Mortgage rate increase throws curveball into market

Mortgage Rates Rise Despite Fed Rate Cuts, Impacting Housing Market

Despite hopes among potential home buyers and sellers, as well as economists’ predictions, the Federal Reserve Bank’s three interest rate cuts in 2024 have not led to reduced mortgage rates or a significant boost in the housing market. Instead, as of January 2, 2025, mortgage rates have risen to 6.91%, their highest level since July 2024.

“The 30-year mortgage interest rate was actually higher at the end of 2024 (6.85%) than at the end of 2023 (6.61%),” said Steven Bourassa, director of the Washington Center for Real Estate Research (WCRER) at the University of Washington. He anticipates that mortgage rates will continue to frustrate the market. “We may well be experiencing the pains of adjusting to a new normal, with persistent interest rates of 6% or higher.”

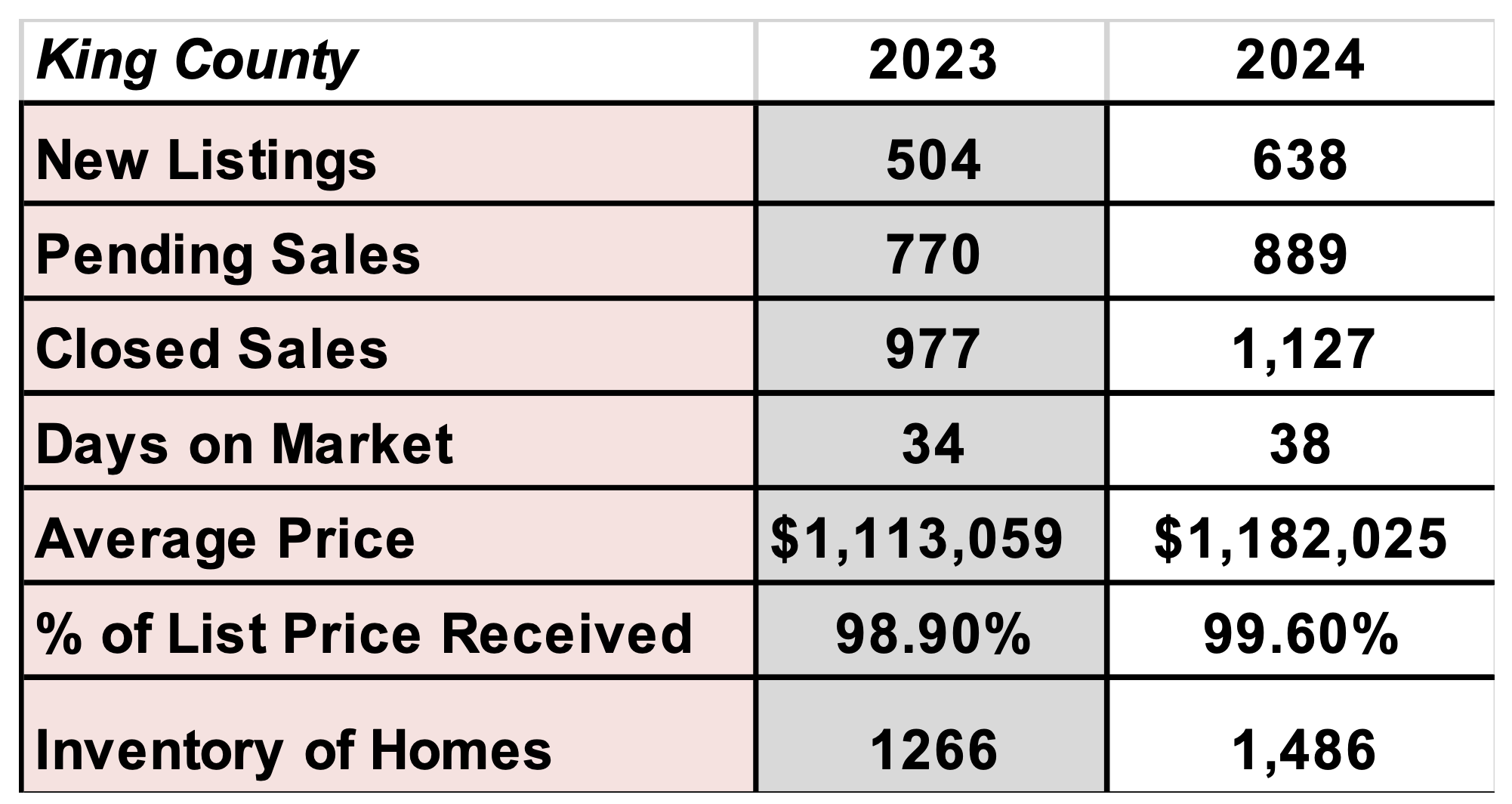

Rising rates have been accompanied by a 4.3% increase in home prices over the past year, further exacerbating affordability challenges. However, the market has shown some signs of increased activity. Active listings and sales transactions were up by 25% and 19.8%, respectively, in December 2024 compared to the previous year, suggesting that buyers and sellers may be adjusting to higher borrowing costs.

While affordability remains a significant concern, these trends point to a gradual adaptation to the evolving landscape of the housing market.

Source: NWMLS

Fed cuts were supposed to lower mortgage rates, but they’re back about 7%. Here’s why

To answer that, it’s good to remember that the Federal Reserve can influence mortgage rates, but it doesn’t set them. In a nutshell, the Fed sets short-term interest rates, but mortgage rates mainly follow a different number: the yield on 10-year Treasury bonds.

That yield has risen sharply in recent months due to several factors:

- Sticky inflation – Since inflation remains persistent, the Fed may be more cautious about cutting rates further.

- A strong economy – With economic growth holding steady, the Fed can afford to delay rate cuts, as a strong economy can also contribute to higher inflation.

It’s also worth remembering that while 7% may feel high—especially compared to the historic low of 2.65% in early 2021—these rates are not unusually high in a broader historical context.

In fact, mortgage rates frequently hovered around 6% or 7% in the 1990s and early 2000s and even reached double digits in the 1970s and 1980s.

Source: NPR

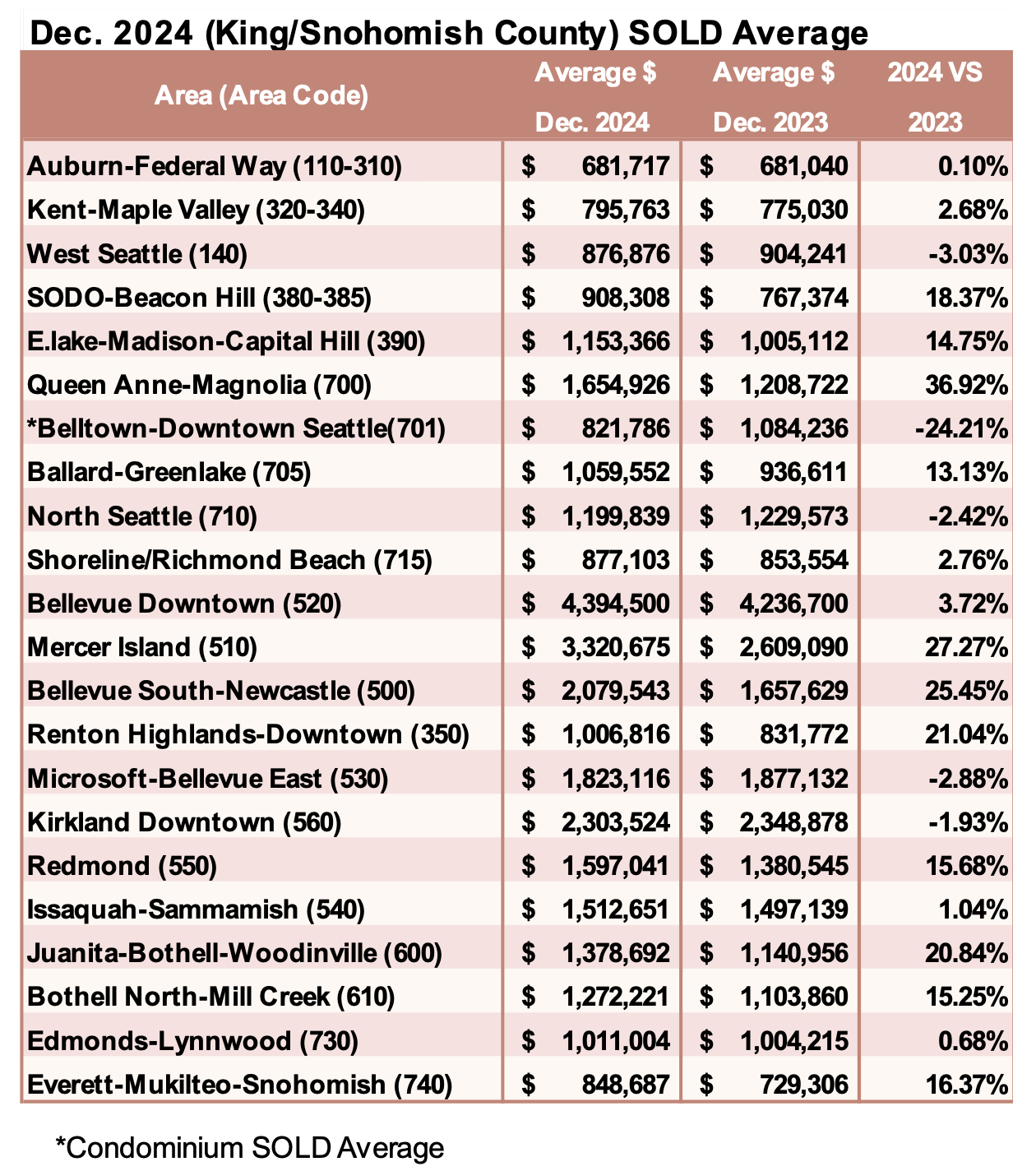

Breakouts! – Residential SOLD Average

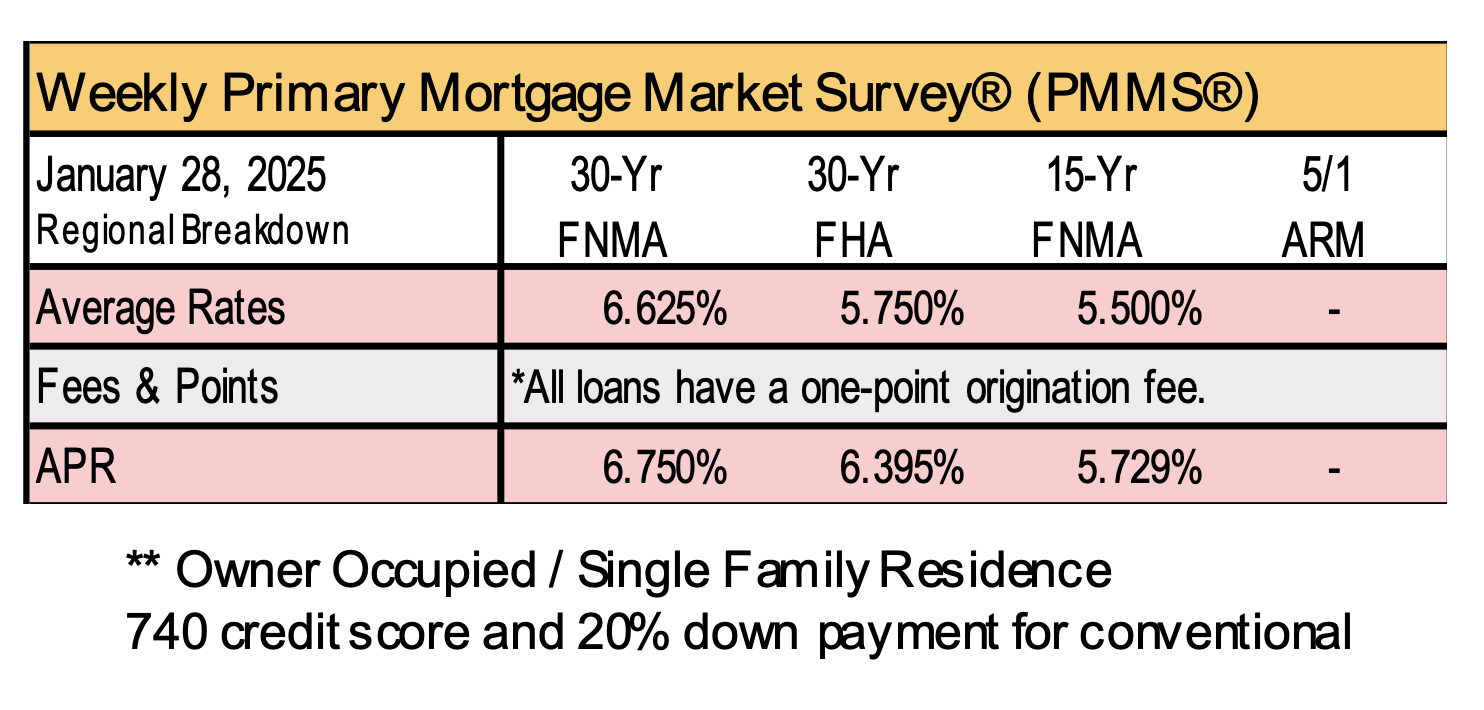

Today’s Mortgage Rates: Is This the New Normal for Mortgage Rates?

Federal Reserve policymakers have acknowledged that while they still believe inflation will eventually reach their 2% target, it may take longer than expected.

In response, forecasters have revised their mortgage rate predictions, now expecting rates to remain elevated throughout 2025.

According to Fannie Mae, 30-year mortgage rates are projected to end 2025 at 6.5%, only slightly lower than current levels. -Business Insider

New Conforming Loan Amount Limits for 2025:

KING/PIERCE/SNOHOMISH COUNTY $806,500.00 High Balance $977,500.00

Gina Brown (NMLS# 115337)

Senior Loan Officer

🏢 C2 Financial (NMLS# 135622)

425-766-5408

ginabrown@C2financial.com

www.loansbygina.com