Unsettled mortgage rates prolong uncertainty in the market

Closed sales increased by over 11% month-over-month, driven by a brief downturn in mortgage rates and a boost in buyer confidence amid hopes for continued rate declines. However, mortgage rates unexpectedly rose again from 6.08% at the end of September to 6.72% at the end of October. This increase correlates to economic data including strong job growth numbers but presents challenges for hopeful buyers. Meanwhile, home prices increased by 2.4% month-over-month on average, further dampening optimism.

“The only thing that seems certain about this market is that houses are not becoming more affordable, due to the ongoing combination of high interest rates and rising prices,” said Steven Bourassa, director of the Washington Center for Real Estate Research (WCRER) at the University of Washington.

While the total number of properties listed for sale declined by about 6% when compared to last month, there was a 29.8% increase when compared to the same month last year, with 14,795 active listings on the market at the end of October 2024 compared to 11,403 at the end of October 2023.

The number of homes for sale increased throughout the NWMLS coverage area, with 23 out of 26 counties seeing a double-digit year-over- year increase. The counties with highest increases in active inventory for sale were Grant (+54.6%), Clark (+49.7%), Pacific (+48%), Clallam (+42.5%), Chelan (+40.9%), Lewis (+35.6%), and King (+35.4%).

There were 7,199 total residential units & condo units under contract in October 2024, an increase of 26.7% when compared to October 2023 (5,684).

A balanced market is considered to be 4 to 6 months by most industry experts. At the current rate of sales, it would take less than two and a half months (2.28) to sell every home that is active in the NWMLS inventory. Snohomish county has the lowest months of inventory in October 2024 which is 1.53 months.

Overall, the median price for residential homes and condominiums sold in October 2024 was $650,000, an increase of nearly 8% when compared to October 2023 ($602,000). When compared to last month, the median price increased 2.4% from $635,000 in September 2024.

– NWMLS

First-time homebuyers are older than ever before, National Association of Realtors survey finds

First-time homebuyers are now the oldest on record, based on findings in a recent survey.

The median age of 38 years old for new homebuyers is up from 35 years old last year and represents an increase from the 1980s when first-time homebuyers were in their late 20s, the National Association of Realtors’ (NAR) annual survey of buyers and sellers noted.

According to the survey, the ages of first-time and repeat homebuyers reached an all-time high with the median buyer age peaking at 56 years old, up 49 in 2023. The age of repeat homebuyers also jumped to 61 years old, which is up from 58 years old last year.

– FOX13 Seattle

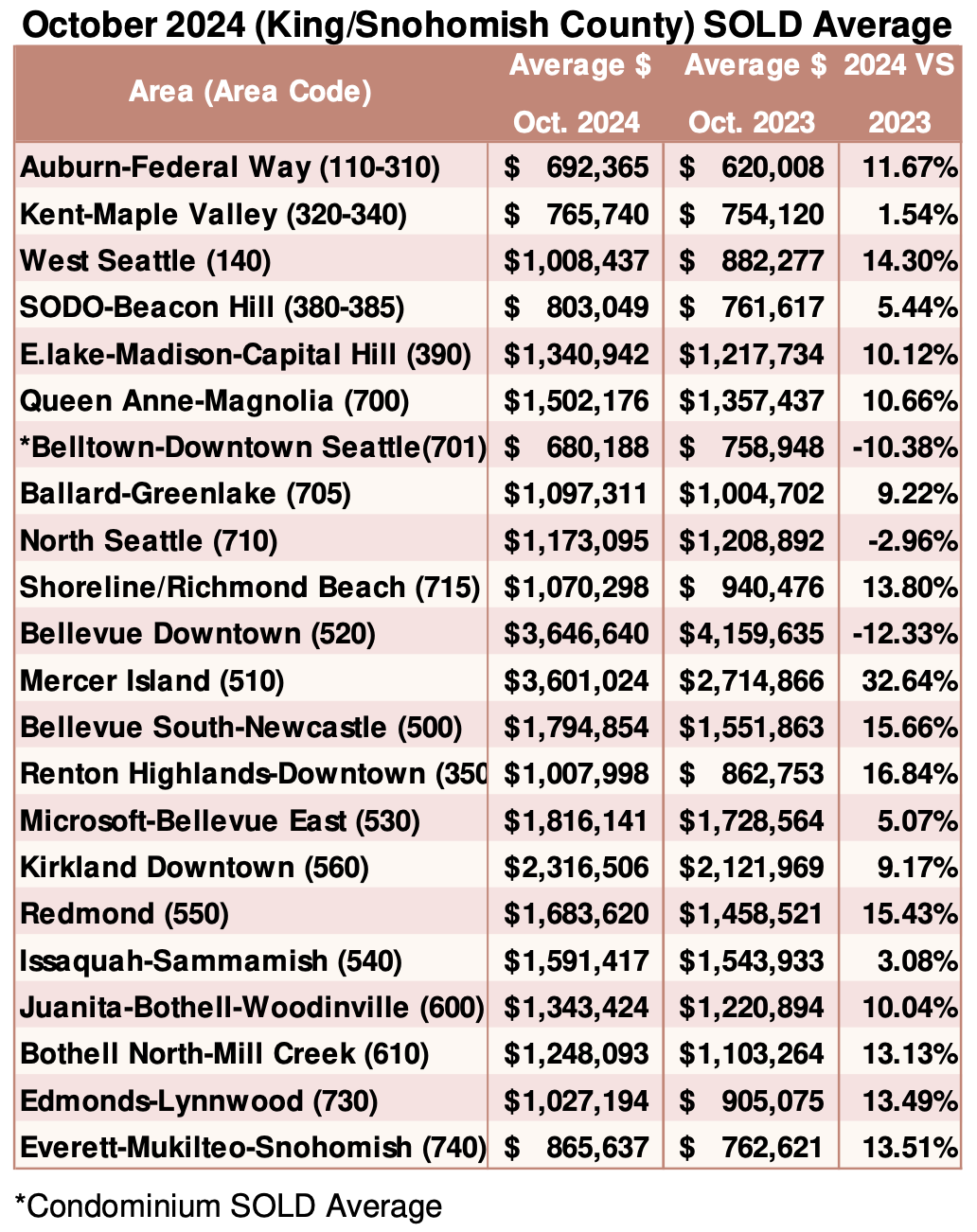

Breakouts! – Residential SOLD Average

Housing confidence inches higher amid record-high optimism toward mortgage rates

As expected, the Federal Reserve trimmed another 25 basis points from its benchmark interest rate in November, bringing it to a target range of 4.5%- 4.75%. The reduction, approved unanimously by the Fed’s policy-setting Federal Open Market Committee (FOMC), was the second straight rate cut from the Fed following September’s long-awaited 50-basis point cut. The statement released by the FOMC on Thursday after its November meeting was little changed from the one it released in September, noting that “labor market conditions have generally eased” and “inflation has made progress toward the committee’s 2% objective but remains somewhat elevated.”

– Arnie Aurellono, Scotsman Guide

Gina Brown (NMLS#115337)

Senior Loan Officer

Home Trust Financial NMLS1761573

425-766-5408

gina@gmgloan.com

www.loansbygina.com

![]()