NWMLS brokers log 64,208 sales during 2023

Northwest MLS members reported 64,208 sales of residential homes and condominiums during 2023. The total closings were valued at more than $48 billion, with residential homes accounting for nearly 87% of the total sales. Compared to 2022, there were 19,829 fewer sales in 2023, a decrease of 23.6%. This is the second year-over-year decrease in sales since the record highs of 2021, where the total number of closings was 107,354 (the first time the sales volume topped the 100,000 mark) and the value of sales was just over $75 billion.

The median price for last year’s completed transactions was $600,000, a decrease of 2.44% from 2022’s figure of $615,000. For comparison, the median price ten years ago in 2013 was $270,000.

The decrease in sales volume in 2023 is indicative of the persistent low inventory paired with high interest rates, particularly in the more populous King and Snohomish counties. This trend is echoed by Mason Virant, associate director of the Washington Center for Real Estate Research (WCRER), who attributes the continued decline to “the high-interest rate environment, [which] has further decreased the purchasing power of prospective buyers.”

Brokers also reported fewer pending sales during 2023 compared to 2022, with year-over-year volumes down 18.24%. The year-over-year number of mutually accepted offers fell 11 out of 12 months last year, peaking early in the year in March; however, the year-over-year accepted offers increased by 2.02% in the month of December, a surprise given historic seasonal trends.

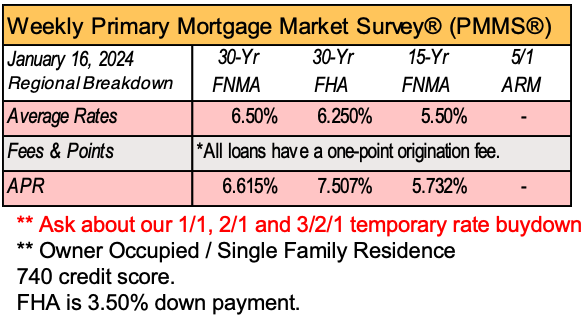

Selma Hepp, chief economist at CoreLogic, noted the decrease of interest rates in December as contributing to the increase of accepted offers. “Rapidly slowing inflation and the Fed’s signal for rate cuts in 2024 provided much needed relief and optimism for housing activity going into the new year, especially with interest rates falling to mid-6% by Christmas.”

Brokers added 81,612 new listings during 2023, down from the previous year’s volume of 110,294. This represented a significant drop of 26.01% of available inventory.

On average, there were 9,579 active listings in the NWMLS database each month in 2023. This is a nearly 5% decrease from 2022’s average of 10,075 and is consistent with reports of persistently low available inventory.

Inventory as measured by months of supply averaged 1.77 months overall for 2023, improving on 2022’s average of 1.464, but still well below the balanced market range of 4-to-6 months.

Although prices continued to remain high compared to those a decade ago, there are signs that the market may be softening as interest rates start to lower in the coming months. The residential median home price of $625,000 was $13,000 less than the 2022 median price of $638,000, a 2.04% decrease.

Price range statistics showed a downward trend, with 35.69% of buyers paying less than $500,000 for their home, up from 29% in 2022. Homes selling for $1 million or more decreased in number, registering only 18.3% of sales compared to 19.85% in 2022. The highest-priced residential home sale was recorded in Medina at $38 million.

Where home prices could jump in 2024

Real estate values are projected to rise 2.5% this year, according to real estate firm CoreLogic. But some locations could see above-average

appreciation. The top gainer is likely to be Redding, California, where homes could jump by 7.3% this year, CoreLogic projected. Redding, a city of about 90,000 residents in Northern California, has a median home price of about $375,000, according to Zillow. Bremerton-Silverdale, Washington is No.3 on the list at 6.51%. Other Washington cities in the top 20 are Mount Vernon-Anacortes (6.2%), Longview (6.07%) and WallaWalla (5.88%).

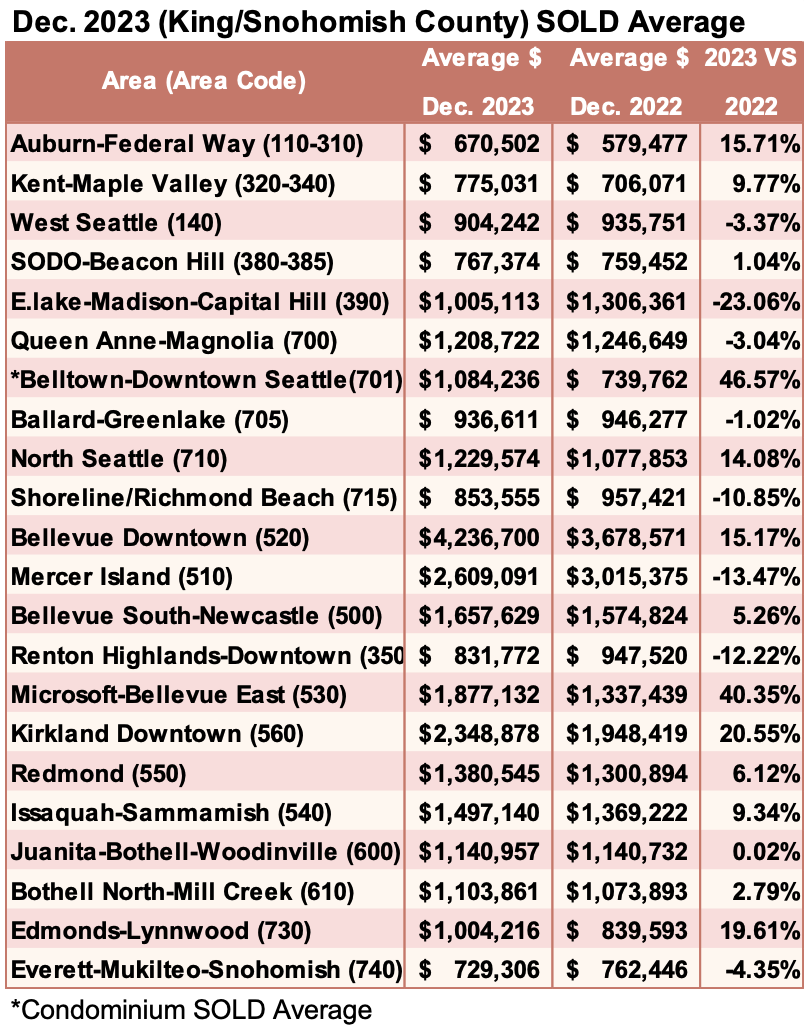

Breakouts! – Residential SOLD Average

NEW LOAN LIMITS FOR 2024

Washington State conforming conventional limit: $766,500.00

King/Snohomish/Pierce County High Balance limit: $977,500.00

Minimum down is ZERO with USDA.

Minimum down with Conventional is 3%.

Minimum down for FHA is 3.50%.

First Time Home Buyer advantages!

Home Equity Lines of Credit.

Investment loans/Bank Statement loans/Construction loans

Call to discuss! 425-766-5408

Gina Brown (NMLS#115337)

Senior Loan Officer

Home Trust Financial NMLS1761573

425-766-5408

gina@gmgloan.com

www.loansbygina.com

![]()