Increased inventory leads the way to market stabilization

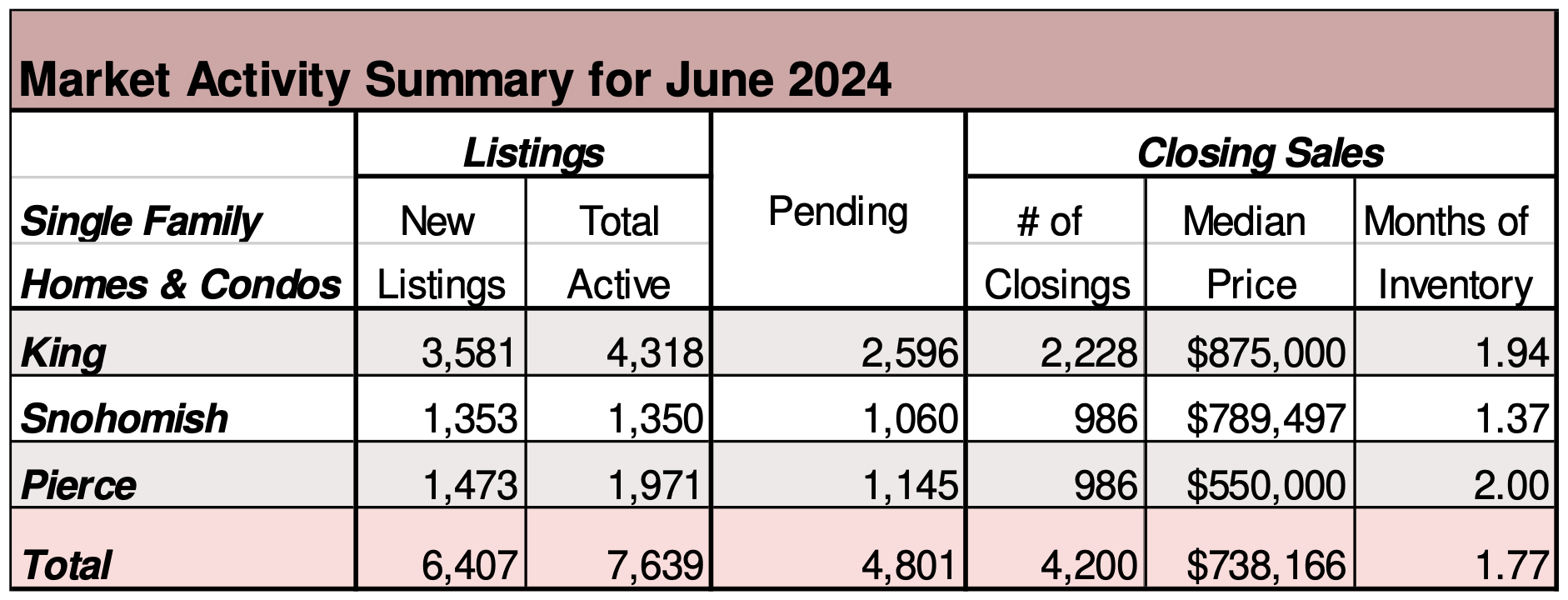

Washington counties covered by NWMLS continue to follow seasonal trends with respect to inventory levels yet divert from typical patterns with regard to transaction volume.

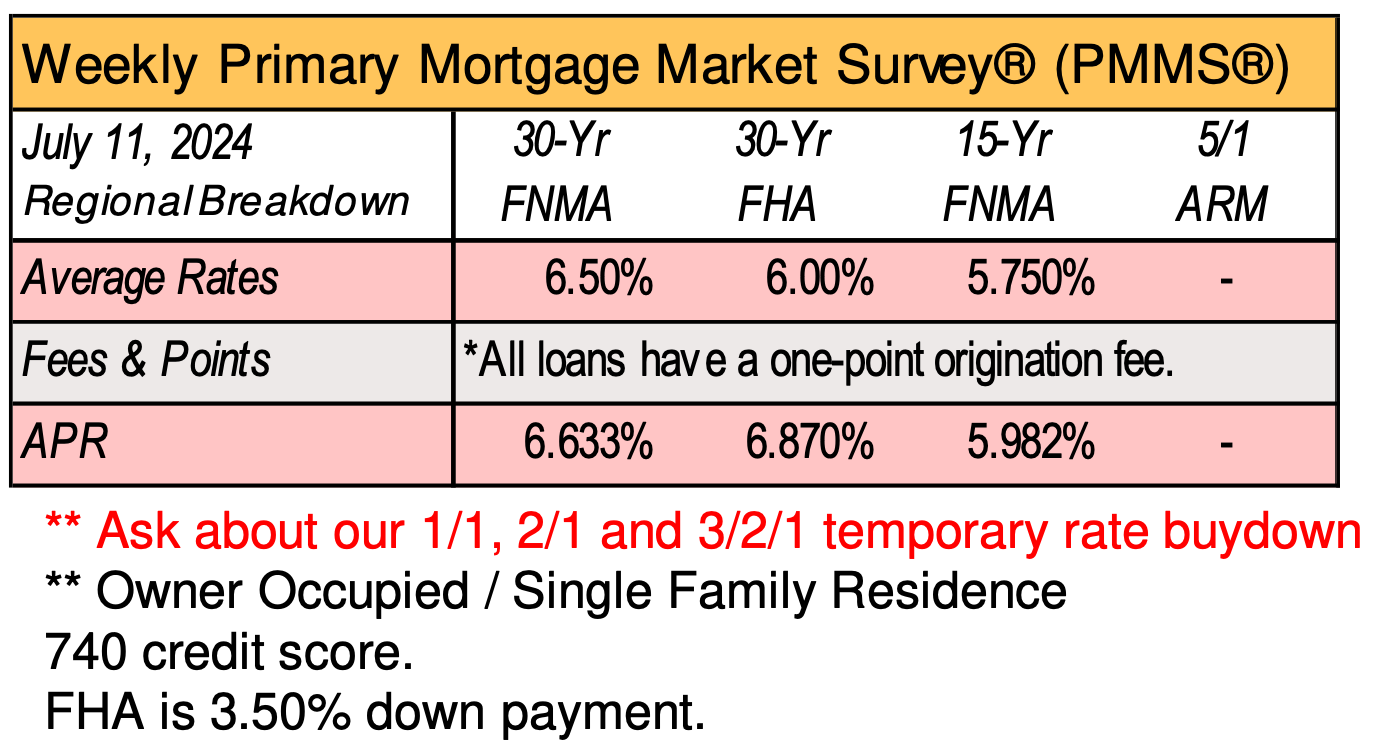

With the 30-year fixed mortgage rate currently at 6.86% (as of late June 2024), the purchasing power of prospective buyers remains constrained relative to a few years ago.

There was a 35.7% increase in total number of properties listed for sale, with 14,393 active listings on the market at the end of June 2024, compared to 10,607 at the end of June 2023. The number of homes for sale increased throughout Washington, with 22 out of 26 counties seeing a double-digit year-over-year increase.

A balanced market is considered to be 4 to 6 months by most industry experts. At the current rate of sales, it would take a little over two months (2.17) to sell every home that is active in the NWMLS inventory.

Year-over-year closed sales transactions decreased by 3.1%, signaling that despite recent decreases in interest rates, buyers may be slightly less active when compared to June 2023. Higher levels of for-sale inventory should have an impact in stabilizing price levels over the summer months.

Overall, the median price for residential homes and condominiums sold in June 2024 was $650,000, an increase of 4% when compared to June 2023 ($625,000). The three counties with the highest median sale prices were San Juan ($950,000), King ($875,000), and Snohomish ($789,497), and the three counties with the lowest median sale prices were Columbia ($274,000), Adams ($236,000). and Ferry ($175,000).

CoreLogic Chief Economist Selma Hepp says the Pacific Northwest housing market is moving slowly toward normalization. “While increased inventory of homes on the market this spring offered potential home buyers more options, elevated mortgage rates put affordability at the forefront of housing market concerns,” Hepp said.

“Home prices did heat up again this spring in the Seattle metro area, putting the region among the strongest appreciating markets across the country. More inventory will slow pressure on home prices over time.” – NWMLS

Seattle City Council greenlights office-to- housing conversions, eyeing up to 2K new units

SEATTLE — Developers now have the green light to convert vacant office space into housing in downtown Seattle.

Under a new law, there could soon be as many as 2,000 new housing units, according to city estimates.

The city council signed off on an amendment to the land use code to let developers convert commercial, high-rise, and other buildings sitting empty in downtown into residential spaces.

“The units would be a mix of affordability levels with some units affordable to households with moderate incomes in the 80% – 100% of Area Median Income (AMI) range. We do expect that other units such as upper floor units with views, or direct access to amenities would serve higher income households,” the city’s Office of Planning and Community Development stated in an email.

– KOMO News

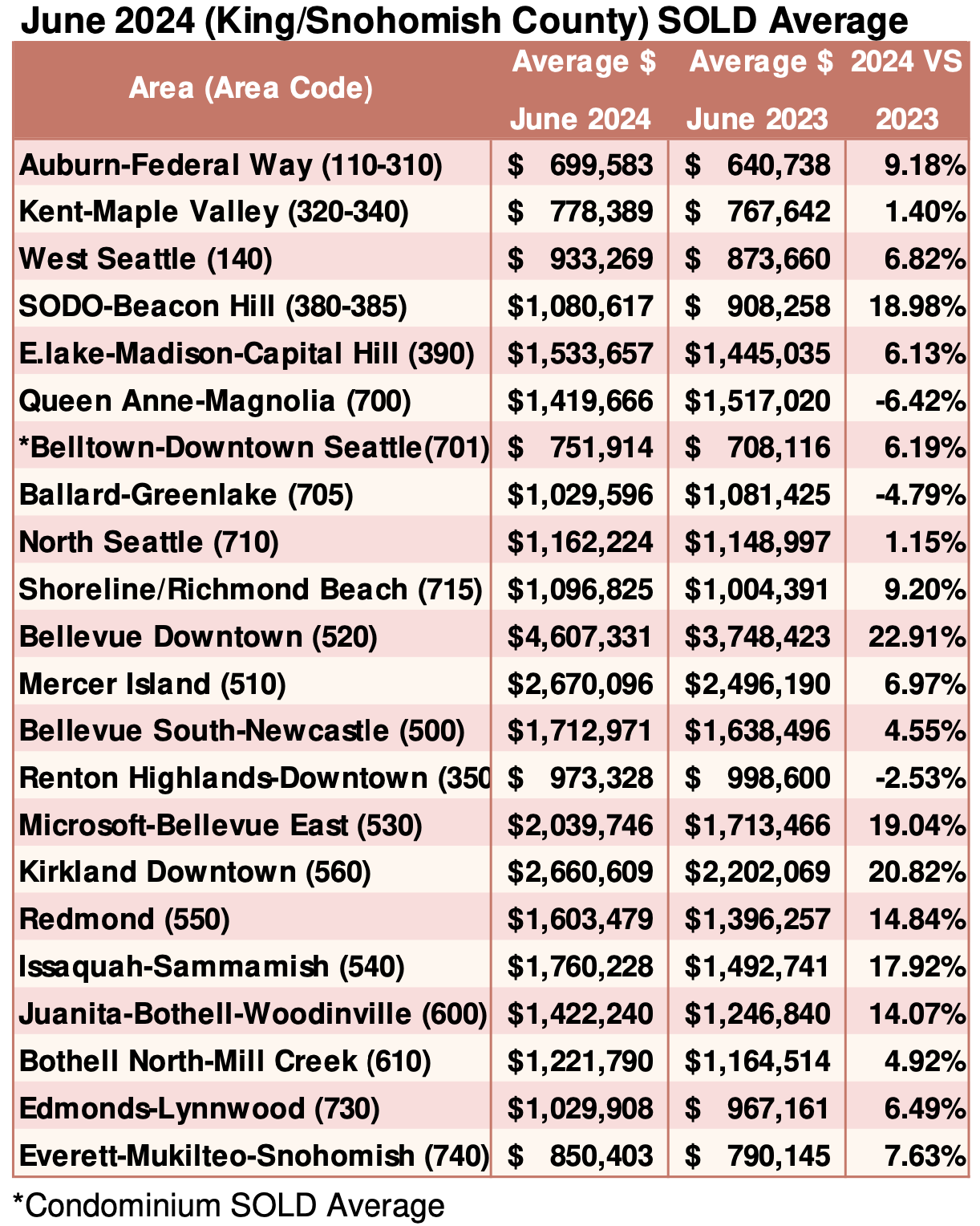

Breakouts! – Residential SOLD Average

What will happen to home prices if inflation stays high?

The unemployment rate remains low at 3.9%, according to the Bureau of Labor Statistics. On the flip side, inflation is at 3.50%

Because of this, some homebuyers are finding it more difficult to afford a home since the average 30-year mortgage rates are over 7%.

Today, home prices are increasing in part because there is relatively little listed inventory, which has greatly benefitted new home builders.

The most significant price increases will happen again if and when mortgage rates come back down and millions more homebuyers come off the sidelines and back into the market.

– Money Watch – quotes taken from article written by Jerry Brown

Gina Brown (NMLS#115337)

Senior Loan Officer

Home Trust Financial NMLS1761573

425-766-5408

gina@gmgloan.com

www.loansbygina.com

![]()