Builder incentives contributing to sales resilience

With home prices growing twice as fast as incomes and mortgage rates at a 23-year high, few are surprised that housing activity has slowed. What may be surprising is sales of newly built homes are bucking the trend and showing remarkable resilience, according to reports from John Burns Research & Consulting (JBRC) and the National Association of Home Builders.

Sales of newly built, single family homes climbed 12.3% in September with the pace of new home sales surging 33.9% compared to the same month a year ago. Researchers attribute the gains to low existing home inventory.

In a recent report, researchers with John Burns Research & Consulting compared changes in income, home prices and mortgage payments from 2000

to September 2023. They found incomes increased 13%, home prices rose 28%, and mortgage payments spiked 89%.

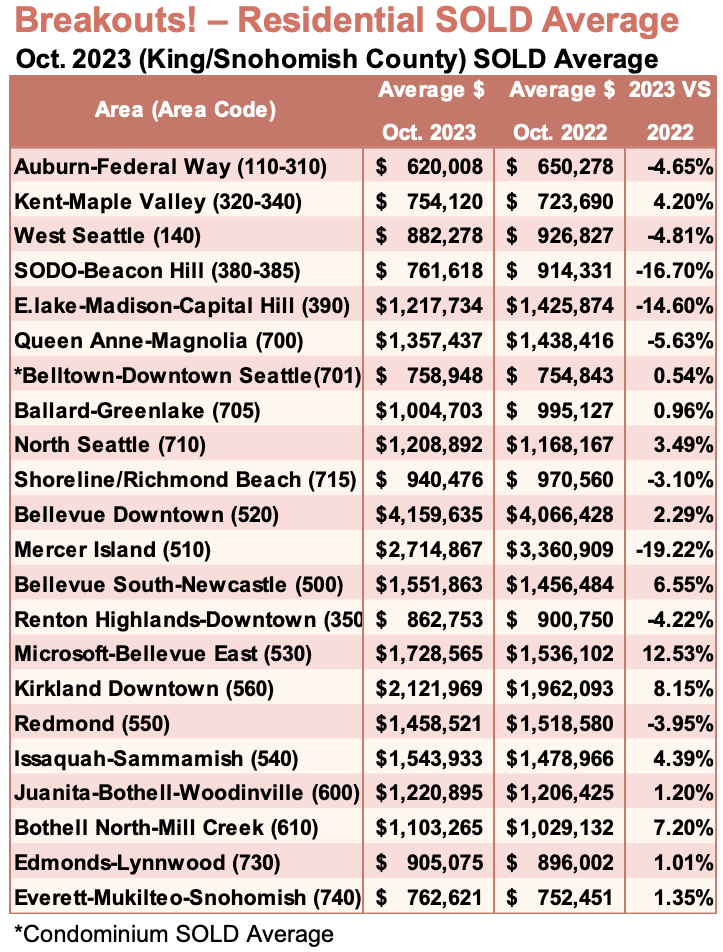

To attract and assist buyers who desire lower monthly payments, builders are offering mortgage rate buydowns.

A Burns survey of more than a hundred production builders revealed 60% are using rate buydowns, with 30% of them offering full-term 30-year buydowns. Builders told the researchers that temporary rate buydowns for the first 1-to-3 years of the mortgage do not solve the affordability problem.

High interest rates continue to influence

Inventory and growth

Further increases in interest rates continue to influence the expected seasonal slow-down during fall and winter months:

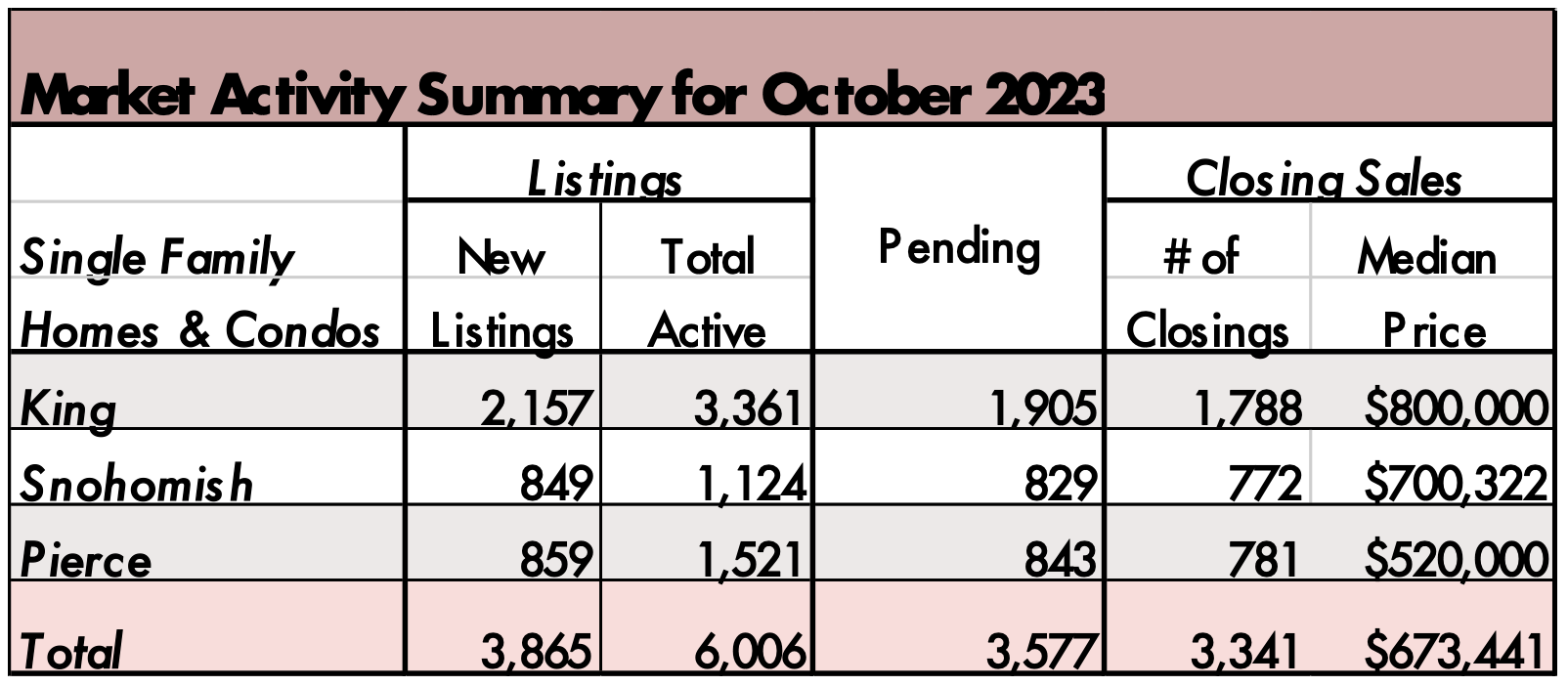

Most counties covered by NWMLS (24 of 26) saw a decrease in the number of homes sold with an average decline of 18%. The median price of

homes sold declined in 11 out of 26 counties, increased in 14, and remained virtually unchanged in one county relative to October 2022.

The three counties with the highest median priced homes sold were San Juan County ($1,150,000), King County ($800,000) and Snohomish County ($700,322); the three counties with the lowest median priced homes sold were Grays Harbor ($325,000), Ferry ($177,500), and Columbia ($110,000).

The volume of homes on the market has continued to decline throughout Washington with 20 out of 26 counties seeing a year over year decrease in the number of homes on the market. When compared to the same month last year, October 2023 experienced a 20% decrease in active property listings on the market in Washington counties covered by the NWMLS.

“With the 30-year fixed mortgage rate currently just shy of 8%, the purchasing power of prospective buyers has weakened further,” said Mason Virant, associate director of the Washington Center for Real Estate Research at The University of Washington. “This has led to a continued decline in year-over-year transaction volume with overall median prices increasing by only 1% across counties covered by the NWMLS.”

Breakouts! – Residential SOLD Average

New home construction

The U.S. South has turned into a hotbed of new-home construction over the past several years. However, as reported in Seattle Agent Magazine, several other cities around the country, including Seattle, are making significant strides in addressing housing shortages with new construction. MoveBuddha analyzed new construction data from the U.S. Census Bureau and the Department of Housing and Urban Development to determine the cities with the most new construction relative to population. Most of the top cities are in the southern part of the country with Myrtle Beach, South Carolina, ranking at No. 1 with approximately 10,688 new homes per every 100,000 residents. Seattle ranked No. 20, with approximately 733 new homes per 100,000 residents.

1 in 3 U.S. Homebuyers are paying all cash

- The share of homes bought in all cash hit its highest level since 2014 in September as elevated mortgage rates made paying in cash more attractive and priced out many buyers who would need loans.

- The number of all-cash sales was still down 11% from a year ago because the overall housing market has slowed so much, but that’s much smaller than the 23% drop in all home sales.

- Buyers are making bigger down payments to offset the cost of high mortgage rates: The typical U.S. buyer put down 16%, the highest percentage in nearly a year and a half.

Gina Brown (NMLS#115337)

Senior Loan Officer

Home Trust Financial NMLS1761573

425-766-5408

gina@gmgloan.com

www.loansbygina.com

![]()