Brokers say home buyers “finally get some relief” with return to “more traditional market”

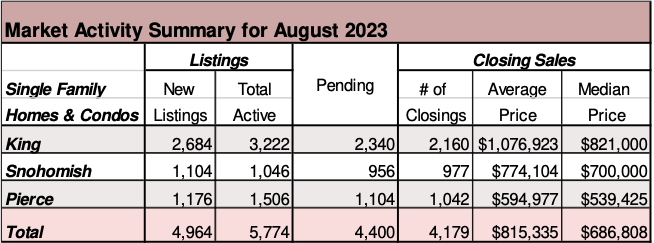

“The shift in the market isn’t a surprise,” said broker Mike Larson when commenting on the latest statistics from Northwest Multiple Listing Service. The report on September activity shows active listings are nearly doubled from a year ago, pending sales declined more than 31%, but prices in most counties are still rising.

NWMLS brokers reported 7,504 closed sales during September, down 27% from a year ago when they notched 10,289 completed transactions.

The median price on last month’s sales across the 26 counties in the report rose about 5.1% from a year ago, increasing from $570,000 to $599,000. Prices are down slightly from the August median of $600,000 and from the year’s peak of $660,000 that was reported in May.

For the 26 counties in the MLS report there were 15,008 active listings at the end of September. That’s a jump of more than 93% from the year-ago total of 7,757 active listings. It is also a slight improvement (2.2%) from August when there were 14,683 active listings across the NWMLS market.

“Overall, September showed signs of a more traditional market with a natural slowdown of pending sales during this time of year,” observed John Deely, executive vice president of operations at Coldwell Banker Bain.

“Although the housing market experienced a major intensity adjustment from the spring, the percentage of homes going under contract within the first 30 days is strong and resilient,” stated J. Lennox Scott, chairman and CEO of John L. Scott Real Estate. “We are seeing approximately 80 percent of sales activity take place in the more affordable, mid-price range, and upper end price points,” he added.

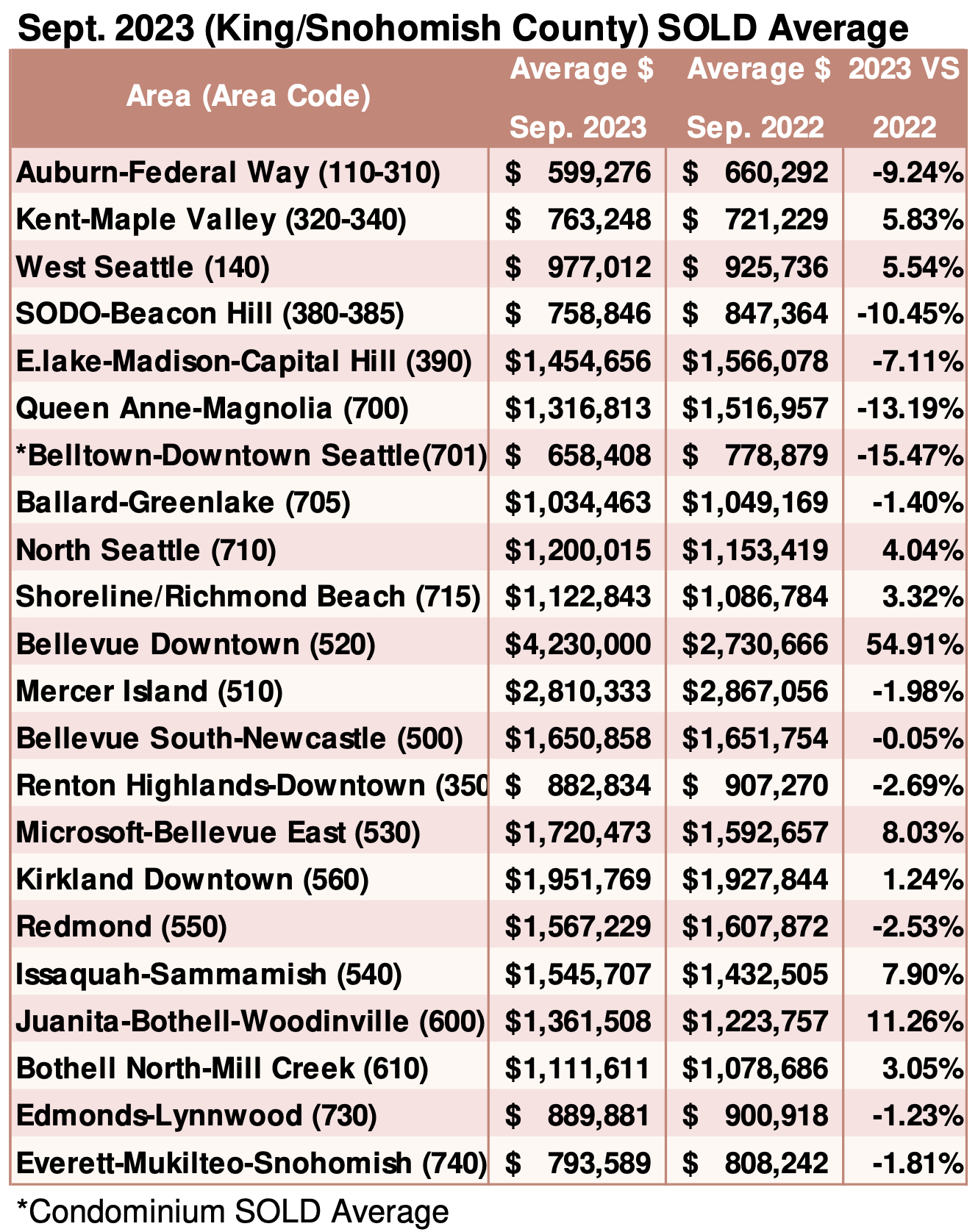

In Kirkland, which Money magazine just ranked third-best place to live in the U.S., the median price of a single family home that sold during September was $1,355,000. That marked a jump of about 8.6% from the year-ago sales price of $1,247,500.

Area-wide, the median price on last month’s single family homes (excluding condos) rose 4.75%, from $589,000 to $617,000. King County, where the median price on last month’s single family home sales was $875,000, had the most expensive homes. Within King County, single family homes on the Eastside fetched the highest price last month at $1.2 million. Homes in the southwest segment of the county sold for about half that amount ($590,000), but they had the highest YOY increase when comparing the six sub-areas tracked by the MLS. Countywide, single family home prices increased nearly 6%.

Condo prices surged 9.2% from a year ago, rising from $435,000 to $475,000.

Best value colleges in Washington state

SmartAsset, a company that offers financial advice, compiled the list using five metrics, including scholarships, median starting salary, tuition costs, living costs and student retention rates. University of Washington campuses in Seattle, Bothell and Tacoma rank the highest on the list, in that order. The Seattle campus had the highest median starting salary at $67,400 followed by the Bothell campus at $63,300. The Tacoma campus had a $61,700 median starting salary but a lower living cost than the other two UW campuses. Tuition across the three campuses was comparable at around $13,200 but scholarship amounts diverged. At $15,780 in average scholarships and grants, the Tacoma campus trailed the Seattle campus’ $16,355 average and the Bothell campus’ $17,093 average.

Breakouts! – Residential SOLD Average

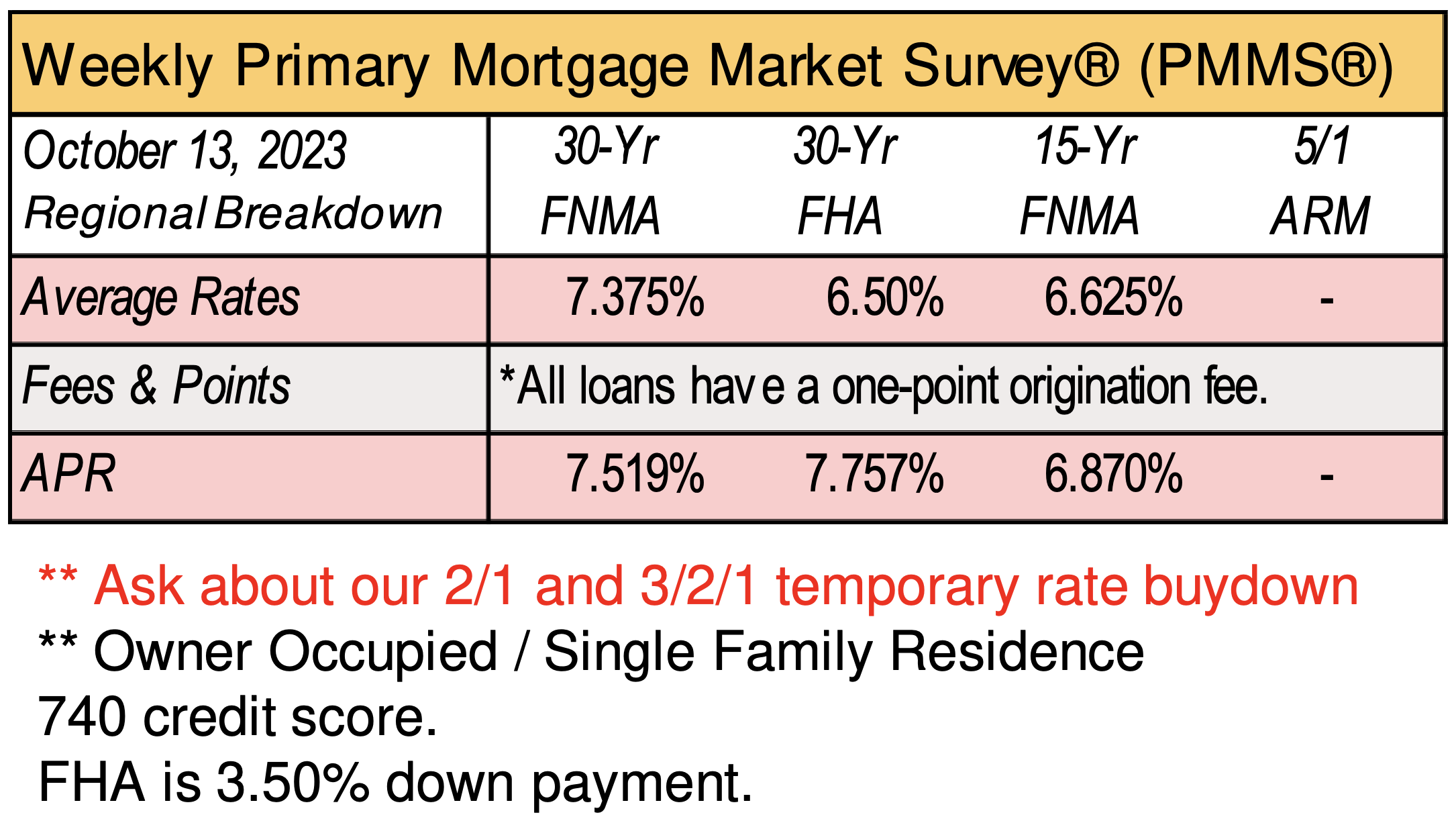

Pending home sales drops as mortgage rates rises

Pending home sales failed to add a third month onto the mini rally it staged in June and July. The National Association of Realtors® (NAR) said its Pending Home Sale Index (PHSI) declined 7.1 percent to 71.8 in August and is now down 18.7 percent from its August 2022 level.

Mortgage rates have been rising above 7 percent since August, which has diminished the pool of home buyers. Some would-be home buyers are taking a pause and readjusting their expectations about the location and type of home to better fit their budgets.”

Gina Brown (NMLS#115337)

Senior Loan Officer

Home Trust Financial NMLS1761573

425-766-5408

gina@gmgloan.com

www.loansbygina.com

![]()