Cautious market optimism as seasonal changes take shape

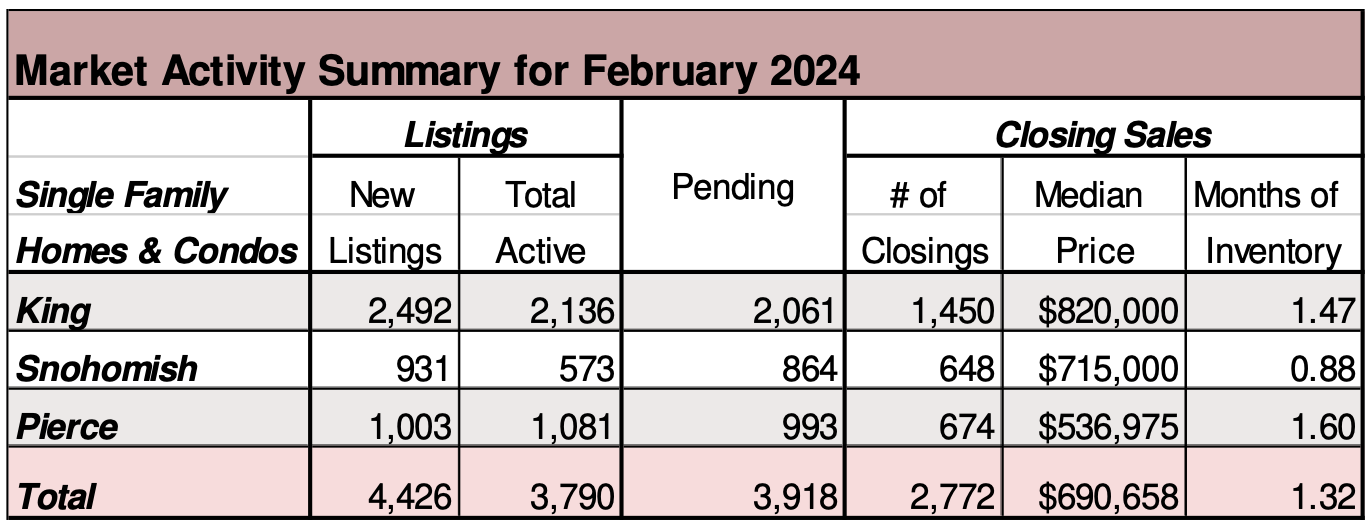

The real estate market has remained slow in accordance with typical seasonal patterns, with expected increases in activity as winter transitions into spring. Interest rates have increased by a quarter percent over the past month to 6.94%, continuing to inhibit prospective buyers’ purchasing power as well as prospective sellers’ willingness to give up low rate mortgages. For the Washington counties covered by NWMLS, February 2024 saw a nearly 2% decrease in closed sales transactions year-over-year, although median prices have continued to rise with a year-over-year increase of nearly 6%.

There were 7,495 active listings on the market at the end of February 2024, an increase of nearly 4% compared to February 2023 (7,234). The volume of homes on the market increased throughout Washington with 17 out of 26 counties seeing a year-over-year increase.

NWMLS brokers added 6,513 new listings to the database in February 2024, an increase of nearly 25% compared to February 2023, when 5,231 new listings were added. The number of new listings added in King County increased more than 33% year-over-year.

There were 5,945 total residential units & condo units under contract in February 2024, a decrease of 4.57% when compared to February 2023 (6,230).

Condominium sales continue to show strong growth throughout the NWMLS service areas, with 636 units sold in February 2024, which is a year-over-year increase of more than 9%. The median sale price of condominiums increased more than 15% year-over-year, from $430,000 at the end of February 2023 to $496,500 in February 2024.

Overall, the median price for residential homes and condominiums sold in February 2024 was $608,111, up nearly 6% when compared to February 2023 ($575,000). The median sales price increased year-over- year in 19 of the 26 counties, with the highest median sales prices in King ($820,000), Snohomish ($715,000), and San Juan ($671,000) counties.

Although seller reluctance has continued to stifle inventory levels, year-over-year inventory levels have improved slightly – an increase of 4% – relative to February 2023,” said Mason Virant, associate director of the Washington Center for Real Estate Research at The University of Washington. “Despite the year-over-year transaction volume decline of 2% over February 2023, low levels of for-sale inventory have led to increased competition amongst buyers, producing a nearly 6% year-over- year increase in median home prices across the Washington counties covered by NWMLS. – NWMLS

The truth about down payments

If you’re planning to buy your first home, saving up for all the costs involved can feel daunting, especially when it comes to the down payment. That might be because you’ve heard you need to save 20% of the home’s price to put down. Well, that isn’t necessarily the case.

As The Mortgage Reports says:

“Although putting down 20% to avoid mortgage insurance is wise if affordable, it’s a myth that this is always necessary. In fact, most people opt for a much lower down payment.”

According to the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. In fact, for all homebuyers today it’s only 15%. And it’s even lower for first- time homebuyers at just 8%. – Keeping Current Matters

Breakouts! – Residential SOLD Average

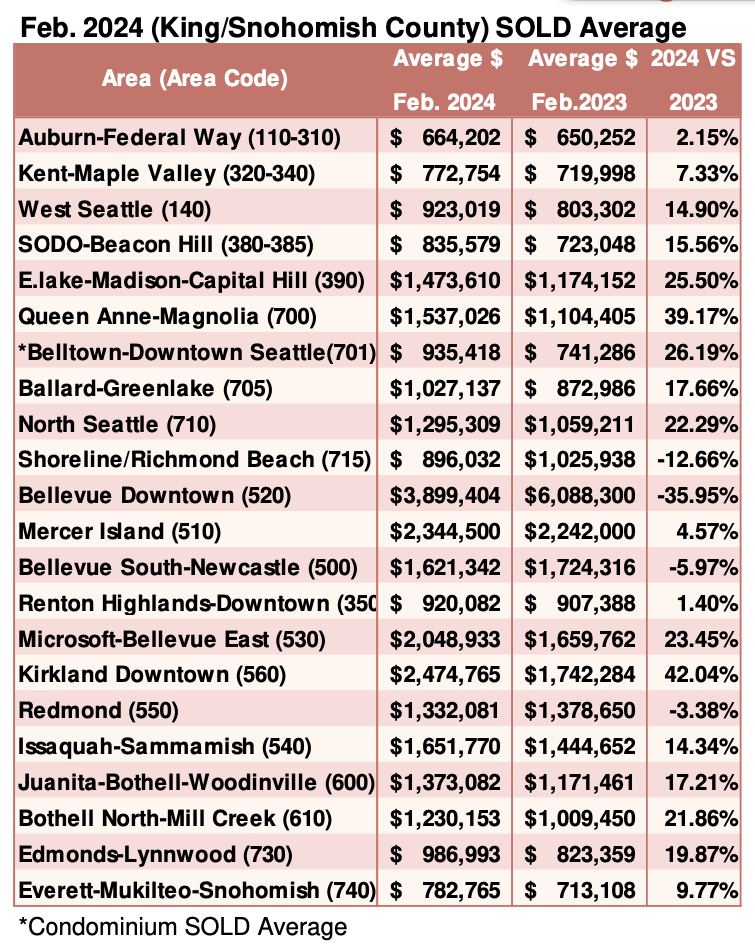

Will mortgage interest rates drop?

Thanks to consistently high inflation, the Federal Reserve has been forced to keep interest rates paused at a 23-year high for some time. That’s meant good things for savers, but for hopeful homebuyers, it’s drastically increased the cost of taking out a mortgage due to higher mortgage rates.

Fortunately, economic conditions change constantly, and with several more Fed meetings on the agenda for this year, the central bank has many chances to cut rates in the coming months. Should that happen, it would likely lead to lower mortgage rates as well. – Lending Tree

Gina Brown (NMLS#115337)

Senior Loan Officer

Home Trust Financial NMLS1761573

425-766-5408

gina@gmgloan.com

www.loansbygina.com

![]()