NWMLS brokers encouraged by declining mortgage rates with some saying pent-up demand is triggering multiple offers

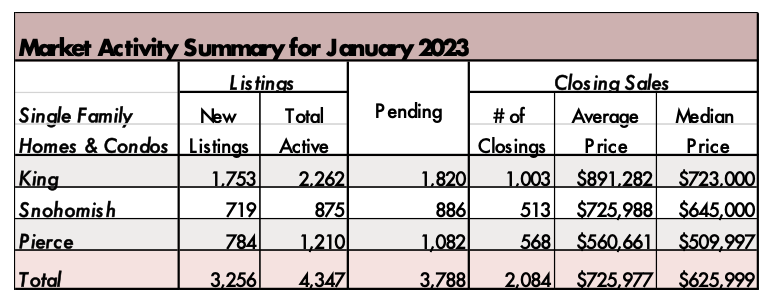

Pending sales around Washington state reached the highest level since October and surged nearly 44% from December, according to the January report from Northwest Multiple Listing Service. Last month’s 5,776 mutually accepted offers were down about 9% from a year ago, but brokers seemed encouraged by the “favorable spike.”

Prices on last month’s closed sales edged up slightly, at 0.41%, compared with twelve months ago. The area-wide median price on January’s 3,264 completed transactions $557,250; a year ago, when there were 5,085 closed sales, it was $555,000.

“We are seeing multiple offers once again,” stated John Deely, VP of operations at Coldwell Banker Bain. “It’s not like it was at the peak of the market, but buyers are out there and competing for properties,” he added.

The selection of properties, based on the number of total active listings in the MLS database, improved significantly from a year ago, rising from 3,092 listings to 8,220 at month end. That total, which includes 7,179 single family homes and 1,041 condominiums, was down about 13.2% from December’s selection.

Brokers added 4,925 new listings to the MLS database in January, about 1,000 fewer than the same month a year ago. Last month’s additions outgained December when 2,980 properties were added, as well as November, when 4,890 listings were added.

“We saw a favorable spike of intensity in the market in January,” reported L. Lennox Scott, chairman and CEO of John L. Scott Real Estate. “With fewer new resale homes coming onto the market, there’s a shortage/low level of unsold inventory, especially in the more affordable and mid-price ranges where approximately 80% of sales activity takes place.”

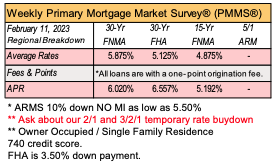

On Thursday, Freddie Mac (the Federal Home Loan Mortgage Home Loan Mortgage Corporation) reported the U.S. weekly average for a 30-year fixed-rate mortgage was 6.09%, down about a full point from November when it peaked at just over 7%. According to its research, this one percentage point rate reduction can allow as many as three million more mortgage-ready consumers to qualify and afford a $400,000 loan, the median home price in the U.S.

NAR Chief Economist Lawrence Yun suggested the “recent low point in home sales activity is likely over.” Commenting on pending sales for December, he stated, “Mortgage rates are the dominant factor driving home sales, and recent declines in rates are clearly helping to stabilize the market.”

Yun believes the “new normal” for mortgage rates will likely be in the 5.5% to 6.5% range, adding, “Job gains will steadily become important in driving local home-sales markets.”

Best state to retire

Out of all 50 states, Washington has been listed as the best state to retire in, according to research by Global Residence Index. The research used seven key factors to rank each of the 50 states, and Washington ranked in the top 10 for five of the seven factors. Air quality, life expectancy, violent crime reports, environment quality, Medicaid spending, and 65+ population were considered the most important factors for those of retirement age, according to Global Residence Index. Another key factor in the research was that Washington held the second highest life expectancy in the United States at 79.2 years.

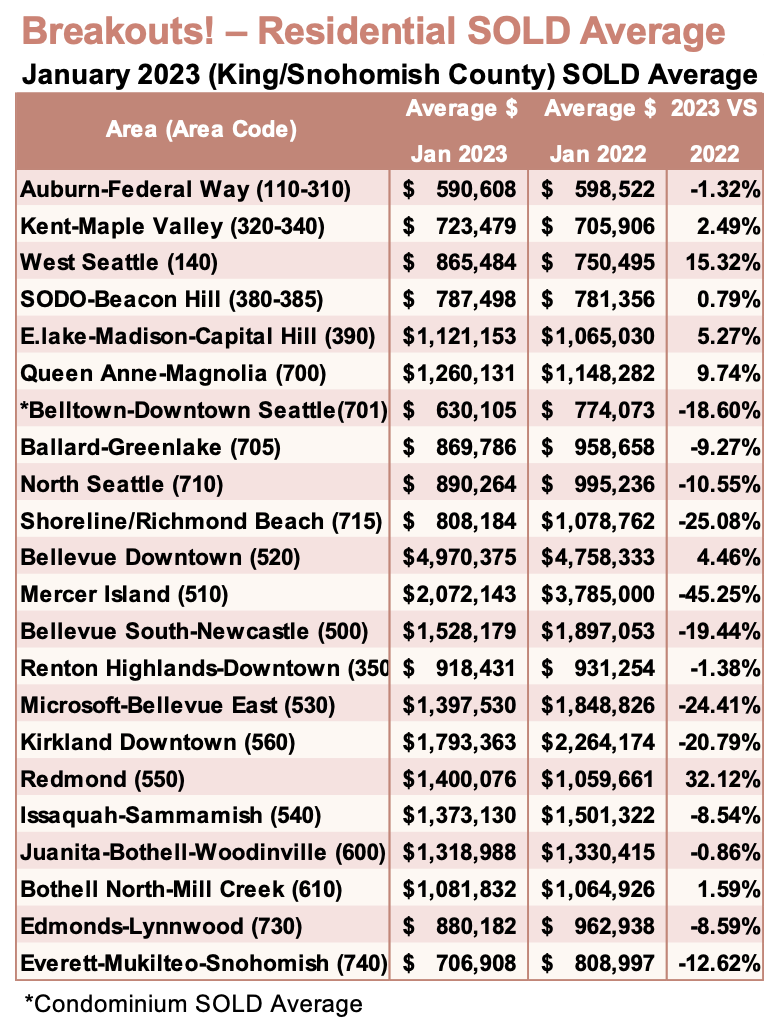

Breakouts! – Residential SOLD Average

Paying points upfront to lower housing payment

According to Black Knight’s newest Mortgage Monitor report, there’s a growing trend of homebuyers paying points upfront to permanently reduce their mortgage interest rates in an effort to stem ongoing affordability woes.

Early 2023 data revealed some signals of recovery in homebuying activity, with purchase loan locks up by 64% between the first and last week of January. That’s the largest such jump in the past five years, with buyers likely motivated in part by declining interest rates and receding home prices.

Purchase borrowers, who made up 81% of new rate locks during the week ending Jan. 21, paid an average of 1.16 points to push down their rates.

Gina Brown (NMLS#115337)

Senior Loan Officer

Home Trust Financial NMLS1761573

425-766-5408

gina@gmgloan.com

www.loansbygina.com

![]()