states in the country, according to a recent WalletHub report. Washington state ranked eighth in the study behind, respectively, New Jersey, DC, Delaware, Connecticut, Massachusetts, Utah and Texas. The study found Washington ranked third in households’ internet access, third in average retail price of electricity, fifth in share of population working from home, 21st in internet cost and 26th in average square home footage. Many employers shifted to work-from-home structures during the pandemic. About 20 percent of all professional jobs were remote at the beginning of 2022, according to WalletHub.

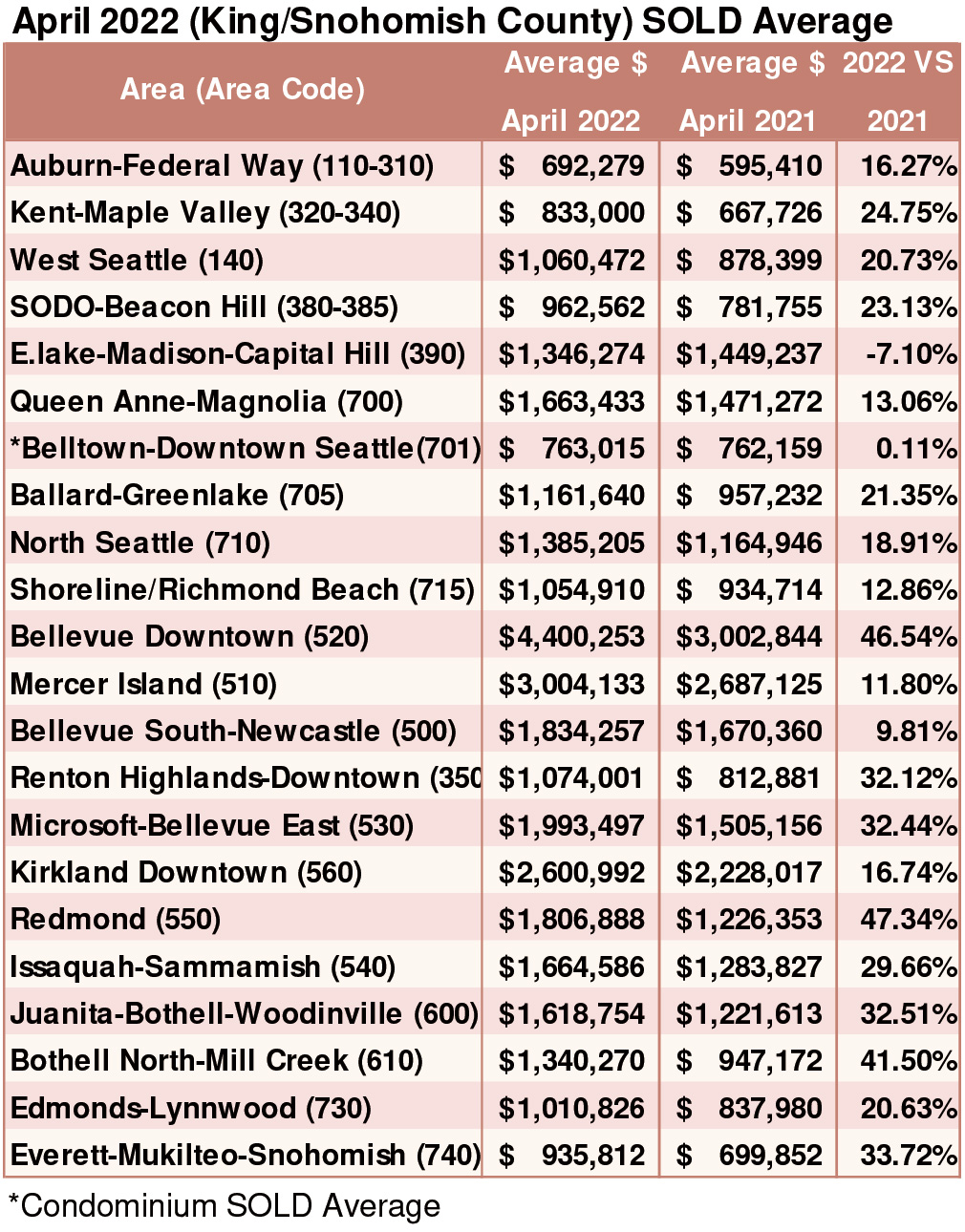

Breakouts! – Residential SOLD Average

Commercial and multifamily lending surge

The volume of commercial and multifamily mortgage loan originations jumped 72 percent in the first quarter of 2022 compared to a year earlier. The Mortgage Bankers Association (MBA) said lenders reported solid increases in all categories of that lending with hotel properties leading the way at 359 percent. While multifamily lending was in fifth place, it still grew 57 percent, behind industrial properties at 145 percent, retail and health care properties (88 and 81 percent, respectively.) Office properties lending increased 30 percent.

Commercial and multifamily loan volume was down by 39 percent compared to the fourth quarter of 2021.

Gina Brown (NMLS#115337)

Senior Loan Officer

425-766-5408

gina@gmgloan.com

www.loansbygina.com