Northwest MLS brokers say bidding wars, escalating prices, and buyer fatigue are widespread

Brokers with Northwest Multiple Listing Service (NWMLS) added 10,562 new listings to inventory during March — the highest volume since September when they added 11,210 properties to the selection. Even so, demand continued to outstrip supply, keeping inventory depleted.

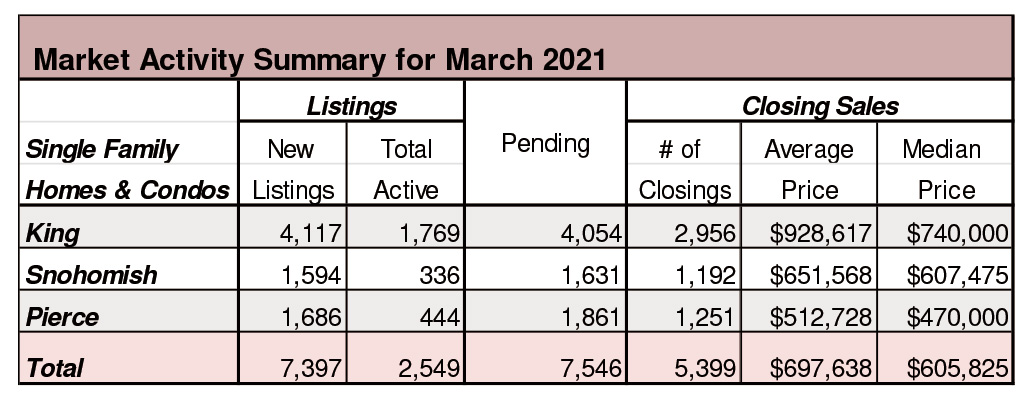

Brokers logged 10,863 pending sales last month. That volume of mutually accepted offers marked a 22.3% increase from a year ago and a 40.6% surge compared to February.

“There’s no April fooling when it comes to how hot the housing market is right now,” commented J. Lennox Scott, chairman and CEO of John L Scott Real Estate. “In King, Snohomish, Pierce and Kitsap counties, the current

spring market we’re seeing is one of the best on record.”

“The drop in the number of active listings between now and last year is extraordinary,” James Young, director of the Washington Center for Real Estate Research at the University of Washington exclaimed. NWMLS statistics show a 55.9% decline in total active listings, shrinking from 9,418 at the end of March 2020 to 4,153 at month end.

Median prices system-wide surged 19.5% compared to a year ago. The median price for the 7,803 sales that closed during March was $548,199; a year ago it was $458,900. Prices rose in every county served by NWMLS, with seven counties reporting YOY price hikes of 25% or more.

Last month’s median price on closed sales of single family homes and condos (combined) was up 7% from February’s figure of $512,000.

Excluding condos, the median price on single family homes rose nearly 21% from a year ago, from $470,000 to $567,250. Compared to the previous month (February), prices were up 10% OR more in seven counties (Cowlitz, Douglas, Jefferson, Ferry, Island, King, and Pacific).

Condominium prices rose 5.2% year-over-year on closed sales that increased 16% (from 1,015 closings a year ago to last month’s total of 1,179).

The volume of new listings (1,528) was similar to the year-ago total (1,455), while the number of active listings (total inventory) dropped 23% YOY.

Pending sales of condos surged nearly 43% from a year ago (from 1,101 to 1,574).

NWMLS director, Meredith Hansen, owner/designated broker at Keller Williams Greater Seattle, noted the Seattle area ranked second nationally in home price appreciation for the past 12 months. (Phoenix led all cities in the latest S&P CoreLogic Case-Shiller Indices.)

“If no new inventory came on the market, we are at 2.19 weeks of inventory, leading to bidding wars, escalating prices, and severe buyer fatigue,” Hansen remarked.

Washington is the best state in the nation

For the second year in a row, Washington has been ranked as the best state in the nation by U.S. News & World Report. “Washington‘s lowcarbon energy system and robust secondary education system continue to rank among the nation’s best, as does the state’s economy, the fastest growing in the nation,” the web-based news magazine reports. It’s the first time since the rankings began that the same state has been named No. 1 for two consecutive years. As in previous years, U.S. News ranked all 50 states based on data within 71 metrics across eight categories, such as education, health care and opportunity. But the Evergreen State also has its shortcomings, according to U.S. News.

These include high living and labor costs that stifle opportunity for the state’s residents. Unemployment also remains high, due to the effects of the pandemic on the economy.

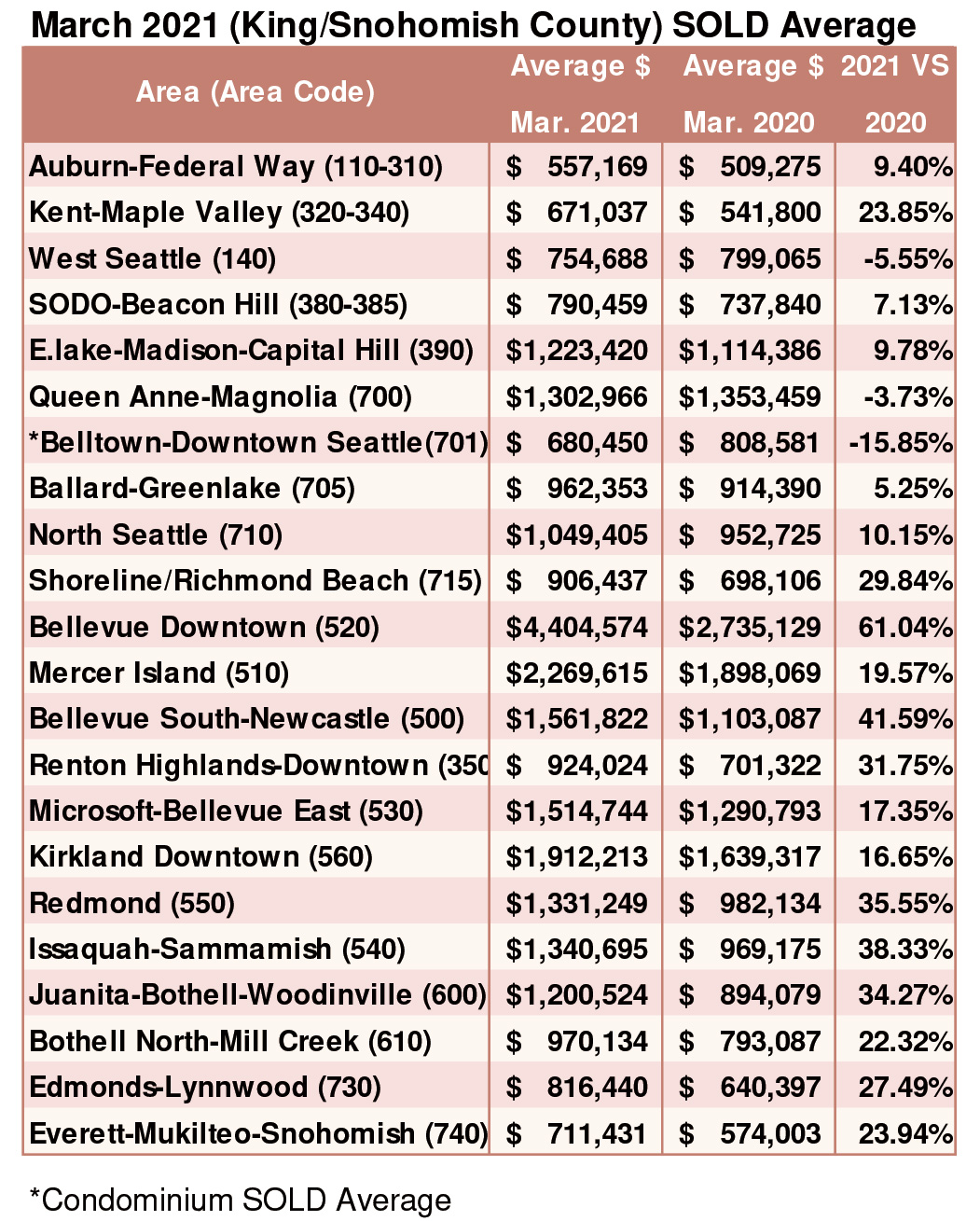

Breakouts! – Residential SOLD Average

People are finally starting to think about selling homes instead of buying them

Consumer attitudes perked up in March, sending the Fannie Mae Home Purchase Sentiment Index up 5.2 points compared to February.

The percentage of respondents who say it is a good time to buy a home rose to 53 percent from 48 percent and there was a 3 point decline in those who viewed the timing as bad.

Attitudes about selling a home increased even more. Sixty-one percent said it was a good time, up from 55 percent in February while the percentage who say it’s a bad time dropped from 35 percent to 28 percent.

Gina Brown (NMLS#115337)

Senior Loan Officer

425-766-5408

gina@gmgloan.com

www.loansbygina.com