Northwest MSL brokers say August housing activity follows patterns of seasonal slowing

August typically brings a dip in housing activity and this year was no different, according to representatives from Northwest Multiple Listing Service when commenting on newly-released statistics. Figures comparing July to August show month-to-month drops in new listings, total inventory, pending sales, close sales, and median prices.

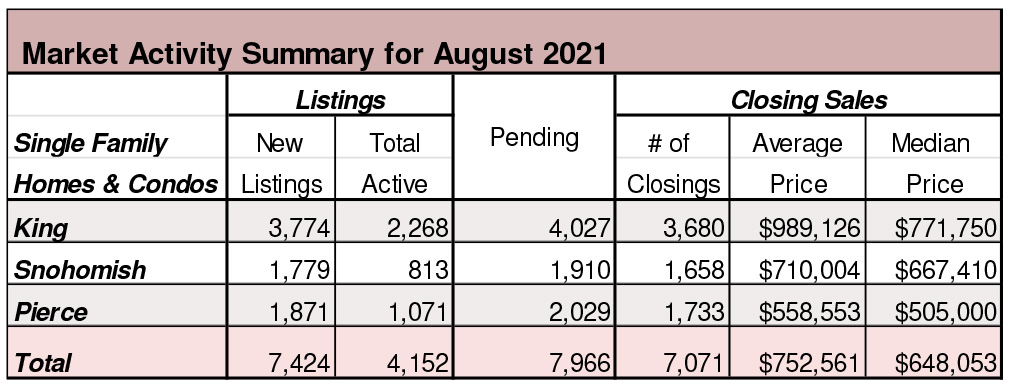

NWMLS statistics show the volume of new listings added during August, including single family homes and condominiums, declined from both July (down 11.5%) and twelve months ago (down 4.2%). Total inventory for the 26 counties in the report also fell, shrinking about 6.6% from July and nearly 22.6% from a year ago. At month end, there were 7,425 active listings, down from the year-ago total of 9,591.

Prices showed signs of moderating during August. The median price on the 10,571 sales that closed last month was $579,000, a drop of $10,000 from July. Prices did rise compared to 12 months ago, climbing from $490,000 for an increase of about 18.2%. That year-over-year (YOY) percentage change was the smallest since February when there was a bump-up of about 15%.

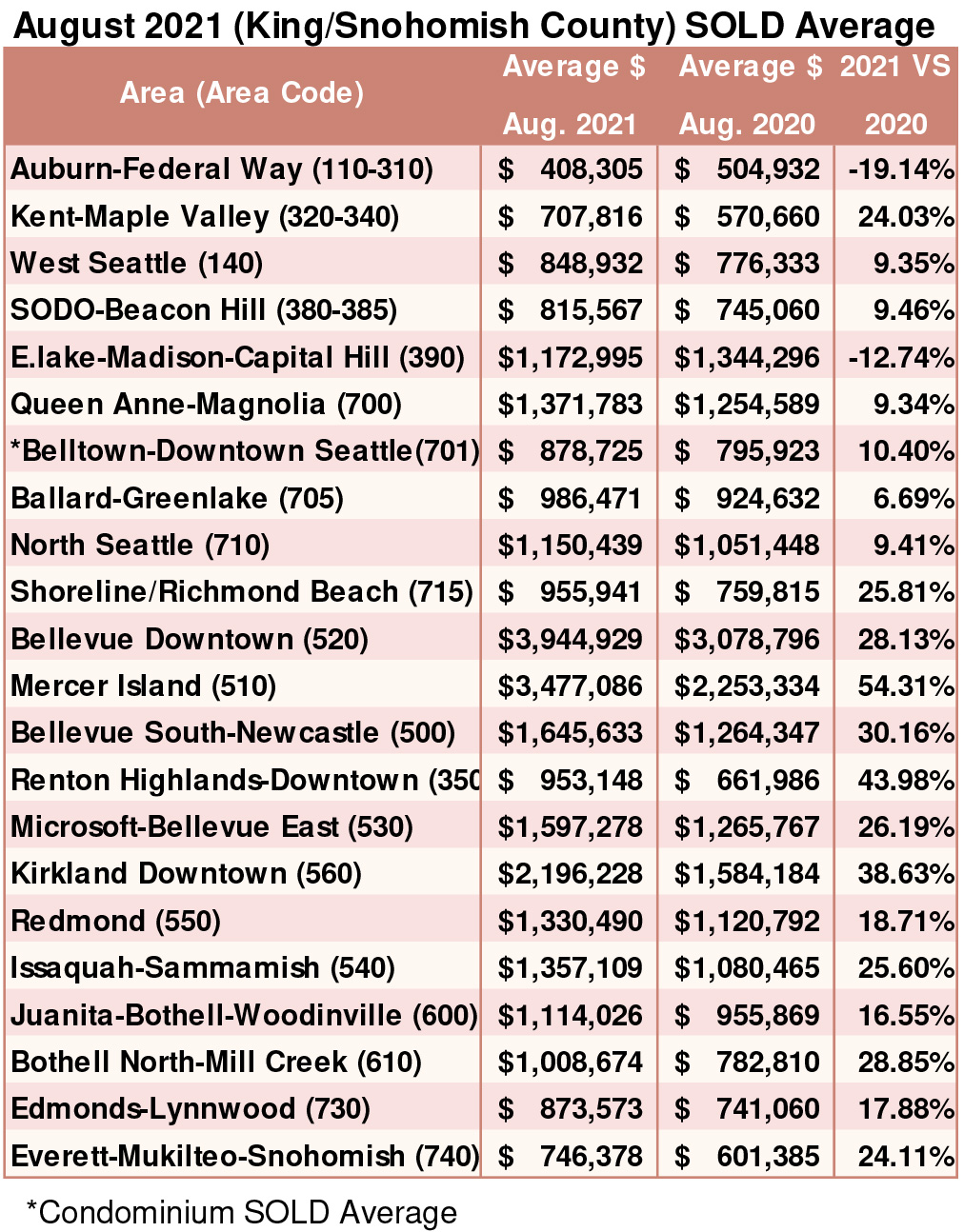

Matthew Gardner, chief economist at Windermere Real Estate, suggested price cooling is in sight. He said he looks at listing prices as a leading indicator of where things are headed. “In King County, median list prices dropped from $740,000 in July to $729,000 in August. That would explain why the median sales price also fell modestly month-over-month. I believe this is because we are hitting a price ceiling and that the rabid pace of home price appreciation will continue to cool as we move through the rest of the year.”

Northwest MLS figures indicate there was around three weeks of inventory (0.70 months) at the end of August. Clark, King, Kitsap, Lewis, Mason, Pierce, Snohomish, and Thurston counties had only about three weeks of inventory, with Snohomish reporting the smallest supply (0.49 months), about two weeks.

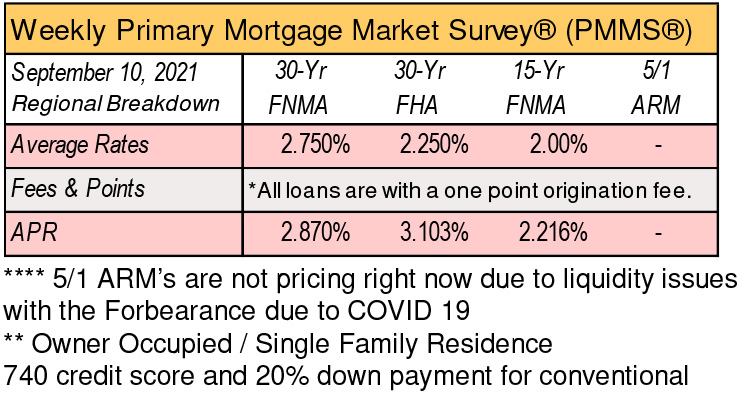

“The extreme real estate market in the Puget Sound area continued during August, with strong buyer demand due to historically low interest rates and a backlog of buyers still looking for a home,” remarked J. Lennox Scott, chairman and CEO of John L. Scott Real Estate.

Scott expects the “housing market intensity for each new listing will start tightening back up again in the Puget Sound region as we start heading toward the first of the year.”

Population growth in Seattle metropolitan area

Seattle was among 14 American cities that grew by at least 100,000 people over the last decade, according to new census data, as the country’s population growth was fueled by diversifying populations in major urban areas, while largely declining in rural areas. By one measure, Washington was growing more diverse, more quickly, than any other state in the country. King County gained more than 338,000 people over the last 10 years, with a total population of 2,269,675. The Seattle metropolitan area, which includes all of Pierce, King and Snohomish counties, was the 15th largest in the nation, with a total population of 4,018,762. Kent, in South King County, was one of the 10 fastest-growing cities in the country, according to census data released in August. King County grew by 17.5%, Snohomish by 16.1% and Pierce by 15.8%.

Breakouts! – Residential SOLD Average

The market might be starting to cool slightly

While existing home sales have increased in the last two months after a four-month slump, those sales don’t look especially bright as we head into the fall and winter doldrums. The National Association of Realtors® (NAR) says pending home sales dipped modestly in July, following a 1.9 percent dip in June. Its Pending Home Sales Index (PHSI), a leading indicator of existing home sales, fell 1.8 percent from its June level to a reading of 110.7.

“The market may be starting to cool slightly, but at the moment there is not enough supply to match the demand from would-be buyers,” said Lawrence Yun, NAR’s chief economist. “That said, inventory is slowly increasing and home shoppers should begin to see more options in the coming months.”

Gina Brown (NMLS#115337)

Senior Loan Officer

425-766-5408

gina@gmgloan.com

www.loansbygina.com