“Extraordinary market conditions” sustain strong home sales around Washington state during holidays

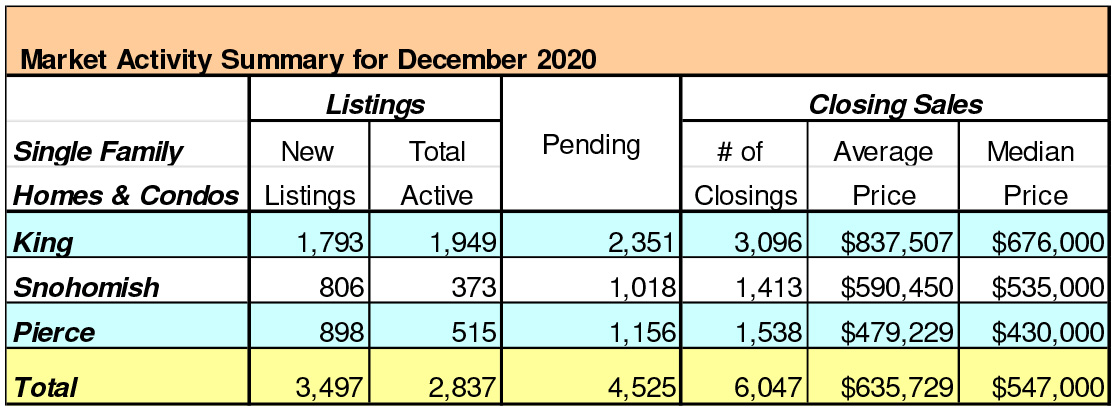

“Insatiable buyer demand” is keeping inventory scarce as house hunters try to outmaneuver and outbid each other, according to reports from Northwest Multiple Listing Service (NWMLS). Its statistical summary for December showed strong activity throughout the holiday season with double-digit increases in new listings, pending sales, closed sales, and prices.

Northwest MLS brokers added 5,260 new listings to inventory during December, a hefty 39.3% increase over the same month a year ago. Last month’s additions fell short of meeting demand as members reported 6,883 pending sales (mutually accepted offers). That number surpassed the year-ago volume by 940 transactions for an increase of 15.8%.

Pending sales were especially robust in several counties where year-overyear (YOY) gains of 25% or greater were notched, notably Grant (up 133%), Kittitas (up 55%) and Pacific (up nearly 43%).

“As more people are working from home, they are also purchasing properties further afield from Seattle,” observed James Young, director of the Washington Center for Real Estate Research at the University of Washington.

At month end, there were 4,732 total active listings system-wide in the MLS database, which encompasses 25 counties. That’s down 44% from a year ago when the selection included 8,469 listings. Measured by months of inventory, there is only about two weeks of supply (0.53 months) overall.

Home prices continue to rise. For the 9,008 sales of single family homes and condos that closed last month, prices jumped nearly 12.2% from a year ago, increasing from $435,000 to $488,000. Only three counties (Ferry, Okanogan, and San Juan) reported year-over-year price drops, while nearly all other counties had double-digit gains, according to the NWMLS report.

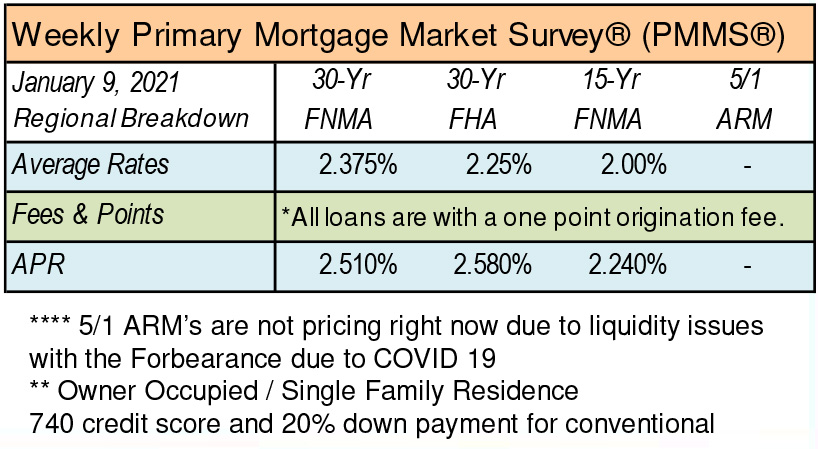

“Housing market activity is truly off the charts,” exclaimed J. Lennox Scott, chairman and CEO of John L. Scott Real Estate. He described activity for new listings going under contract as “frenzy-level,” fueled by low interest rates and a huge backlog of buyers.

“Now that the holiday season is over, local housing markets will see a surge of buyers entering the market in 2021,” Scott predicts. He also reported those who can work from home are moving to lifestyle/destination markets further outside city centers.

Windermere Chief Economist Matthew Gardner stated “As we move into 2021, I expect continued strong demand from buyers, but unfortunately, the likelihood that there will be any significant increase in inventory is slim. As a result, I believe prices will continue to rise, which is good news for sellers, but raises concerns about affordability. This, combined with modestly rising mortgage rates, could end up taking some steam out of the market but overall, I expect housing to continue being a very bright spot in the Puget Sound economy.”

Spanaway is the hottest real estate market

A new study by Redfin has concluded that six of the nation’s 10 most competitive real estate markets are in Western Washington, with five of them in the greater Tacoma area. And no area is hotter right now than Spanaway, where the report finds nearly 69% of homes sell above list price and are only on the market an average of five days — eight days fewer than last year, Redfin reports. Overall home prices in the area were up nearly 21% from last year and supply was down nearly a third. The town rated a 98 on Redfin’s 100-point scale determining which markets are most competitive. Close behind on the list are Lacey and Tacoma, both scoring a 96, where homes typically last just six days on the market.

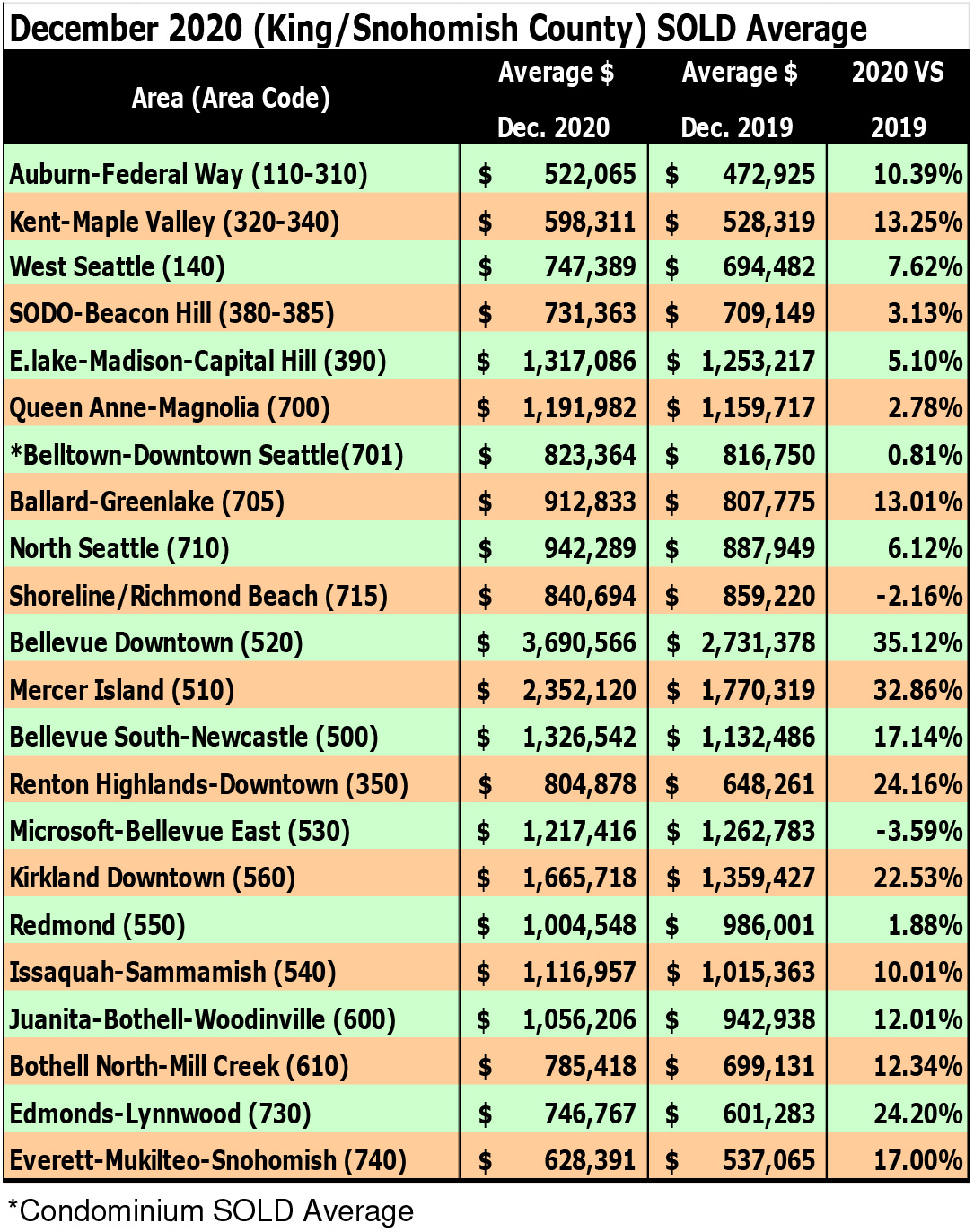

Breakouts! – Residential SOLD Average

Home ownership vs Renting

In most parts of the country owning a home is more affordable than renting one according to ATTOM Data Solutions’ 2021 Rental Affordability Report. The company looked at the median price of a three-bedroom home in 915 U.S. counties and the rent for a comparable home and found owning more affordable 572 or 63 percent of them.

Home-prices are rising faster than rents and wages in a majority of the country. Yet, home ownership is still more affordable, as amazingly low mortgage rates that dropped below 3 percent the cost of rising home prices in check,” said Todd Teta with ATTOM Data Solutions.

Gina Brown (NMLS#115337)

Senior Loan Officer

425-766-5408

gina@gmgloan.com

www.loansbygina.com