Northwest MLS brokers see signs of busy spring market despite slow January

A frigid first week of January, surges in coronavirus cases, and depleted inventory were among factors brokers from Northwest Multiple Listing Service cited for last month’s slower than year-ago sales.

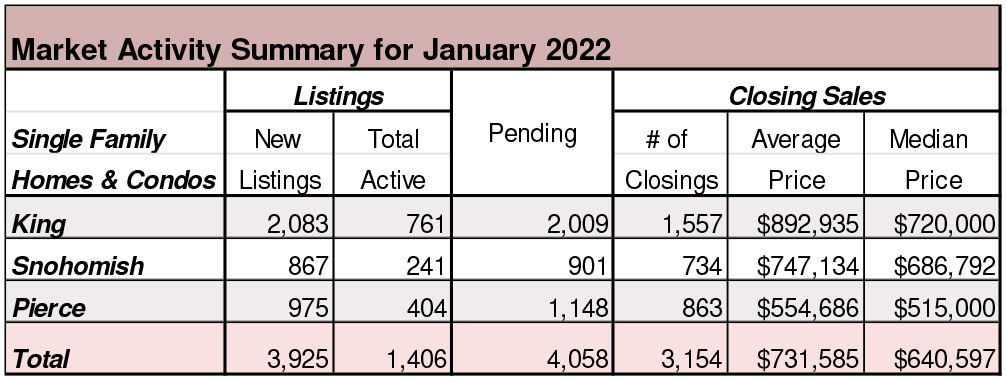

In newly released statistics for January, the MLS reported 6,350 pending sales of single family homes and condominiums during January, about 1,000 fewer than the same month a year ago for a drop of 14%. The year-over-year (YOY) number of closed sales also fell, dropping from 5,896 completed transactions to 5,085 for a decline of nearly 13.8%.

“When there’s uncertainty, the default position for most sellers is to stay put, do nothing, and hunker down,” suggested Mike Larson, managing broker at Compass Tacoma. He said many things are contributing to sellers’ reluctance to put their homes on the market, “most notably, COVID, inflation, the economy, the holidays, and finding a replacement property. Security and certainty are more important than cashing in on record amounts of equity.”

Broker-members added 5,927 new listings during January, nearly 1,000 fewer than the same month a year ago, but an improvement on December’s volume of 4,617. Only five counties reported YOY gains in new listings.

Last month’s pending sales outgained new listings to further shrink inventory. At month end the selection included a meager 3,092 active listings, down more than 30% from a year ago. There is about 2.5 weeks of supply (0.61 months) across the 26 counties served by Northwest MLS.

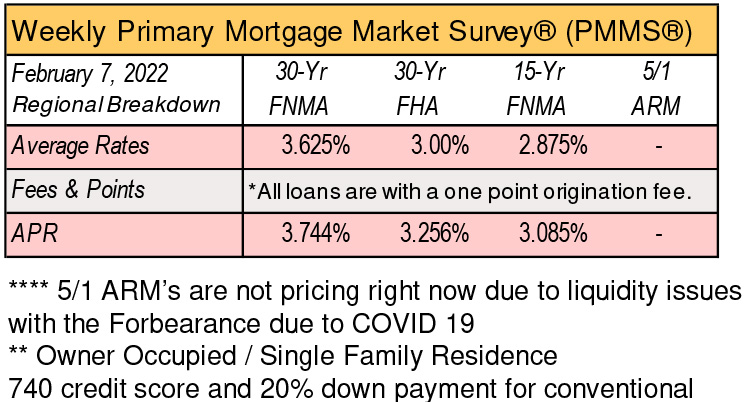

“The market remains virtually sold out, and there is a significant backlog of buyers looking for a home to purchase,” reported J. Lennox Scott, chairman and CEO of John L. Scott Real Estate. With higher mortgage rates expected, he said buyers are more anxious to get a home, even during the inventory shortage.

“Given the market conditions, nearly all homes are going under contract within a week of being listed, and multiple offers are commonplace in price ranges where there is a shortage of available homes for sale,” added Scott.

Last month’s prices were up nearly 14.9% from a year ago, climbing from $483,250 to $555,000. Five counties reported price gains of 30% or more, led by Okanogan at 46.3%.

Condominium prices surged nearly 21% area-wide, rising from $359,950 to $435,000, while the number of new listings, active listings, pending sales and closed sales all declined from the same month last year.

“The market dipped slightly in January, mainly due to weather and concerns over the latest pandemic variant, but the general feeling is that it’s going to be a good year,” said John Deely, executive vice president of operations at Coldwell Banker Bain. Commenting on last year’s record-setting volume of closings, he believes “rate increases during 2022 combined with the sunset of the pandemic will bring more sellers to the market.”

2022’s forecasted hottest housing markets

Originally posted on Puget Sound Business Journal, the highly competitive Bellevue-Seattle-Tacoma metro is likely to stay that way for at least another year, according to a recent study from Realtor.com that identified the 30 hottest markets for 2022. Our market landed at number 8 on the list. The study ranks metros based on the combined forecast of year-over-year price growth plus increase in unit sales. The Seattle region came in high at 17.1%, reflecting a projected unit sales increase of 9.6% in 2022 and a price increase of 7.5%. The rankings found that projected growth could be found in markets all across the country, with a special focus on Midwestern cities. While the effects of the pandemic are still deeply felt in the housing industry, new options for remote work have opened up the possibility for buyers to decide where and how they really want to live – and in 2022, Bellevue and Seattle will be among the most desired locales in the country.

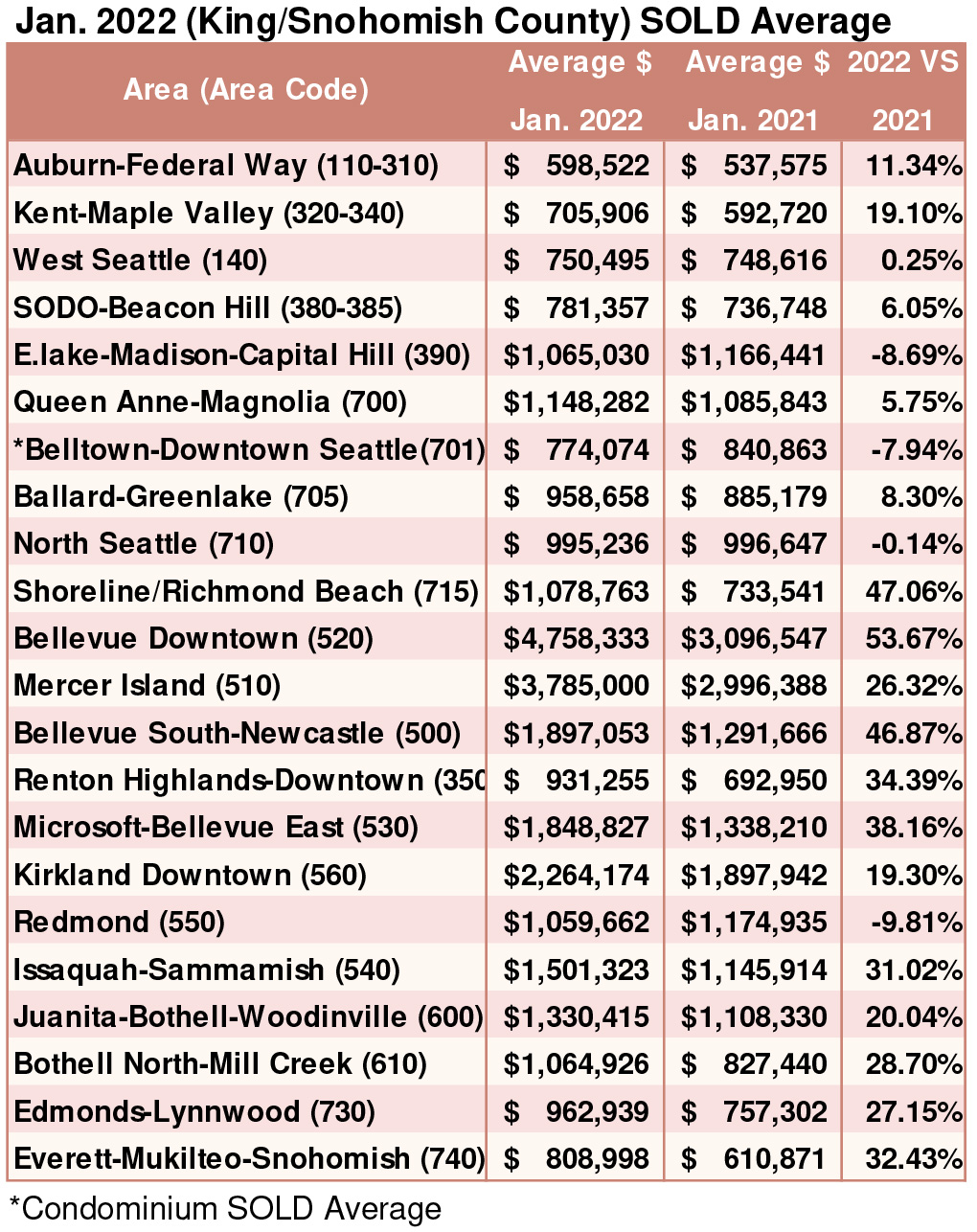

Breakouts! – Residential SOLD Average

Big jump in Home seller profit

Home sellers across the country realized a median profit of $94,092 on the typical sale in 2021, according to Attom Data Solutions.

That’s up 45% from 2020 and 71% from two years ago as rapidly rising prices continued to provide a big boon to sellers nationwide.

Last year’s typical profit marked the highest since at least 2008, and profits rose in more than 90% of markets.

The West saw the highest returns on investment, with 16 of the 20 metros with the highest ROIs in the country. Those cities included Boise (121% ROI); Spokane, Washington (86.5%); Bremerton, Washington (82.7%); Prescott, Arizona (81.2%); and Salem, Oregon (81.2%).

Gina Brown (NMLS#115337)

Senior Loan Officer

425-766-5408

gina@gmgloan.com

www.loansbygina.com