Lowered mortgage rates provide boost but affordability remains elusive

The further reduction of interest rates in September by the Federal Reserve provided a positive end-of-the-summer boost to the market. Double-digit increases in active and new listings and single-digit increases in median home prices demonstrated a tentative balance between the ongoing seller’s market and newfound buyer confidence.

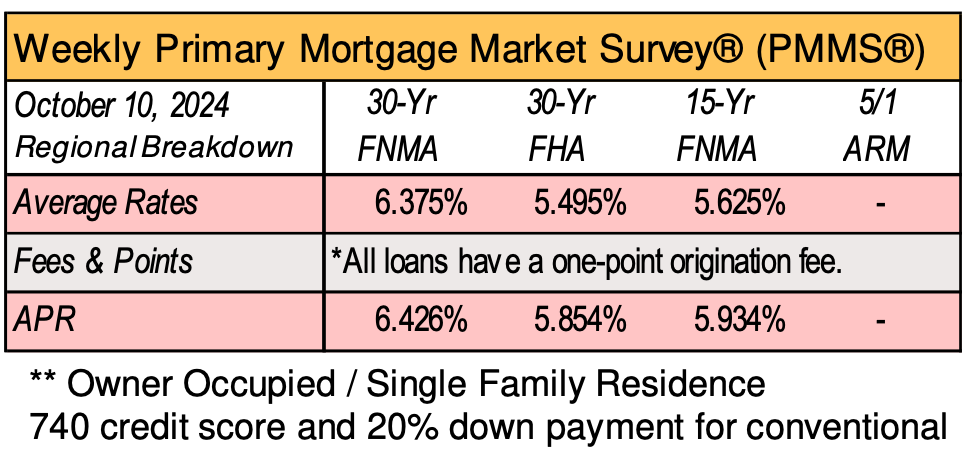

However, experts caution that without deeper cuts to interest rates, housing affordability will remain out of reach for many would-be buyers. “Interest rates remain over double what they were just three years ago (6.08% at the end of September versus 3.01% at the same time in 2021 for 30-year fixed rate mortgages). This continues to have a major impact on affordability,” said Steven Bourassa, director of the Washington Center for Real Estate Research (WCRER) at the University of Washington. “It seems unlikely that the volume of transactions will pick up substantially without some significant improvement in affordability.”

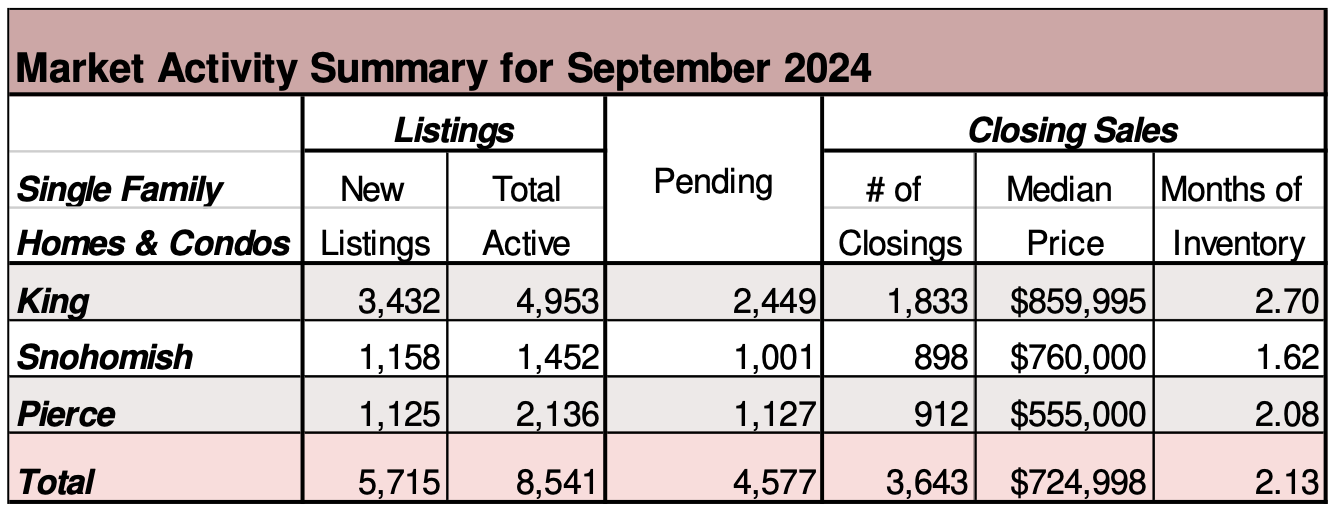

The number of homes for sale increased throughout the NWMLS coverage area, with 22 out of 26 counties seeing a double-digit year-over- year increase.

There was a 31.4% increase in the total number of properties listed for sale, with 15,748 active listings on the market at the end of September 2024, compared to 11,983 at the end of September 2023.

NWMLS brokers added 8,508 new listings to the database in September 2024, an increase of 12.7% compared to September 2023 (7,551).

There were 7,165 total residential units & condo units under contract in September 2024, an increase of 13.5% when compared to September 2023 (6,312). When compared to last month, pending sales decreased by 362 transactions (-4.8%), with 7,527 pending sales in August 2024.

The number of closed sales increased by 1.9% year-over-year (5,828 in September 2024) compared to 5,722 in September 2023.

Overall, the median price for residential homes and condominiums sold in September 2024 was $635,000, an increase of 5.8% when compared to September 2023 ($600,000). The three counties with the highest median sale prices were King ($859,995), San Juan ($829,000), and Snohomish ($760,000).

– NWMLS

ZIP code north of Seattle has nation’s hottest housing market, data shows

MOUNTLAKE TERRACE, Wash. – Homes are selling faster in one Snohomish County ZIP code than anywhere else in the United States, new data shows.

98043 in Mountlake Terrace saw homes last on the market for just 27 days in Q2, according to The Business Journals’ analysis of data from Black Knight Inc. on the hottest housing markets in the country.

Alameda County in California was second on the list, with homes selling in 29 days on average in Q2.

Three King County ZIP codes — 98014, 98034 and 98155 — also ranked in the top 10 of markets where houses get sold the quickest. 98014 is in Carnation, 98034 is in Kirkland and 98155 is in north Seattle.

The Business Journals also found earlier this year that a ZIP code across the water from Seattle is the nation’s most expensive outside of the state of California. The typical home value in 98039, or Medina, is over $4.4 million.

– King 5 News

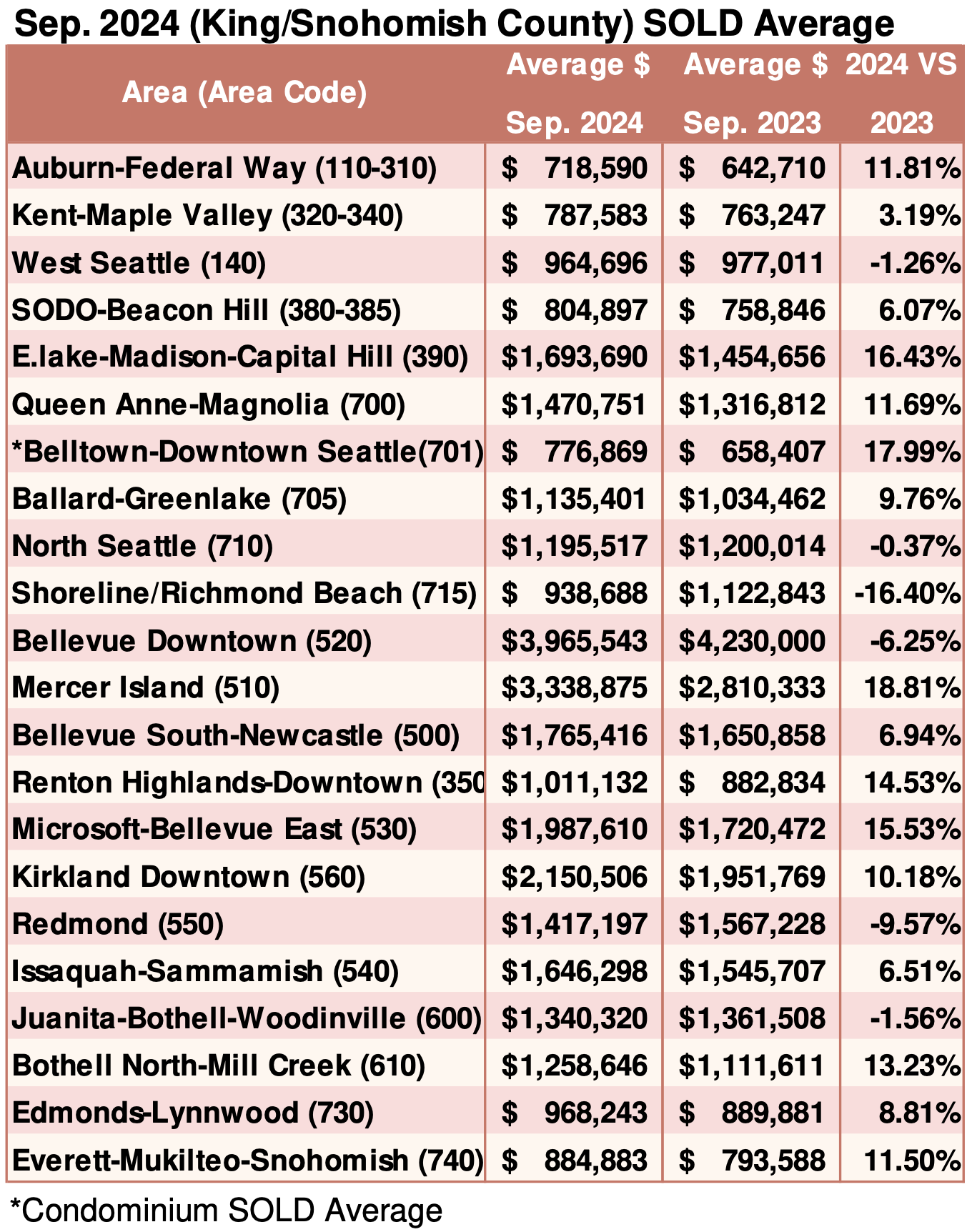

Breakouts! – Residential SOLD Average

Housing confidence inches higher amid record-high optimism toward mortgage rates

Renter Sentiment Also Up, Including Share Expecting Rates to Fall.

The Fannie Mae (FNMA/OTCQB) Home Purchase Sentiment

Index® (HPSI) increased 1.8 points in September to 73.9, its highest level in more than two years, as consumers reported survey-high optimism that mortgage rates will decline over the next 12 months. In September, a record 42% of consumers said they expect mortgage rates to decline, up from 39% the month prior and 24% in June.

– Fannie Mae

Gina Brown (NMLS#115337)

Senior Loan Officer

Home Trust Financial NMLS1761573

425-766-5408

gina@gmgloan.com

www.loansbygina.com

![]()