Brokers say home buyers “finally get some relief” with return to “more traditional market”

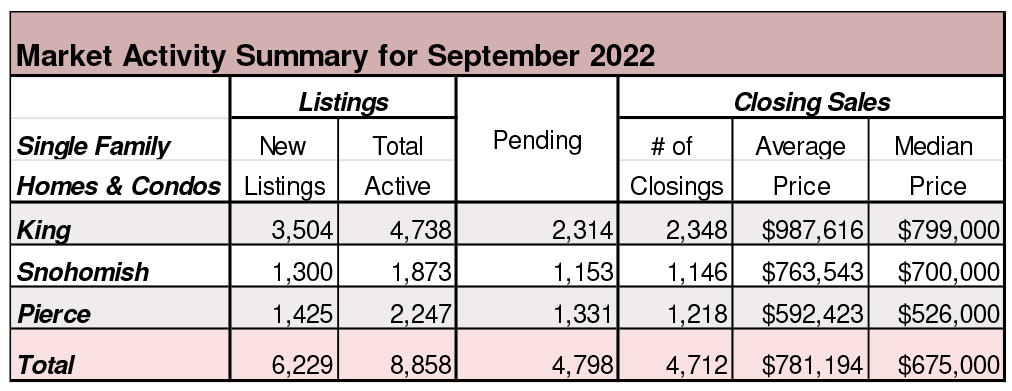

“The shift in the market isn’t a surprise,” said broker Mike Larson when commenting on the latest statistics from Northwest Multiple Listing Service. The report on September activity shows active listings are nearly doubled from a year ago, pending sales declined more than 31%, but prices in most counties are still rising.

NWMLS brokers reported 7,504 closed sales during September, down 27% from a year ago when they notched 10,289 completed transactions.

The median price on last month’s sales across the 26 counties in the report rose about 5.1% from a year ago, increasing from $570,000 to $599,000. Prices are down slightly from the August median of $600,000 and from the year’s peak of $660,000 that was reported in May.

For the 26 counties in the MLS report there were 15,008 active listings at the end of September. That’s a jump of more than 93% from the year-ago total of 7,757 active listings. It is also a slight improvement (2.2%) from August when there were 14,683 active listings across the NWMLS market.

The inventory of single family homes (excluding condominiums) nearly doubled from a year ago, jumping from 6,679 to 13,266 (up 98.6%). Condo listings jumped about 62% from the year-ago figure of 1,078 to 1,742.

Pending sales (mutually accepted offers) of single family homes and condos declined from a year ago, shrinking from 11,318 to 7,764, a drop of more than 31%. Last month’s pendings also fell from the August figure of 9,552 (down 18.7%).

“Although the housing market experienced a major intensity adjustment from the spring, the percentage of homes going under contract within the first 30 days is strong and resilient,” stated J. Lennox Scott, chairman and CEO of John L. Scott Real Estate. “We are seeing approximately 80 percent of sales activity take place in the more affordable, mid-price range, and upper end price points,” he added.

Area-wide, the median price on last month’s single family homes (excluding condos) rose 4.75%, from $589,000 to $617,000. King County, where the median price on last month’s single family home sales was $875,000, had the most expensive homes. Within King County, single family homes on the Eastside fetched the highest price last month at $1.2 million. Homes in the southwest segment of the county sold for about half that amount ($590,000), but they had the highest YOY increase when comparing the six sub-areas tracked by the MLS. Countywide, single family home prices increased nearly 6%.

Condo prices surged 9.2% from a year ago, rising from $435,000 to $475,000.

Most ethnically diverse cities in the U.S.

Three local cities were named among the most ethnically diverse in the country. According to a new report from WalletHub, Kent is the seventh-most ethnically diverse city — out of more than 500 — in the United States, while Federal Way and Renton ranked Nos. 12 and 16, respectively. The personal-finance website used three key metrics: ethnoracial diversity, linguistic diversity and birthplace diversity. Jersey City, NJ, Germantown, Germantown, Md., Gaithersburg, Md., Silver Spring, Md. and Spring Valley, Nev. ranked Nos. 1-6, respectively. Bellevue claimed No. 37 and Everett capped the top 100. Yakima (No. 116), Seattle (No. 128), Tacoma (No. 135) all ranked in the top 135.

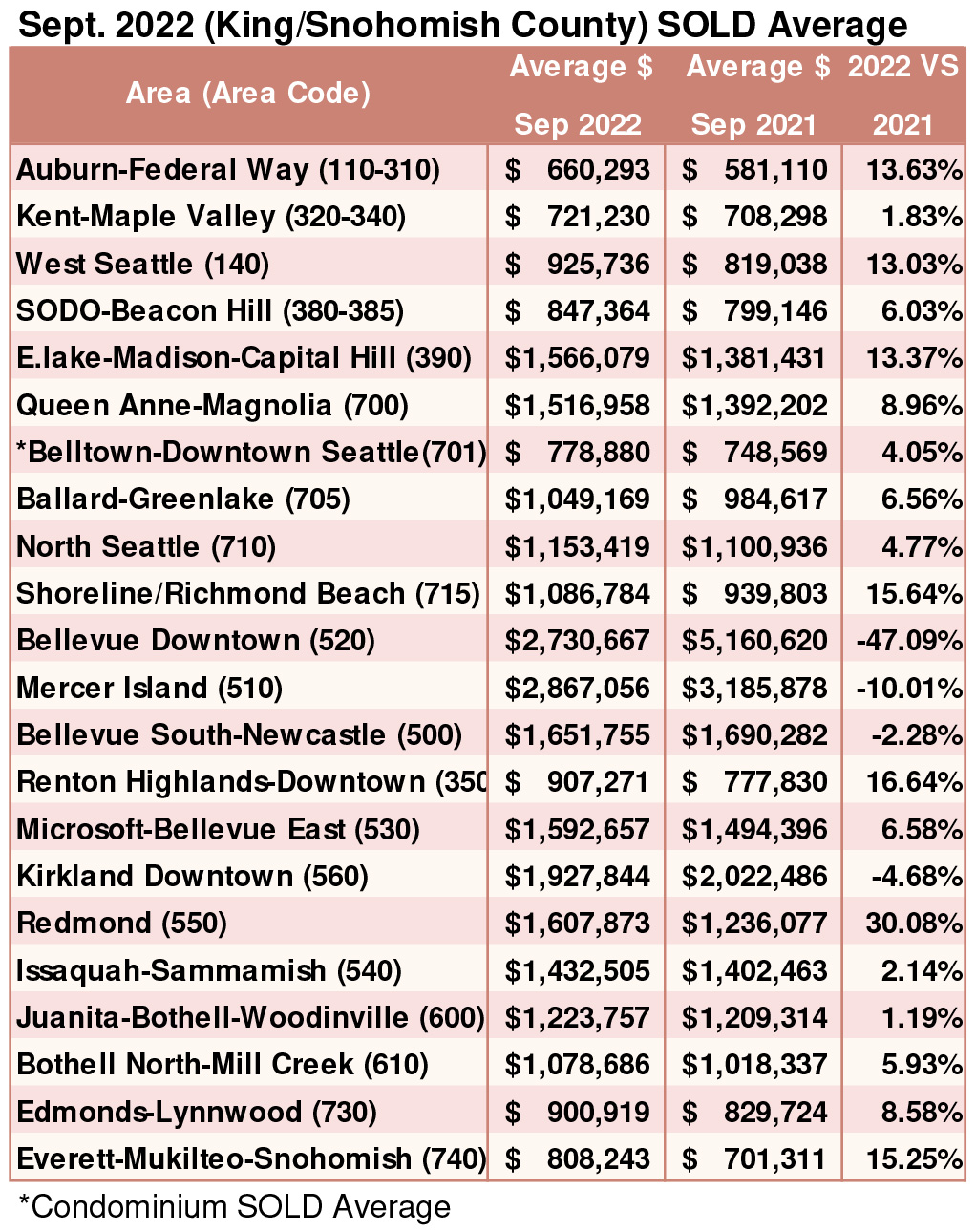

Breakouts! – Residential SOLD Average

Seattle’s housing market is cooling faster

Seattle’s housing market is cooling faster than any other major U.S. city, according to a recent report from Redfin.

Redfin examined price drops, supply, pending sales, sale-to-list ratio, speed of homes sales and more from February to August to determine which housing markets in the 100 most populous U.S. cities are slowing the fastest.

The 10 fastest cooling housing markets, according to Redfin: Seattle; Las Vegas; San Jose, California; San Diego; Sacramento; Denver; Phoenix; Oakland; North Port, Florida; and Tacoma.

The markets cooling fastest are many of the same places that saw the biggest spikes in home prices during the last three years.

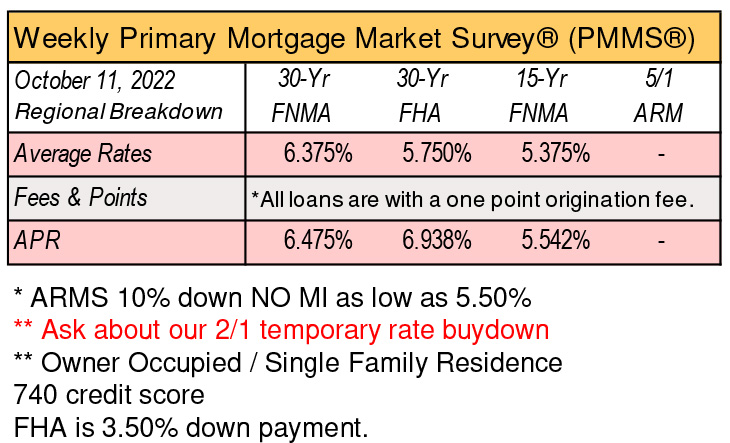

Gina Brown (NMLS#115337)

Senior Loan Officer

Home Trust Financial NMLS1761573

425-766-5408

gina@gmgloan.com

www.loansbygina.com

![]()