Decreased mortgage rates have yet to influence the market

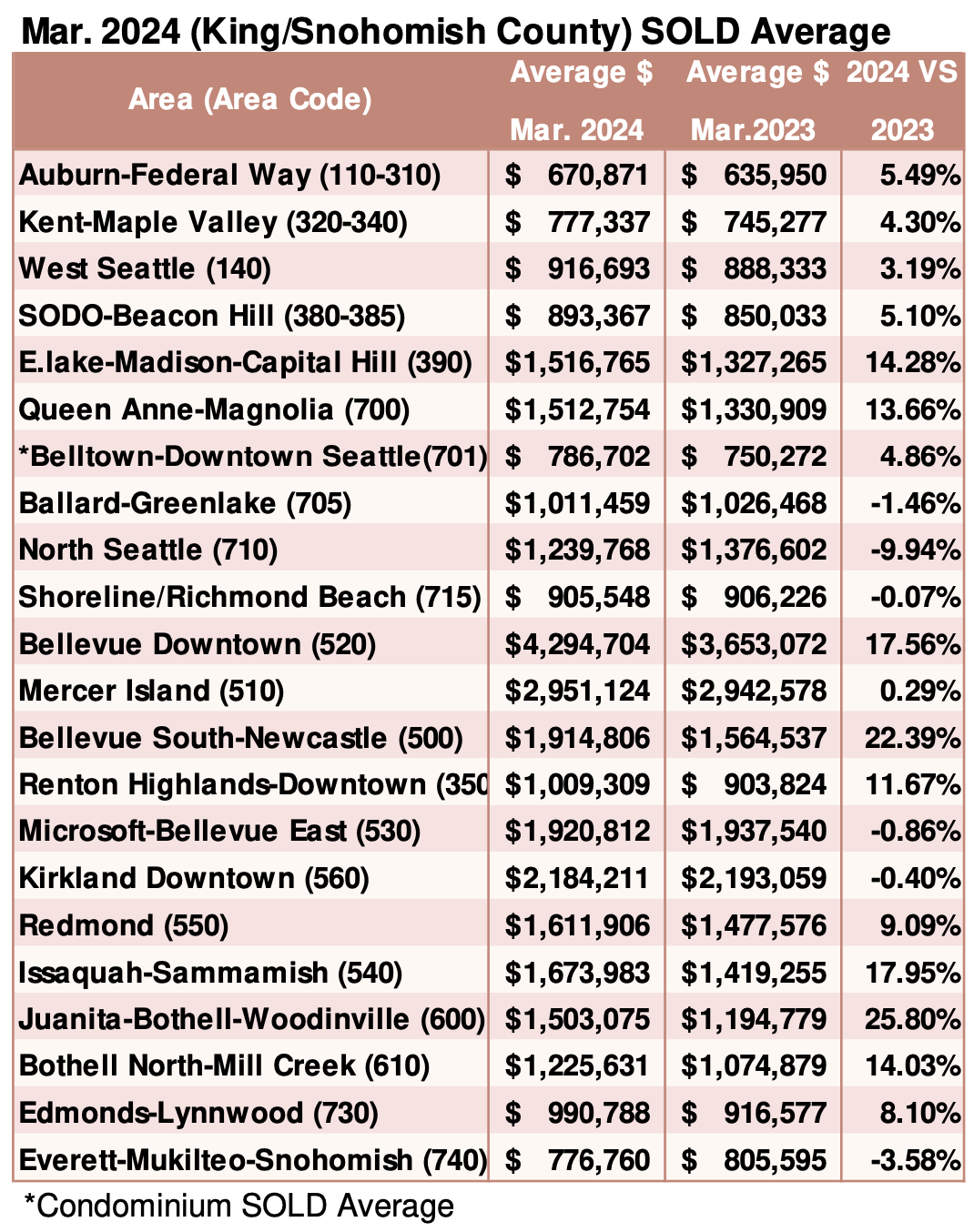

Interest rates have decreased by 0.15% over the past month to 6.79%, and while the rate decrease is encouraging, it has yet to have a significant impact on prospective buyers’ purchasing power or prospective sellers’ willingness to give up low interest rate mortgages.

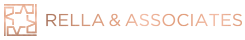

For the Washington counties covered by NWMLS, March 2024 saw an 11.2% decrease in the number of closed sales year-over-year, although median sales prices have continued to steadily rise with a year-over-year increase of 7.5%.

“Northwestern markets are finally showing signs of thawing,” said Selma Hepp, chief economist for CoreLogic. “With new listings picking up the pace from 2023 lows, potential home buyers have more options to choose from.”

“Still, there seems to be more buyers in the market than the available inventory. As a result, home prices continue to rise despite elevated mortgage rates and constrained affordability.”

There were 8,100 active listings on the market at the end of March 2024. The number of homes on the market increased throughout Washington with 20 out of 26 counties seeing a year-over-year increase. Overall, there was a 1.16% year-over-year increase in active property listings in Washington counties covered by NWMLS.

There were 7,218 total residential units & condo units under contract in March 2024, a slight increase of around 1% when compared to March 2023 (7,136).

The total dollar value of closed sales for residential homes for this month was $3,685,299,238 and was $461,759,636 for condominiums.

At the current rate of sales, it would take less than two months to sell every home that is active in the NWMLS inventory. The four counties with the lowest months of inventory in March 2024 were Snohomish (0.8), King (1.23), Pierce (1.39), and Kitsap (1.41).

Overall, the median price for residential homes and condominiums sold in March 2024 was $633,717, up 7.4% when compared to March 2023 ($590,000). The median sales price increased year-over-year in 19 of the 26 counties, with the highest median sales prices in King ($850,000), San Juan ($750,000), and Snohomish ($730,000) counties. The three counties with the lowest median sale prices were Pacific ($347,500), Grant($325,000) and Columbia ($274,000).

– NWMLS

Seattle area now has more “million-dollar cities” than ever

The number of “million-dollar cities” in the Seattle metro area —

where typical homes are worth $1 million or more — continues to rise. There are now more of these properties than the region has ever had. “Competition will stay fierce, especially for the most attractive and well- priced homes. If mortgage rates drop later this year, as many expect, we may see a surge in million-dollar cities as even more buyers jump in and drive prices higher.“

The Seattle metro area has 17 “million dollar cities” as of February 2024 (it had 15 in February 2023). They are: Hunts Point, Medina, Yarrow Point, Clyde Hill, Beaux Arts Village, Woodway, Mercer Island, Sammamish, Bellevue, Redmond, Woodinville, Newcastle, Kirkland, Fall City, Issaquah, Snoqualmie and Bothell.

– KUOW Puget Sound Public Radio

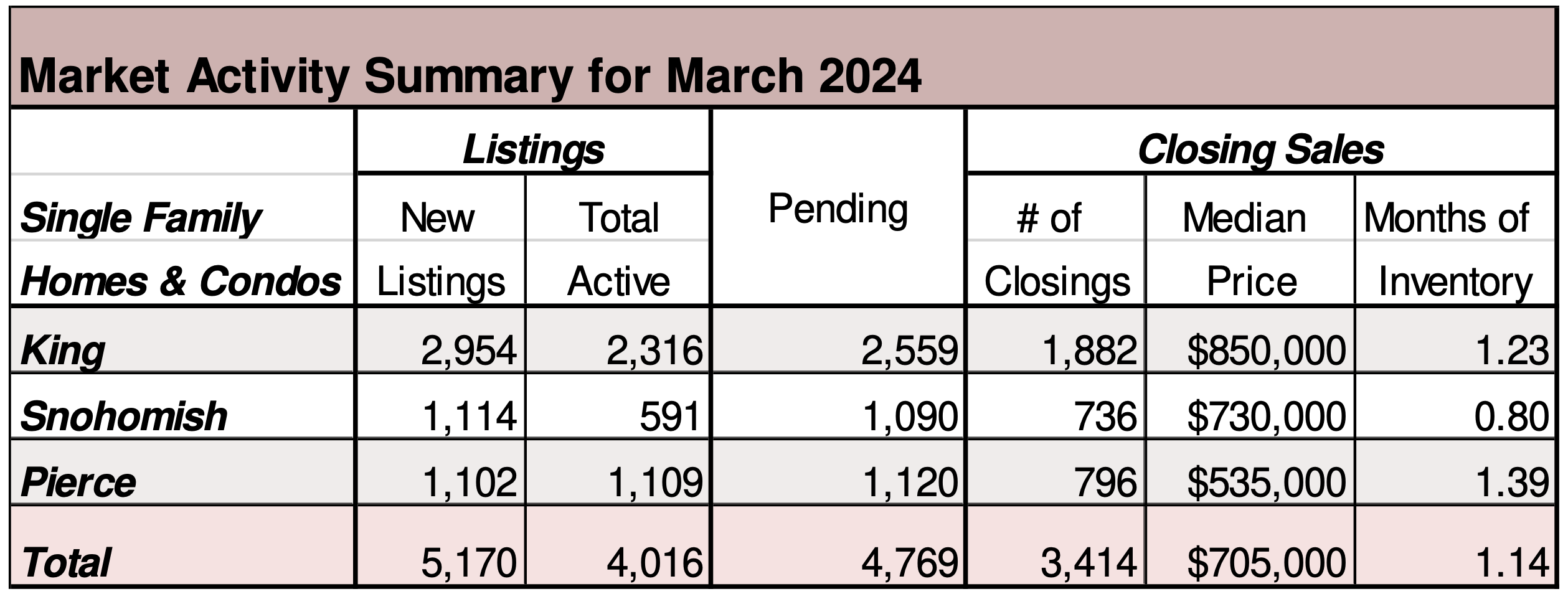

Breakouts! – Residential SOLD Average

Are consumers adjusting to the current mortgage rate environment?

Results from Fannie’s latest sentiment survey suggest households are recalibrating expectationsThe Fannie Mae Home Purchase Sentiment Index (HPSI) saw its first decrease in four months in March, receding 0.9 points to a reading of 71.9. The index took a step back largely because consumers are growing more pessimistic once again about the direction of mortgage rates, with 34% now anticipating that mortgage rates will rise in the next 12 months. That’s up from 32% one month prior and surpassing the 29% this month who believe that mortgage rates will drop.

– Scotsman Guide

Gina Brown (NMLS#115337)

Senior Loan Officer

Home Trust Financial NMLS1761573

425-766-5408

gina@gmgloan.com

www.loansbygina.com

![]()