Reduced inventory motivates increased home prices

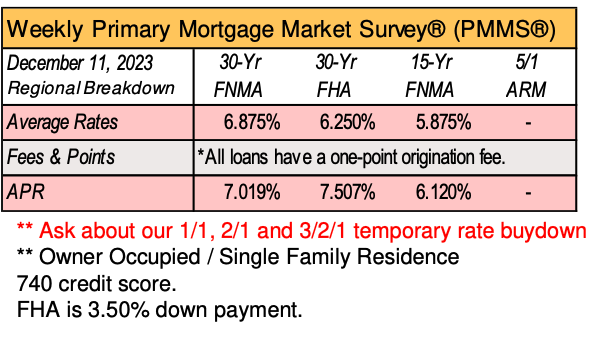

A slight decrease in interest rates has raised cautious optimism – interest rates had fallen to around 7.2% as of December 1, 2023, in comparison to 7.8% in October 2023, and a continuation of that decrease would have a positive impact on the market in general. However, the decline in seasonal inventory continues to drive home prices upward, spurring an increase of 4.6% in prices from November 2022.

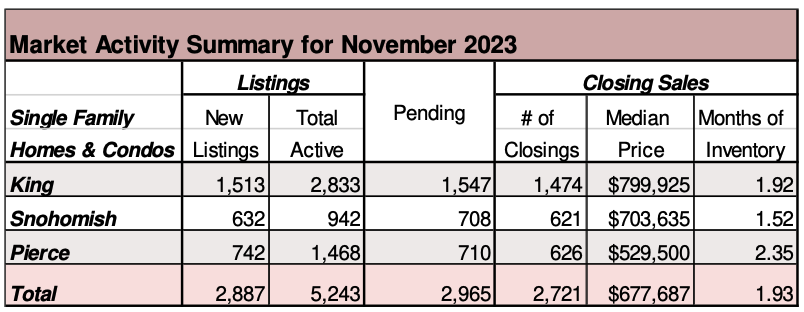

NWMLS brokers added 4,595 new listings to the database in November 2023, a decrease of 6% compared to November 2022, when 4,890 new listings were added.

There were 4,678 total residential units & condo units under contract in November 2023, an overall decrease of 8.4% compared to November 2022. There were 8 counties with a year-over-year increase in the number of pending sales, including Kittitas, Douglas, Adams, Jefferson, Walla Walla, Okanogan, Chelan, and Grant.

NWMLS brokers reported 4,367 closed sales in November 2023, which is a 16% drop from closed sales in November 2022 (5,194). However, this is a slight improvement from October’s year-over-year change in closed sales, which decreased 18% when compared to October 2022.

The median sales price increased year-over-year in 21 of the 26 total counties included in the statistical report. Overall, the median price for homes sold in November 2023 was $601,341, up 4.6% when compared to November 2022 ($575,000). The three counties with the highest median priced homes sold were San Juan ($975,000), King ($799,925) and Snohomish ($703,635). The three counties with the lowest median priced homes sold were Grant ($327,999), Ferry ($313,750) and Adams ($221,500).

When compared to the same month last year, November 2023 experienced a 17% decrease in the number of active property listings on the market. The total volume of homes for sale has continued to decline, with 19 out of 26 counties seeing a year-over-year decrease.

Although the number of sales transactions and housing inventory levels typically drop in the fall and winter months, the expected seasonal slow-down continues to be exacerbated by the high interest rate environment for buyers relying on mortgages.

“With the 30-year fixed mortgage rate currently just over 7.2%, the purchasing power of prospective buyers remains stunted relative to a few short years ago,” said Mason Virant, associate director of the Washington Center for Real Estate Research at The University of Washington. “Moreover, current owners with low-rate mortgages continue to be reluctant to sell. This has led to a continued decline in year-over-year transaction volume and the inventory levels in the market.”

The typical U.S. homebuyer earns more money

and is more likely to pay cash this year, according to Bloomberg. And, increasingly, she is a single woman, according to the annual Profile of Home Buyers and Sellers report from the National Association of REALTORS®. Facing limited home inventory, rising prices and high mortgage rates, house hunters were forced to increase their down payment: For first-time buyers, it reached 8% of the total price, the highest rate since 1997, according to the report. The average homebuyer’s income jumped to $107,000 in 2023 from $88,000 a year earlier. Buyers are getting older, at 35 for a first house compared with 29 in the early 1980s, the report found. The share of recent buyers who were married couples dropped to 59%, the lowest since 2010, while unmarried couples’ share has remained little changed in recent years at 9%. Increasingly, buyers are single women. The portion of homes bought by single women and single men was roughly the same 40 years ago, but now the rate for women is almost double that of men. The typical single female buyer also tends to be a bit older: 38 for a first home, compared with 33 for single men.

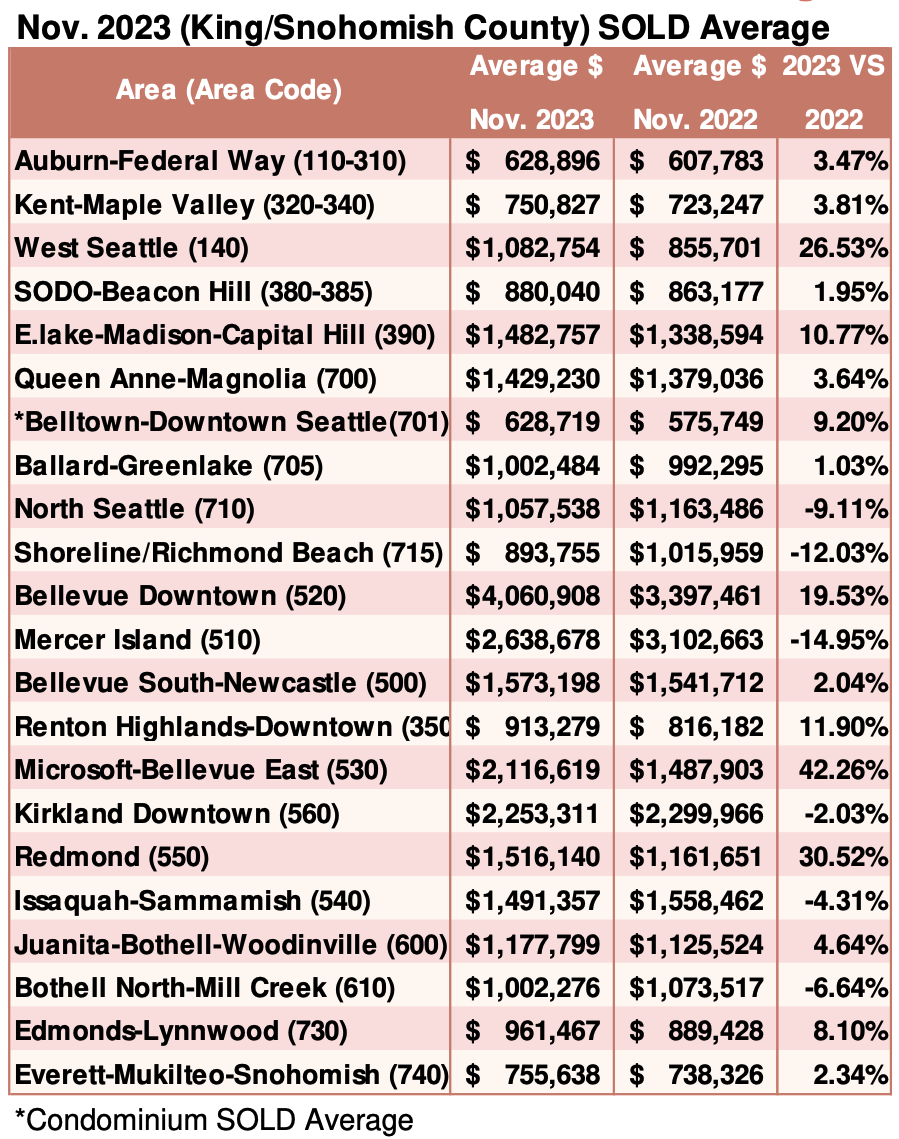

Breakouts! – Residential SOLD Average

Rates come down and New listing rise

Homebuying is becoming more affordable as mortgage rates continue declining. The median U.S. housing payment was $2,561 during the four weeks ending December 3, down $177 from the record high it hit in October. That’s spurring action from sidelined homebuyers and sellers. Mortgage-purchase applications are up 15% from the 28-year low they dropped to at the start of November. New listings are up 7% year over year, the biggest increase since August 2021, and the number of homeowners contacting Redfin for help selling their home is up by double digits from a year ago.

Gina Brown (NMLS#115337)

Senior Loan Officer

Home Trust Financial NMLS1761573

425-766-5408

gina@gmgloan.com

www.loansbygina.com

![]()