Market activity increases despite “constrained” mortgage rate impacts

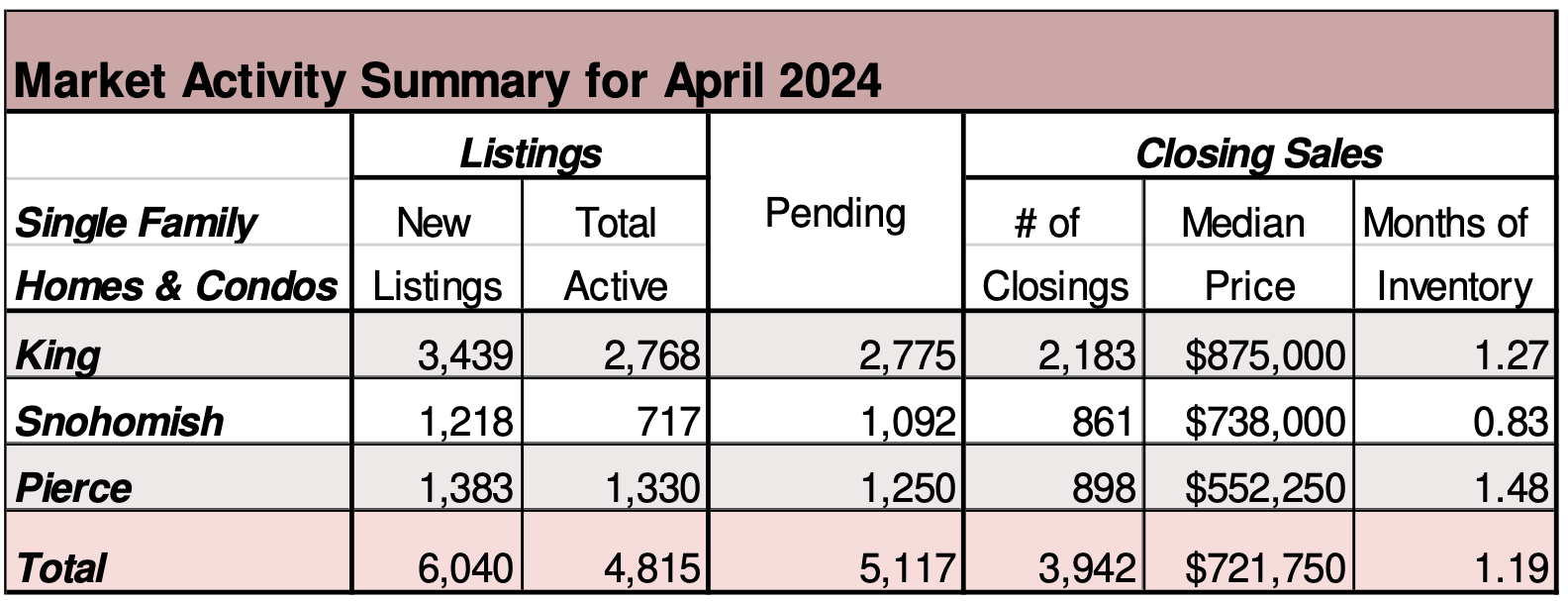

The real estate market has begun to pick up consistent with typical seasonal patterns, with further increases in activity expected over the next few months as we transition from spring to summer. Interest rates have increased by 0.38 percentage points over the past month to 7.17%, continuing to constrain prospective buyers’ purchasing power and prospective sellers’ willingness to give up low interest rate mortgages. Nevertheless, for the 26 counties covered by NWMLS, April 2024 saw a nearly 10% increase in the number of closed sales year-over-year and an almost 8% increase in median sales prices year-over-year, signaling some market optimism.

There were 9,813 active listings on the market at the end of April 2024, an increase nearly 21% when compared to April 2023 (8,114). The number of homes on the market increased throughout Washington with 23 out of 26 counties seeing a year-over-year increase.

There were 7,792 total residential units & condo units under contract in April 2024, an increase of 9.2% when compared to April 2023 (7,137).

A balanced market is considered to be 4 to 6 months by most industry experts. At the current rate of sales, it would take less than two months to sell every home that is active in the NWMLS inventory.

Overall, the median price for residential homes and condominiums sold in April 2024 was $651,000, up 7.9% when compared to April 2023 ($603,250). The median sales price increased in 23 out of 26 counties. The three counties with the highest median sale prices were San Juan ($1,055,000), King ($875,000) and Snohomish ($738,000). The three counties with the lowest median sale prices were Grant ($340,000), Adams ($331,500) and Okanogan ($317,000).

Condominium sales saw significant growth in NWMLS service areas, with 858 units sold in April 2024, a year-over-year increase of 15.6%. The median sale price of condominiums increased 11.5% year-over-year, from $465,000 in April 2023 to $518,538 in April 2024.

“Despite interest rates increasing back into the low 7% range, year- over-year inventory levels have improved dramatically relative to April 2023,” said Mason Virant, associate director of the Washington Center for Real Estate Research at The University of Washington. “It may take 4 to 6 months to be realized, but higher levels of for-sale inventory should soon have an impact on stabilizing price levels.”

– NWMLS

Seattle-area Housing market picks up, but buyers feel the squeeze

“Mortgage rates averaged around 7% throughout April, increasing a bit as the month wore on. While some industry observers say home shoppers are getting used to this new reality, high monthly mortgage payments are keeping some would-be buyers out of the market entirely.

Even as high mortgage rates dampen demand, a “rising tide” of millennials and other young people are looking for homes in marketsacross the country, including the Seattle area, said Wells Fargo senior economist Charlie Dougherty. Those buyers are “very price sensitive, but they also are getting married and having kids and looking to purchase a home,” Dougherty said.

The size of that group rivals baby boomers at their peak in the 1980s, and their push toward homeownership is driving up demand and home prices nationwide, “making the affordability crisis even worse,” Dougherty said.”

– Seattle Times

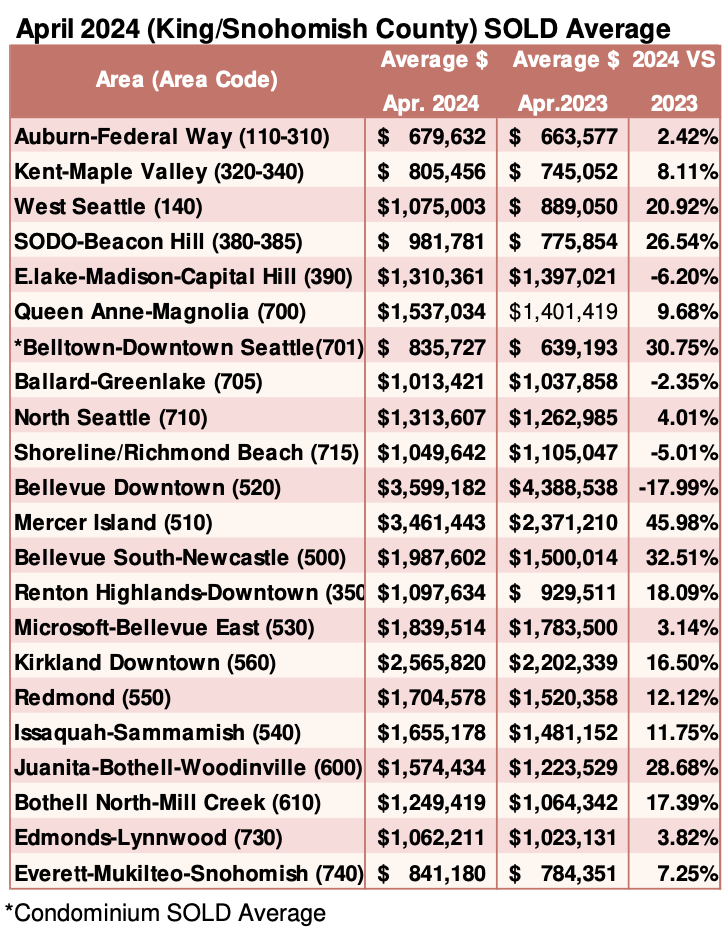

Breakouts! – Residential SOLD Average

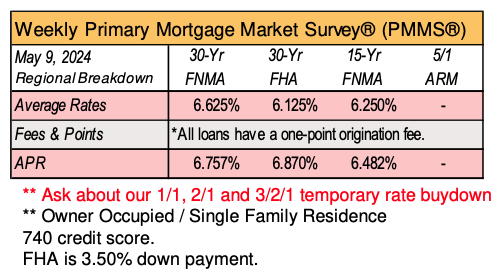

Preparing for a mortgage?

Here are 10 essential steps to get started: Check your credit report, dispute inaccuracies, research loans and rates thoroughly, and be realistic about what you can afford. Understanding lenders’ criteria and financing options is key to securing the best terms. Let’s work together to navigate the process and find the perfect mortgage for your needs. Reach out today to understand your mortgage options. I have many types of loans to help your dream of homeownership!

– Gina Brown

Gina Brown (NMLS#115337)

Senior Loan Officer

Home Trust Financial NMLS1761573

425-766-5408

gina@gmgloan.com

www.loansbygina.com

![]()