Northwest MLS brokers say motivated home buyers turn to creative financing options

Brokers with Northwest Multiple Listing Service (NWMLS) are reporting a return to some creative financing methods as motivated home buyers and sellers grapple with higher mortgage rates. Despite that, and the seasonal slowdown in activity, 6,435 hopeful homebuyers succeeded in having sellers accept their offers to purchase during October.

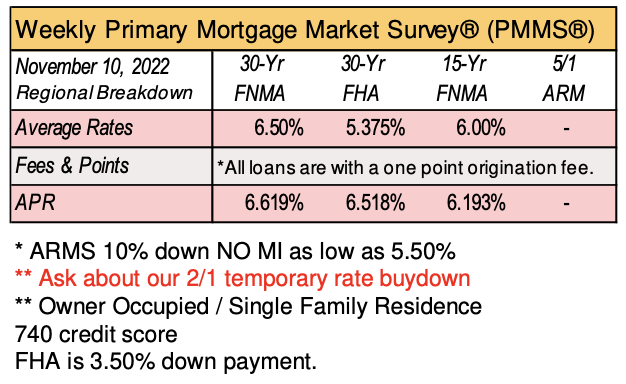

“Buyers are benefiting from more choices in inventory and less competition, while sellers are more negotiable when it comes to contingencies,” reported NWMLS director Meredith Hansen. “We are seeing more 2/1 buydowns and adjustable-rate mortgages with buyers planning to refi when the rates come back down,” added Hansen, the founder and operating principal at Keller Williams Greater Seattle.

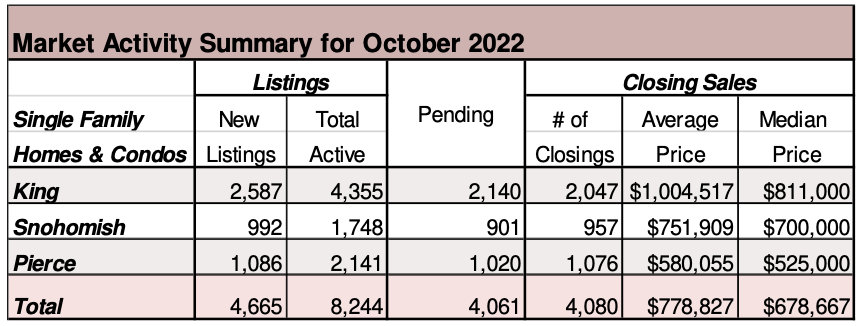

The latest Northwest MLS shows 6,435 pending sales last month, and about the same volume (6,464) of closed sales. Both figures were down from the year-ago totals, with pending sales dropping about 39% and closings declining around 35%.

Median sales prices still rose year-over-year in most of the 26 counties on the report. Area-wide, the median price on last month’s completed sales of single family homes and condominiums was $595,000. That was an increase of about 3.5% from twelve months ago, but a decline of approximately 9% from May when prices peaked at $660,000.

Brokers added 7,260 new listings during October, down about 21% from the same month a year ago. At month end, the selection included 14,214 active listings of single family homes and condos system-wide. That was more than double the year-ago inventory of 6,588.

The uptick in supply boosted the months of inventory figure to 2.2. That is the highest level, based on this metric, since January 2019.

“Buyers’ opportunities abound,” proclaimed Gary O’Leyar, owner/CFO at Berkshire Hathaway HomeServices Signature Properties in Seattle, noting inventory in several counties is two-to-three times larger than a year ago.

“As for the interest rate ‘elephant in the room,’ the time has come for buyers and sellers to revisit financing methods from previous markets,” O’Leyar said, mentioning the use of buydowns, adjustable-rate loans, carrying back second deeds of trust, and closing cost allowances as possible options.

“Even with more choice on the market than we’ve seen in several years, pending sales fell last month,” remarked Matthew Gardner, chief economist at Windermere Real Estate. “The cause is almost certainly rising mortgage rates, which rose from 6.65% early in the month and ended above 7.1%; this is clearly having an impact on buyers,” he added.

Gardner believes many buyers may remain sidelined until mortgage rates stabilize, but added he had “bad news for those buyers who are sitting on the fence waiting for home prices to implode.” He expects regional home values will turn modestly negative in 2023, but said, “those who hope to pick up a home ‘on the cheap’ are likely in for a long wait.”

Best cities to live in the U.S.

One city in King County was ranked No. 3 among the best cities to live in the country in a new Money Magazine report. Kirkland claimed bronze in the competition, which is judged by economic opportunities, quality of life, diversity and where the best futures lie. Atlanta took home the No. 1 slot, followed by Tempe, Ariz. The Money Magazine report said Kirkland residents — of which there are 90,472 — pay $2,000 a month for the average one-bedroom rental, and median home sales top $1 million. The median household income in Kirkland is just under $130,000, according to the report. Camas, Wash., took home No. 32 on the list. Camas was touted for its proximity to Portland, its tree-lined 4th Avenue, the Liberty Theatre and more.

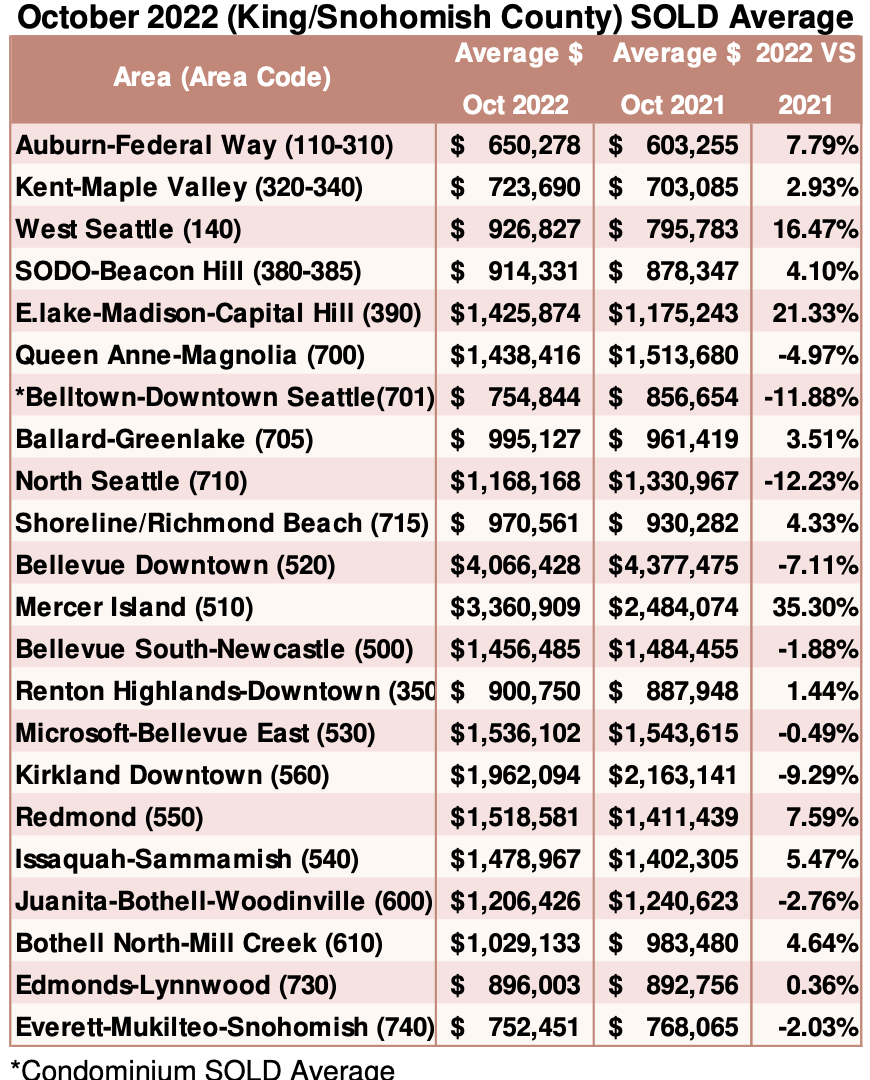

Breakouts! – Residential SOLD Average

Black Knight’s Mortgage Monitor

According to the Black Knight Home Price Index, median home prices fell 0.52% in September, continuing a three-month streak of declines – but slowed at half the pace of the prior two months.

Annualized appreciation slowed to 10.7% – still more than twice long-term norms – and, while indicative of continued correction, the 1.2% decline from August is the smallest seen in four months.

Despite price corrections, home values in the nation’s 50 largest markets remain elevated by anywhere from 19% to 66% since the start of the pandemic.

Gina Brown (NMLS#115337)

Senior Loan Officer

Home Trust Financial NMLS1761573

425-766-5408

gina@gmgloan.com

www.loansbygina.com

![]()