Northwest MLS report shows “typical August,” and return to more “normalized conditions”

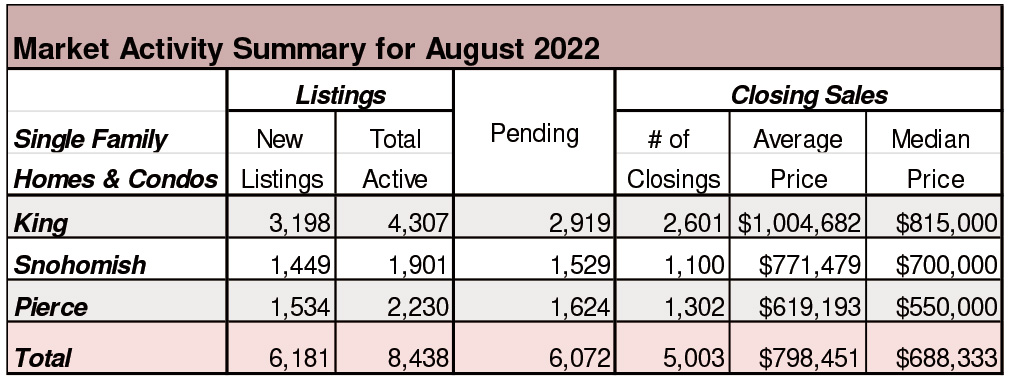

In a report summarizing August activity, Northwest MLS figures showed a continued buildup of inventory – nearly double the selection of a year ago and more than three times the offerings at the end of the first quarter.

Brokers added 9,914 new listings to inventory during August, a drop from both July’s total of 11,805 and the year-ago total (11,437). At month end there were 14,683 active listings of single family homes and condominiums across the 26 counties in the NWMLS report.

Northwest MLS members reported 9,552 pending sales, a drop of nearly 22% from the year-ago total of 12,238 pendings. Activity picked up from July when there were 8,775 pending sales, a gain of nearly 8.9%.

Similarly, the volume of closed sales fell from a year ago. MLS members recorded 7,998 completed transactions, improving 4.6% from July’s total of 7,645. But last month’s closings were down about 24% from the same month a year ago when members notched 10,571 closed sales.

“Last month’s housing numbers certainly are eye-opening,” stated Windermere Chief Economist Matthew Gardner. “However,” he continued, “I believe they are simply indicating the market is trending back to the more normalized conditions that we were seeing before the pandemic.”

J. Lennox Scott, chairman and CEO of John L. Scott Real Estate, commented on the local housing market’s resilience. “The resilience is clear as a steady cadence of homes going under contract continues. In the more affordable and mid-price ranges, demand remains strong as buyers look to get settled before fall.”

The median price on sales of single family homes and condos that closed during August was $600,000, up more than 3.6% from a year ago, but down slightly from July when the area-wide price was $625,000.

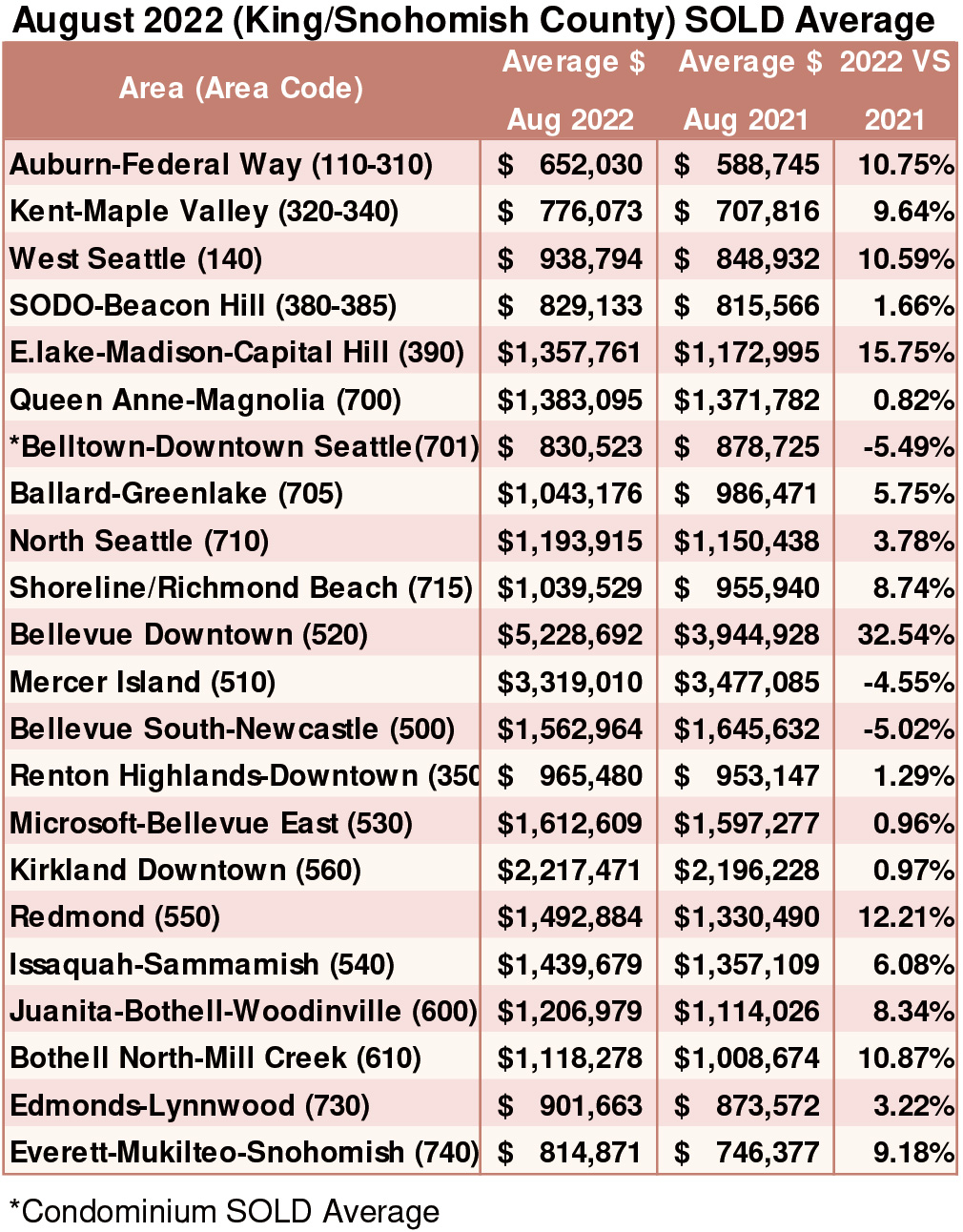

Within the six sub-areas on the report for King County, North King County notched the largest year-over-year gain on single family home prices at 11.5%, followed by the map areas within Seattle (5.9%), Southwest King County (4.1%), the Eastside (about 3.9%), and Southeast King County (nearly 3%). Prices fell 11.3% on Vashon compared to a year ago.

Condo prices system-wide rose 3.3% from twelve months ago. Across all counties, the median price rose from $435,625 to $450,000. In King County, where nearly 60% of condo sales occurred, the median price increased 5.9%, from $458,000 to $485,000.

Scott expects only two more months this year will have an increased selection of new resale listings coming on the market. “Once winter hits, new resale listings will become scarcer until activity ticks up to a higher level in March 2023,” he stated.

Seattle one of the top large real estate markets

WalletHub released a report detailing the top real estate markets in the country, and Seattle edged out all but three other large cities. The personal finance website ranked Seattle the No. 4 large real estate market in the United States. The report relied on 17 metrics to determine the most attractive real estate markets nationwide, including median home-price appreciation, median days on market and job growth. Austin ranked No. 1, followed by Nashville and Forth Worth, Texas. Portland clocked in at No. 16. WalletHub ranked Seattle No. 16 in the country for best places to buy a house.

Breakouts! – Residential SOLD Average

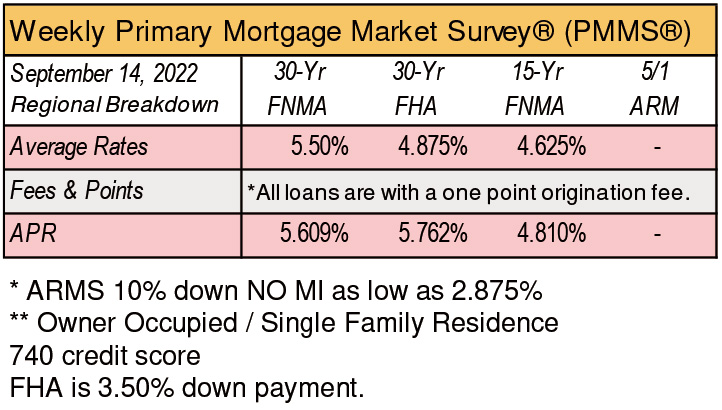

2023 Loan Limit Increase comes early!

Usually, the loan limits are increased on January 1st of every year. Good news is that Gina Brown of Home Trust Loans has access to the new loan limits and they are available now. The Conforming loan amount increased to $715,000.00. The new High Balance loan limit for King/Snohomish/Pierce counties is now $984,616.00. This is huge for buyers. Imagine a down payment of 5% and the purchase price is slightly over one million. The higher limits enable the borrower the affordability lower down payment and easier guidelines of the conforming/conventional loans. Questions? Please call Gina Brown at 425- 766-5408

Gina Brown (NMLS#115337)

Senior Loan Officer

Home Trust Financial NMLS1761573

425-766-5408

gina@gmgloan.com

www.loansbygina.com

![]()