Northwest MLS housing market “still lacks direction”

Prices on homes that sold during August rose 2.5% from a year ago, marking the first year-over-year (YOY) increase since January, according to a new report from Northwest Multiple Listing Service. The median price of $615,000 for 6,734 closed sales across 26 counties matched July’s figure.

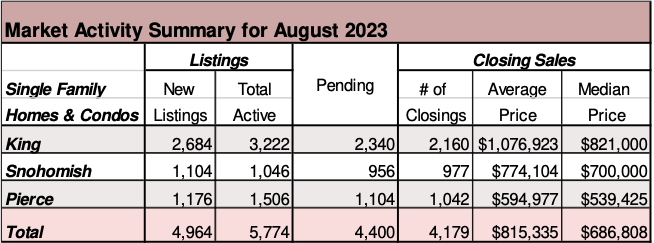

For other key metrics on August activity, including new and active listings, pending sales, and closed sales, the YOY comparisons showed declines.

Brokers added 8,152 new listings of single family homes and condominiums last month, down from 9,914 for August 2022, a drop of nearly 17.8%. Last month’s systemwide tally of new listings was the smallest monthly total since April.

NWMLS members reported 7,189 pending sales during August, which was the lowest level since April’s total of 7,137, and down nearly 25% from the year ago figure of 9,552.

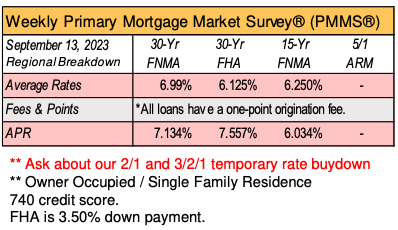

The average interest rate on a 30-year home loan reached 7.23% as of August 24, according to Freddie Mac. That is the highest rate since 2001, but it subsequently dropped to 7.12% for the week ending September 7. Along with forcing buyers to sit on the sidelines, the escalating rates are a deterrent to would-be sellers who bought or refinanced home in recent years and don’t want to swap their 3% rate for a 7% mortgage.

Despite slower activity, supply remained constrained with only 1.71 months of inventory in the MLS database. That’s down from both a year ago when there was 1.84 months of supply, and from last month when the figure was 1.76.

Commenting on supply and the 11,525 active listings at month end (down more than 21.5% from a year ago), J. Lennox Scott, executive officer at John L. Scott Real Estate, said over the next two months home buyers will experience the best selection and availability of homes for sale until March 2024. “This is due to the reduced number of homes that come on the market over the winter months,” he explained.

Scott expects home prices will rise after the first of the year, particularly in the more affordable and mid-price ranges, again citing limited supply.

Windermere Chief Economist Matthew Gardner described conditions as “a housing market that still lacks direction.” He believes “it likely won’t find its footing until mortgage rates start to pull back, which I expect to see as we enter the fall months – and assuming the U.S. economy continues to moderate.”

How much do you need to earn?

Despite the cooling housing market, Seattle-area buyers now need to earn more money than a year ago to afford a starter home — typically priced in the low to mid-$500,000s according to the Seattle Times. Seattle-area households need to make nearly $142,000 a year to afford a typical first home in the region, according to an analysis from Redfin. That’s an increase of 4% from last year, and well above King County’s median household income of about $106,000. In the Seattle metro area, covering King and Snohomish counties, those starter homes were homes with a median sale price of $535,000 between April and June. That median price would require a monthly mortgage payment of $3,545, according to Redfin’s analysis, assuming a 20% down payment and costs for interest, taxes and insurance.

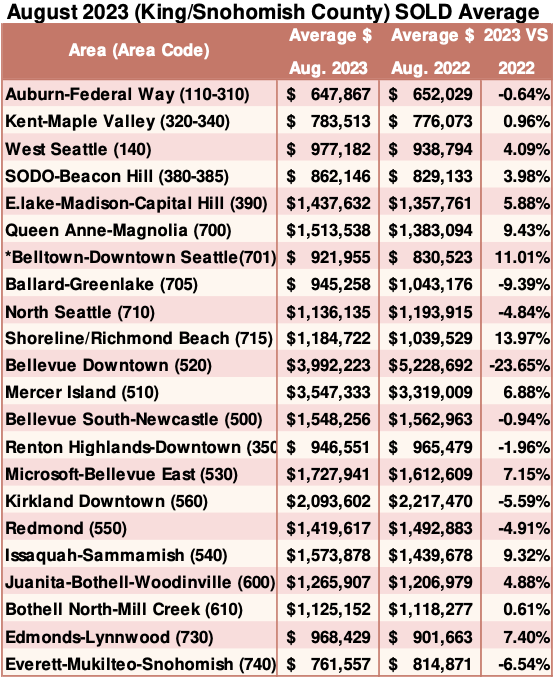

Breakouts! – Residential SOLD Average

New York Federal Reserve survey

American consumers are worried about access to credit amid persistently higher interest rates and tighter standards at banks, according to a New York Federal Reserve survey.

Respondents indicating that the ability to get loans, credit cards and mortgages is harder now than it was a year ago rose to nearly 60%, the highest level in a data series that goes back to June 2013. The results were part of the New York Fed’s Survey of Consumer Expectations for August.

Since March of last year, the central bank has hiked its key borrowing rate 11 times totaling 5.25 percentage points as it seeks to tame inflation.

Gina Brown (NMLS#115337)

Senior Loan Officer

Home Trust Financial NMLS1761573

425-766-5408

gina@gmgloan.com

www.loansbygina.com

![]()