Will increases in inventory and lower mortgage rates ease Affordability?

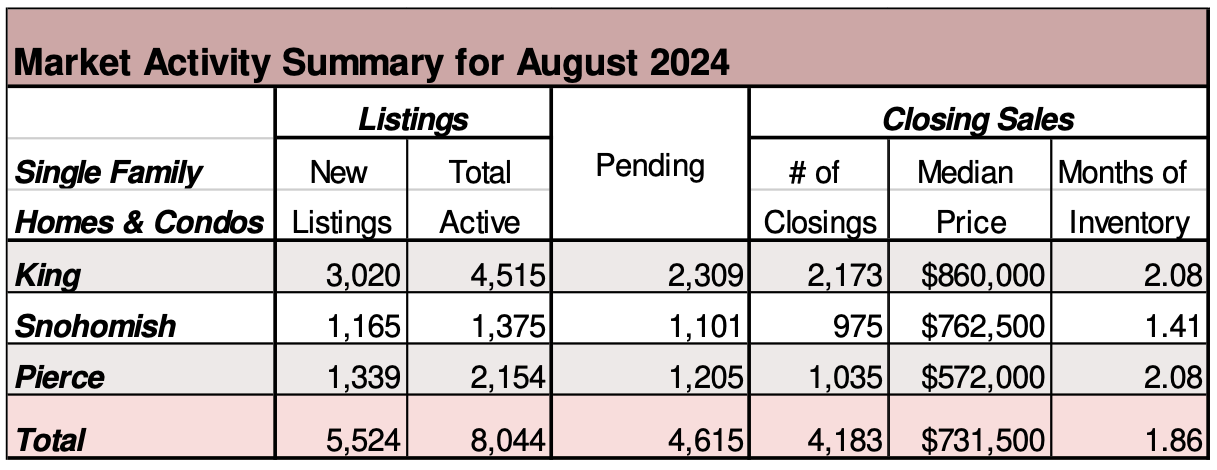

Mortgage rates are at their lowest level since March 2023 (6.35% for a 30-year fixed rate mortgage as of August 29th), and August 2024 reflected year-over-year increases in the number of active listings, new listings and pending sales. At the same time, the number of closed sales year-over-year was virtually unchanged, and median home prices rose in 20 of the 26 counties covered by NWMLS. The Federal Reserve is expected to further reduce interest rates in September, sending encouraging signals to potential buyers.

There was a 34.1% increase in the total number of properties listed for sale, with 15,453 active listings on the market at the end of August 2024, compared to 11,525 at the end of August 2023.

NWMLS brokers added 8,941 new listings to the database in August 2024, an increase of 9.7% compared to August 2023 (8,152).

There were 7,527 total residential units & condo units under contract in August 2024, an increase of 4.7% when compared to August 2023 (7,189).

The number of closed sales remained relatively unchanged year-over-year (6,727 in August 2024 compared to 6,734 in August 2023).

Overall, the median price for residential homes and condominiums sold in August 2024 was $645,000, an increase of 4.9% when compared to August 2023 ($615,000). The three counties with the highest median sale prices were San Juan ($905,000), King ($860,000) and Snohomish ($762,500), and the three counties with the lowest median sale prices were Ferry ($282,500), Adams ($307,475) and Pacific ($332,500).

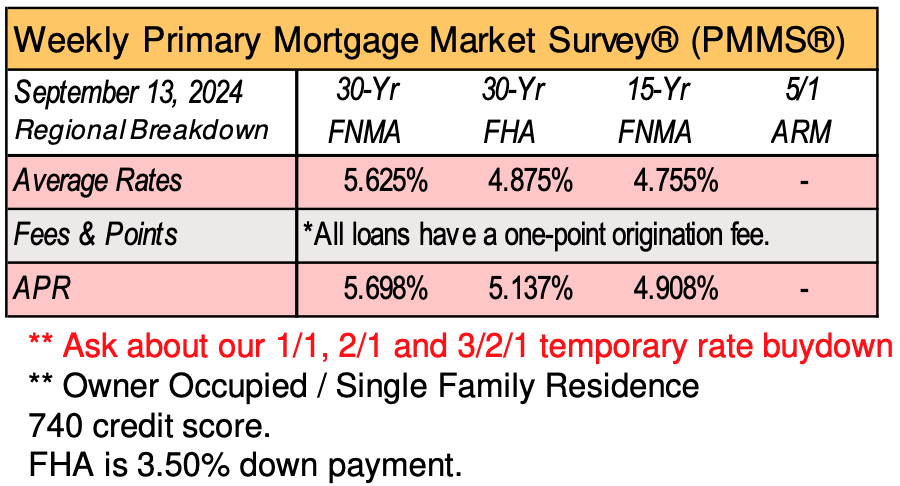

“Mortgage interest rates have already started to moderate, dropping to 6.35% (for 30-year terms) at the end of August from this year’s high of 7.22% at the beginning of May,” said Steven Bourassa, director of the Washington Center for Real Estate Research (WCRER) at the University of Washington. “Unfortunately, lack of supply is going to continue to be an issue affecting house prices. Single and multi-family permitting dropped off noticeably in 2022 as interest rates ramped upwards, and single-family home prices will likely continue to increase as interest rates drop.”

– NWMLS

Seattle among top U.S. cities for fastest home sales

SEATTLE – Seattle is one of the fastest-moving real estate markets in the U.S., with homes selling in an average of just nine days, according to a recent study by Joybird.

The analysis, which examined Redfin data from over 47,000 homes sold in the largest U.S. cities as of July 2024, found that the average home in the country stays on the market for 35 days. However, Seattle’s market is moving at a significantly faster pace, driven by the region’s booming tech industry and limited housing supply. The city’s strong economy, bolstered by the presence of major companies like Amazon and Microsoft, continues to push demand, resulting in quick sales.

Top U.S. cities where homes are selling the fastest:

• Grand Rapids, MI – 6 days on the market

• Wichita, KS – 8 days on the market

• Seattle, WA tied with Albany, NY and Allentown, PA – 9 days on the market

• Richmond, VA tied with Omaha, NE – 10 days on the market • Spokane, WA – 11 days on the market – Fox 13 Seattle

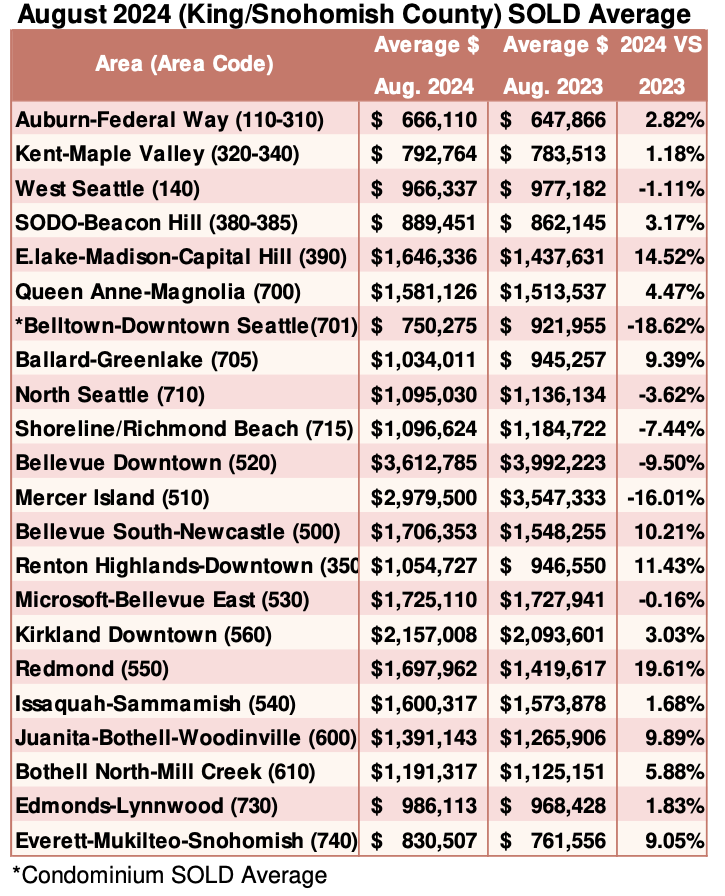

Breakouts! – Residential SOLD Average

Newest Fannie Mae sentiment survey reveals rising interest rate positivity

Consumers are much more optimistic about the way mortgage rates are trending.

That’s according to the latest iteration of Fannie Mae’s Home Purchase Sentiment Index (HPSI), which was up 0.6 points in August to a reading of 72.1. The index is designed to express consumers’ views of the purchase market into a single number; the higher the reading, the more positive the consumer perception of the market. The reading is derived from consumers’ answers to a six-question survey, with Fannie also tracking trends for each of the component questions.

Gina Brown (NMLS#115337)

Senior Loan Officer

Home Trust Financial NMLS1761573

425-766-5408

gina@gmgloan.com

www.loansbygina.com

![]()