Buyer hesitancy sidelines some while others compete for scarce housing inventory

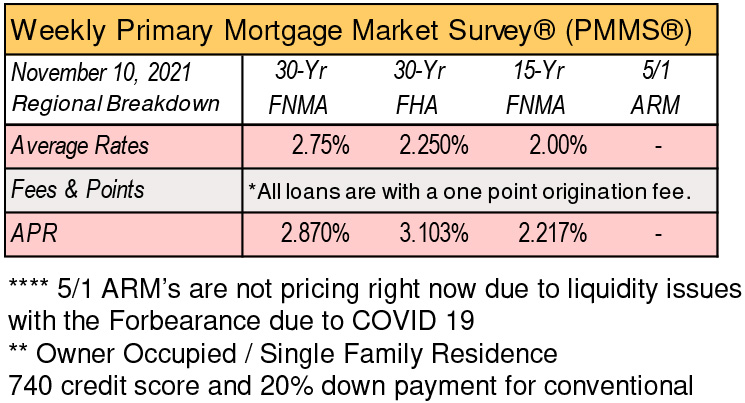

Northwest Multiple Listing Service brokers are detecting indecisiveness by some buyers who are getting mixed “work from home” messages from their employers. The hesitancy, coupled with cooler, wetter weather and increases in mortgage rates were likely factors in slower listing and sales activity during October.

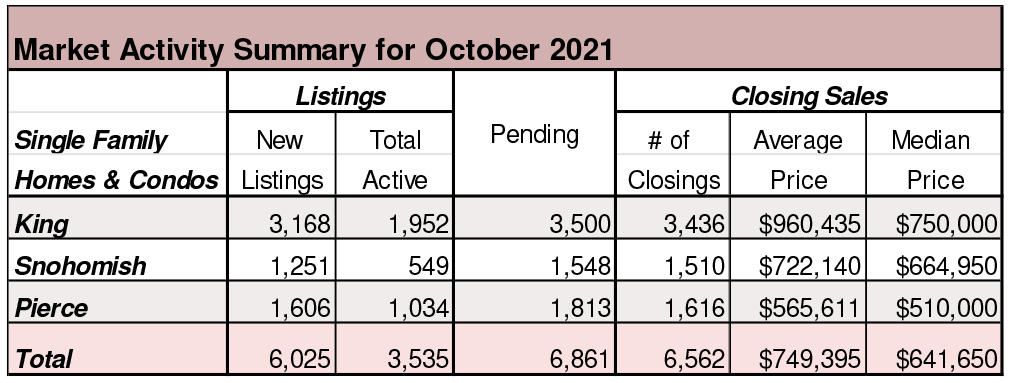

Northwest MLS brokers reported 10,620 pending sales last month, a drop of 3.8% from a year ago and a decline of 6.2% from September. Pending sales volume fell in 13 of the 26 counties in the MLS report, but tight inventory could be hampering the ability of buyers to find their dream home.

The latest report shows there were 9,983 closed sales during October. That was 823 fewer completed transactions than a year ago (down 7.6%) and 306 fewer than September (down about 3%).

House hunters were able to select from 9,219 new listings MLS added to inventory last month. That was 1,209 fewer than the same month a year ago for a drop of 11.6%. Compared to September, new listing activity shrunk nearly 19%.

At month end, there were 6,588 active listings in inventory, down 23.6% compared to a year ago, and the smallest selection since June, but the selection improved by double digits in eleven counties.

Measured by months of supply, there was less than three weeks of supply area-wide (0.66). Eleven counties, including eight in the Puget Sound region, had less than one a month of supply.

“As the weather cools, the housing market intensity heats up for each new listing,” according to J. Lennox Scott, chairman and CEO of John L. Scott Real Estate. “Buyers want to lock in a great interest rate.” He said the intensity of activity in the Puget Sound area “is either approaching or already at spring 2021 levels, depending on the local area,” adding buyers will face constrained inventory until March 2022.

Would-be buyers will find prices for single family homes and condos are 15% higher than a year ago, with most counties reporting double-digit gains. Area-wide, the price for last month’s closed sales was $575,000, which was $75,000 higher than twelve months ago. For single family homes (excluding condos), prices rose 16.3% YOY, rising from $515,000 to $599,000. Condo prices were up about 11.3%, increasing from $395,000 to $439,475.

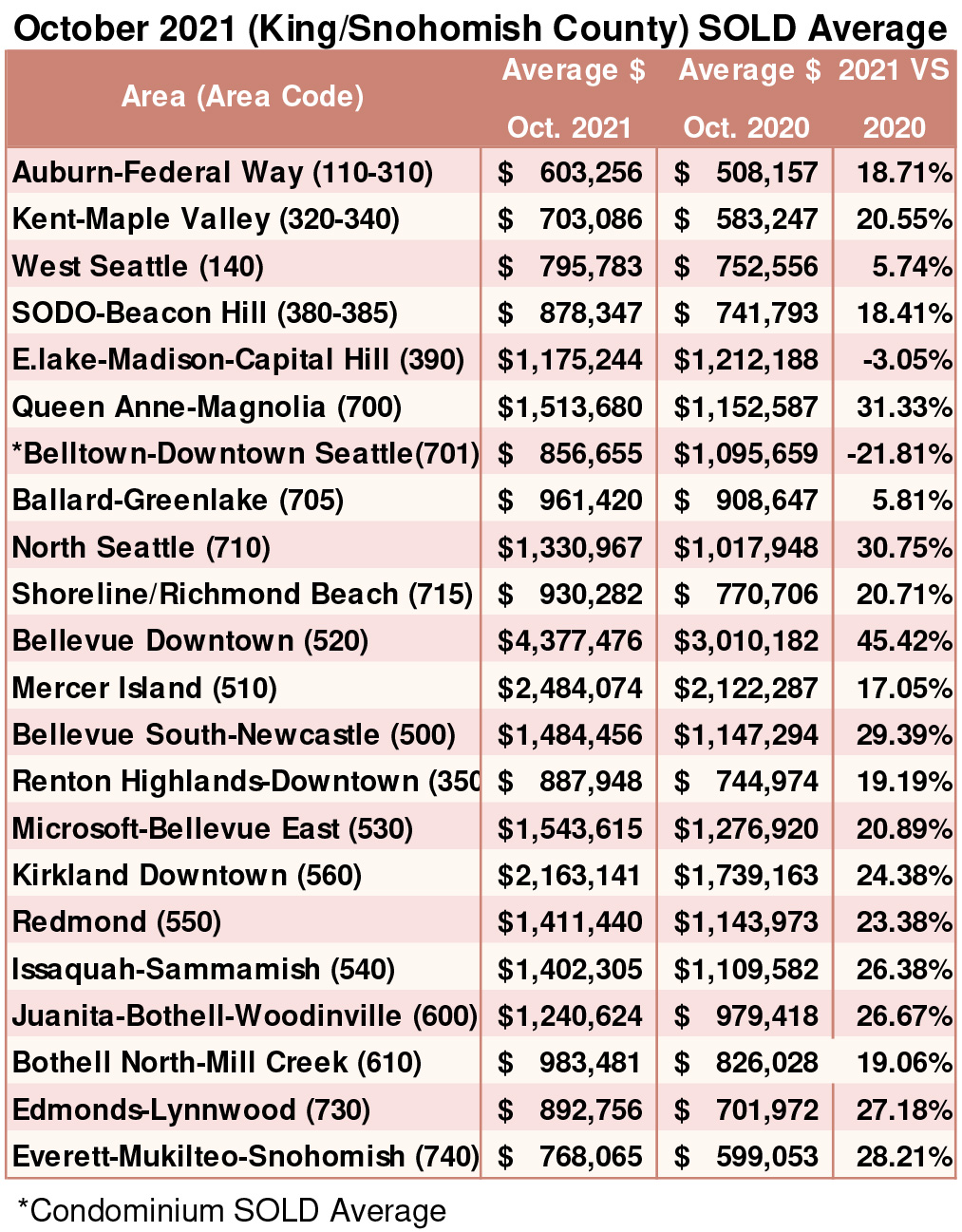

King County was the exception among the metro areas with double-digit price gains. Prices were up about 9.5% from twelve months ago, increasing from $685,000 to $750,000. Within the county, prices in Seattle registered the smallest gain at 5.3% while Vashon prices jumped more than 33% compared to a year ago. Homes that sold in the Southeast part of the county surged 19.7%, followed by the Southwest segment at 17.7%. On the Eastside, where the median price was more than $1.1 million, year-over-year prices were up 17.3%.

Best small cities to live in America 2021

With urban core counties experiencing population declines for the first time in a decade, in part due to COVID-19, the personal-finance website WalletHub released its report on 2021’s Best Small Cities in America.

To help Americans put down roots in places offering good quality of life and affordability, WalletHub compared more than 1,300 U.S. cities with populations between 25,000 and 100,000 across 43 key indicators of livability. They range from housing costs and school-system quality to restaurants per capita. The results are:

1. Sammamish, WA

2. Carmel, IN

3. Brentwood, TN

Breakouts! – Residential SOLD Average

Homebuyer migration patterns

Are homebuyer migration patterns starting to normalize and resemble pre-pandemic trends? A new statistic from Redfin seems to suggest so.

A report from the national real estate brokerage revealed that 30.2% of homebuyers were looking to move to a different metropolitan area in third-quarter 2021. That’s the lowest percentage in four quarters, down from 31.1% in Q2 2021 and a peak of 31.5% in Q1 2021. Interest in relocating to a new metro fell for the second straight quarter following four straight quarterly gains.

Redfin based its analysis on a sample of about 3.3 million users.

Gina Brown (NMLS#115337)

Senior Loan Officer

425-766-5408

gina@gmgloan.com

www.loansbygina.com