Housing market downturn “inevitable” with higher rates, but brokers find bright spots

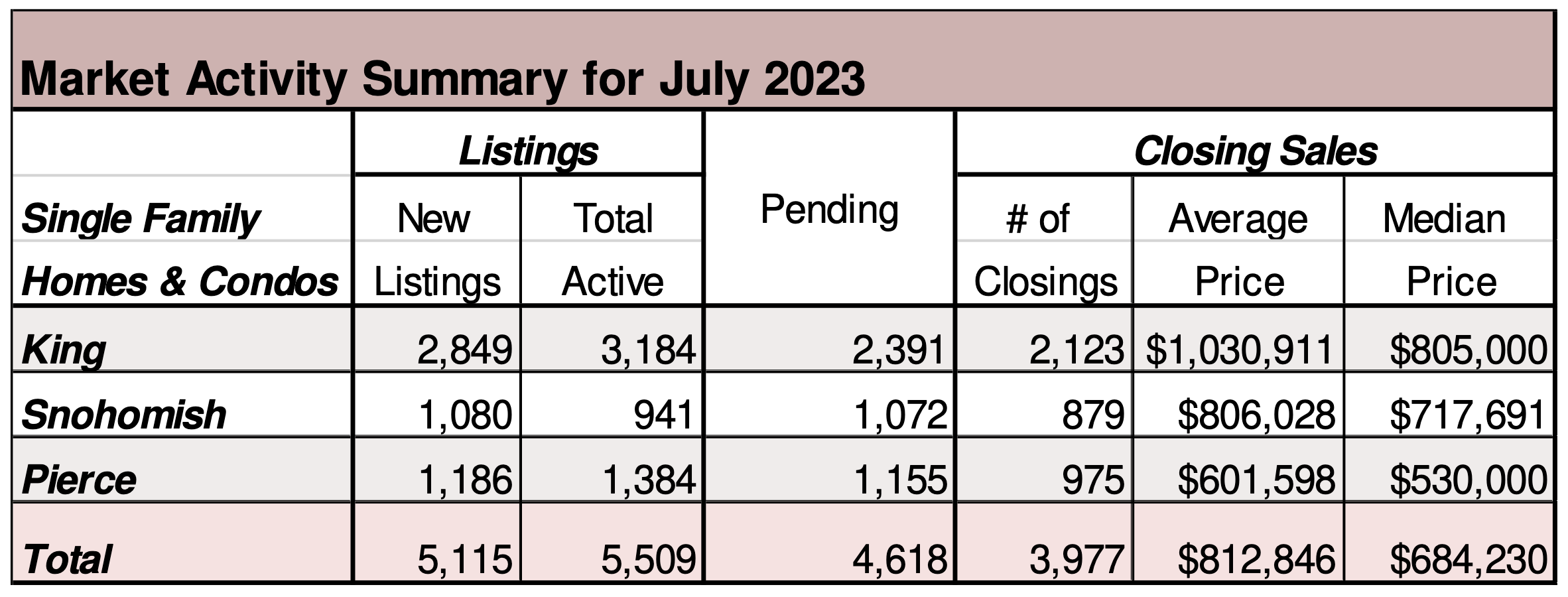

The Northwest MLS statistics summarizing July activity for 26 counties in the report showed declines in listings, pending sales, closed sales and prices when compared to 12 months ago. The same metrics, which include single family homes and condominiums, were also down from June, with the exception of total active listings and months of inventory. Both showed slight month-over-month improvement.

Buyers could choose from 10,982 active listings at the end of July, a gain of 375 properties compared to June’s total. Last month’s inventory dropped 28.6% from the year-ago selection of 15,381propoerties. Of the selection, 8,205 listings were added system-wide during July.

A slower pace of sales contributed to a modest uptick in months of supply, rising from 1.55 months in June to 1.76 months in July; a year ago there was 2.01 months of supply.

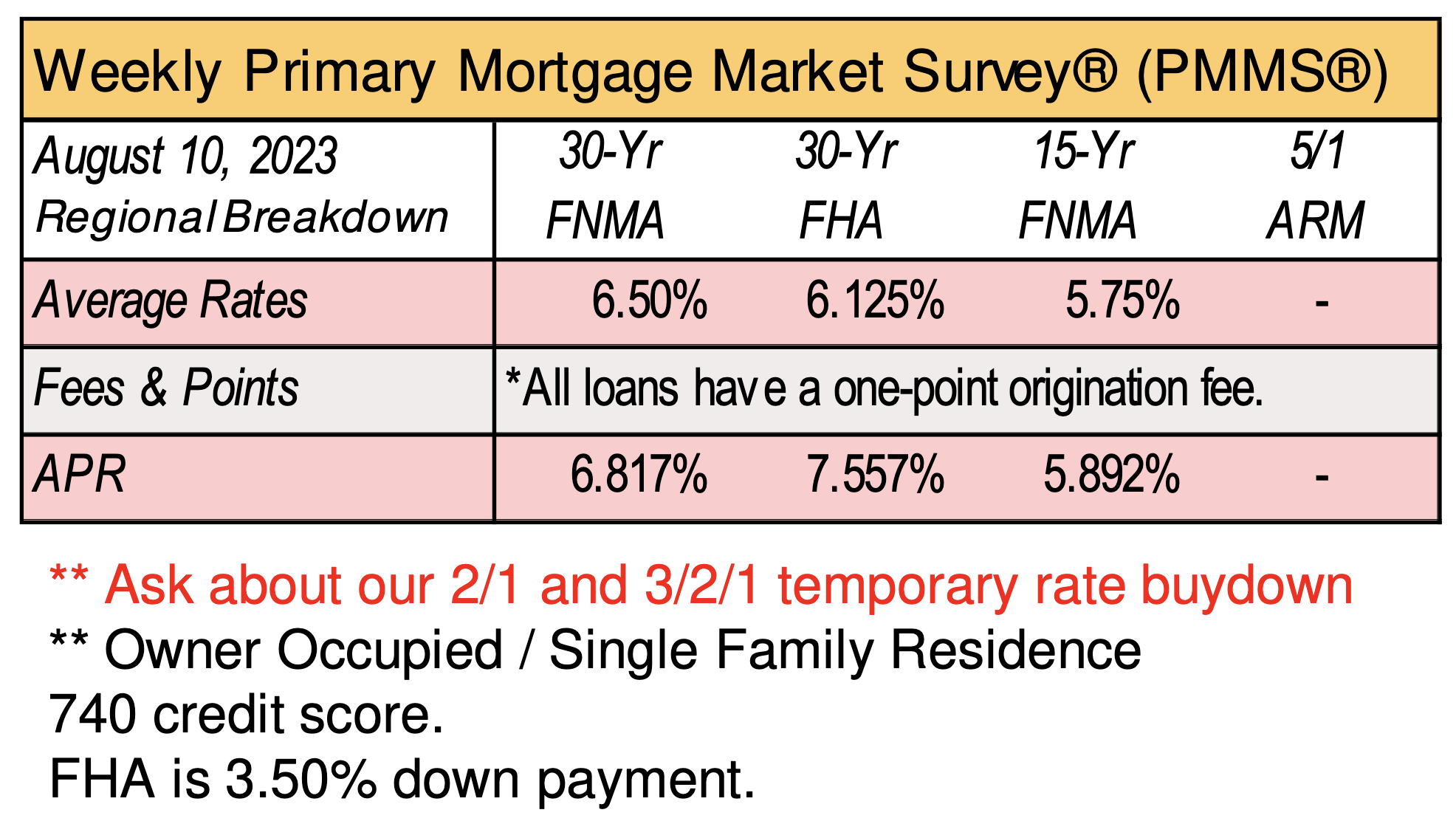

Last week’s rate on a 30-year fixed rate mortgage was 6.9%, according to Freddie Mac. A year ago, it was 4.99% and two years ago it was 2.77%.

The jump in mortgage rates combined with a lack of choices for buyers has put a drag on sales, John Deely, executive vice president of operations at Coldwell Banker Bain, remarked. “Adding to buyers’ hesitancy is the record- breaking price growth in 2021 and 2022. Cost pressures are impacting affordability, and it is unlikely to significantly improve in the near future.”

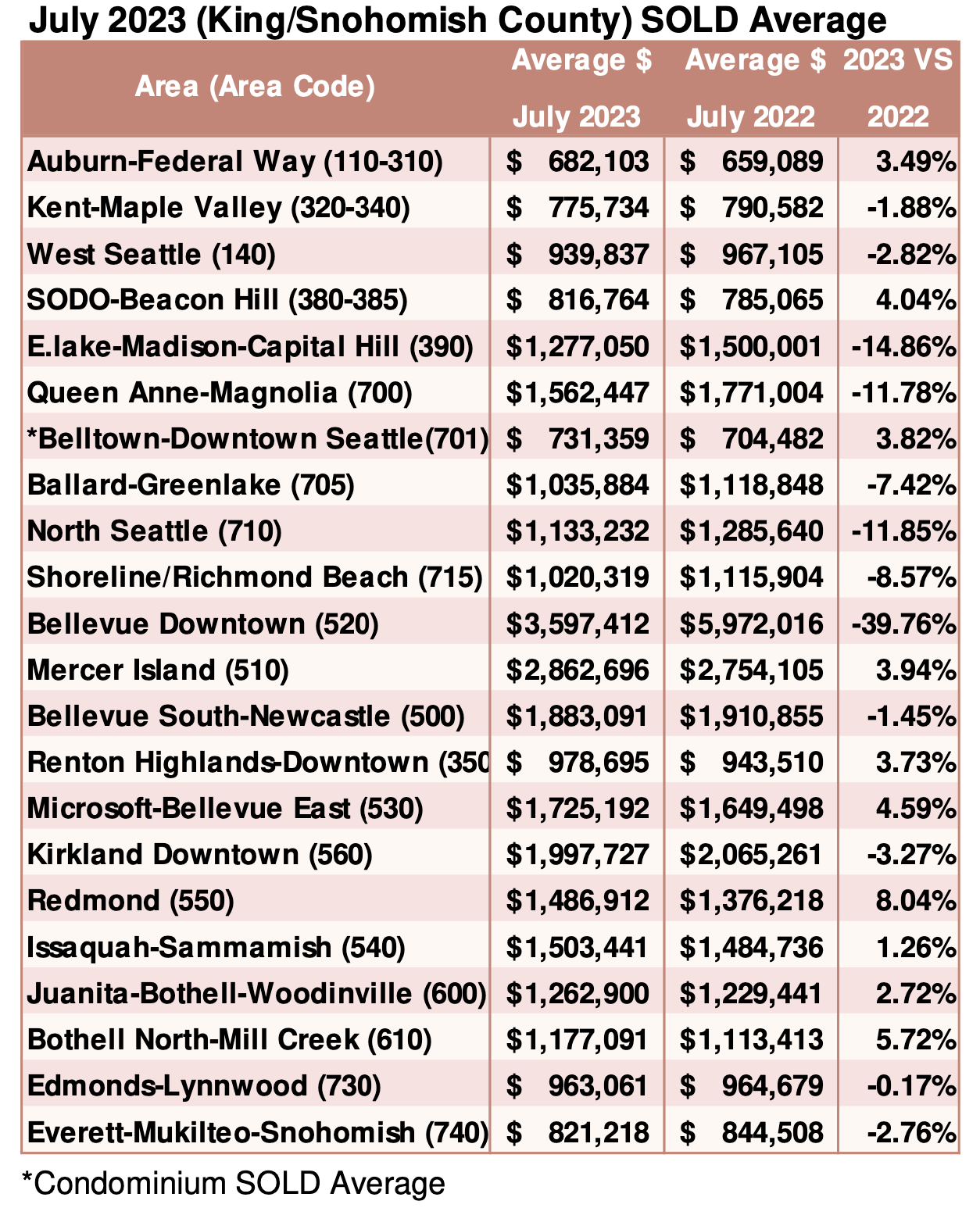

Windermere Chief Economist Matthew Gardner said it appears sellers may have found a price ceiling, with last month’s median list price in King County falling 2.7% compared to June, while the asking price remained flat in Snohomish County and rose slightly (up 0.3%) in Pierce County. “Buyers may have taken advantage of these conditions as month-over-month sales prices fell in the tri-county market.”

Dean Rebhuhn, owner at Village Homes and Properties in Woodinville, said despite low inventory and rising rates, sales are “very active in select areas” with prices and lifestyle choices continuing to drive the market.

Looking ahead, J. Lennox Scott, executive officer at John L. Scott Real Estate, said with lower mortgage interest rates forecasted “we anticipate more buyers searching to purchase a home.” He estimates 70% of buyers have a home to sell, which could provide additional inventory, but with demand in the more affordable and mid-price ranges exceeding the number of new listings, Scott believes prices will climb.

“Separately, the luxury market and lifestyle/destination markets are positioned with great selection and great pricing. We anticipate more buyer activity over the year ahead,” Scott stated.

Only 1% of U.S. homes changed hands

The U.S. home turnover rate in the first half of 2023 has fallen to the lowest in at least a decade as high mortgage rates compel owners to stay put, according to a report by Redfin. About 14 out of every 1,000 U.S. homes changed hands during this period, down from 19 in the same period during 2019, according to the real estate brokerage’s report examining housing turnover since the pandemic. California, and specifically the San Francisco Bay Area, had the least housing availability out of any state, the report said. The brokerage said only 6 out of 1,000 San Jose homes changed hands this year. In the Seattle area, 11 of every 1,000 homes turned over in the last year, a 37% drop in turnover from 2019. The highest turnover rate was in Newark, New Jersey, with 24 of every 1,000 homes changing hands.

Breakouts! – Residential SOLD Average

Mortgage credit availability falls

“Mortgage credit availability declined to its lowest level since 2013, as lenders pulled back on underutilized loan programs and as liquidity concerns remain for some jumbo lenders,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Declining origination volumes have led to lower profitability for many lenders, resulting in narrower loan product offerings to reduce operational costs.

“One key driver of this month’s decline was a drop in cash-out refinance loan programs. The 30-year fixed mortgage rate averaged 6.94 percent in July. This has significantly discouraged cash-out refinance activity, as borrowers turn to home equity and consumer loans instead.

Gina Brown (NMLS#115337)

Senior Loan Officer

Home Trust Financial NMLS1761573

425-766-5408

gina@gmgloan.com

www.loansbygina.com

![]()